Q3 'Jiyeok Credit Guarantee Foundation Guarantee Behavior Survey' Results

Rising Credit Risk Index for Small Business Owners... Increasing Demand for Loan Guarantees

On the 3rd, a restaurant in Myeongdong, Seoul, where self-employed people’s worries are deepening, is quiet. Photo by Mun Ho-nam munonam@

On the 3rd, a restaurant in Myeongdong, Seoul, where self-employed people’s worries are deepening, is quiet. Photo by Mun Ho-nam munonam@

"Although social distancing has ended, the business at the hof bars hasn't improved to the level it was before the COVID-19 outbreak. Business has been slow, so I have continued to rely on loans this year as well, but I no longer have the strength to endure. I am still repaying a loan guaranteed by the Credit Guarantee Foundation from two years ago. Is it possible to take out an additional loan of about 20 million won?" (Kim Kyung-min, 45, who consulted with the Regional Credit Guarantee Foundation)

As the New Start Fund application, which forgives debts of delinquent borrowers, is being implemented, the credit risk index of small business owners in South Korea has been steadily rising. This means that the probability of small business owners defaulting or failing to repay loans taken from banks is increasing over time.

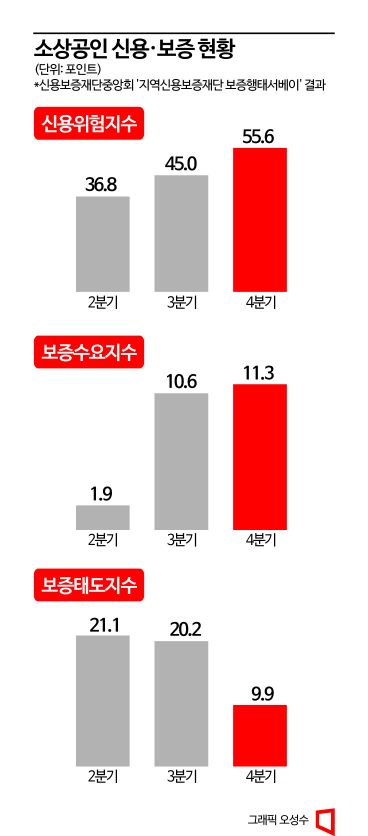

According to the 'Regional Credit Guarantee Foundation Guarantee Behavior Survey' released by the Korea Credit Guarantee Foundation on the 28th, the 'Small Business Credit Risk Trend Index' for the third quarter of this year was 45.0 points, up 8.2 points from 36.8 points in the second quarter. The index is based on 0, with values closer to 100 indicating higher credit risk. This survey was conducted in September through questionnaires and phone interviews with 151 guarantee managers from headquarters and branches of 16 regional credit guarantee foundations.

In the fourth quarter, the 'Small Business Credit Risk Trend Index' is expected to rise to 55.6 points. This indicates that over time, small business owners' ability to repay loans will gradually decrease. The report explained, "The increase in interest rates and inflation has prominently contributed to the rise in credit risk," and added, "This trend is expected to continue into the fourth quarter."

As the situation for small business owners worsens, the demand for 'loan guarantees' from government agencies is also increasing. Small business owners with low credit ratings find it difficult to obtain loans from banks, so they request guarantee certificates from the Regional Credit Guarantee Foundation. After branch-level screening, if a guarantee certificate is issued to the small business owner, they can then go back to the bank to borrow money. The demand for such guarantees increased from 1.9 points in the second quarter to 10.6 points in the third quarter. The report forecasts this will further rise to 11.3 points in the fourth quarter.

As the credit risk of small business owners rises and guarantee demand increases, the guarantee screening process has become more stringent. The 'Guarantee Attitude Index,' which indicates the degree of screening, fell from 21.1 points in the second quarter to 20.2 points in the third quarter, and is expected to sharply drop to 9.9 points in the fourth quarter. A lower Guarantee Attitude Index means stricter guarantee screening.

A representative from the Korea Credit Guarantee Foundation stated, "Overall, small business owners' sales in the third quarter were reported to be unchanged or improved compared to the second quarter, but many responses indicated a decline in creditworthiness, especially among those who had already received guarantees, due to worsening external conditions," and explained, "As economic uncertainty continues, the circumstances of small business owners are also deteriorating."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)