SpeakEasy Labs Secures 38 Billion KRW Investment... Largest Edutech Funding This Year

[Asia Economy Reporter Donghyun Choi] Although startups are facing an investment winter, hundreds of billions of won are pouring into edutech companies. As educational content combined with artificial intelligence (AI), big data, and games gains high popularity, the edutech industry is being recognized by investors as a stable investment destination capable of withstanding harsh conditions.

Spik E-Labs, which operates the AI voice recognition English learning solution "Spik," secured 38 billion won in Series B funding this month. This is the largest amount raised by a domestic edutech company this year. Notably, the investment attracted participation from the "OpenAI Startup Fund" and multiple Silicon Valley investors, drawing attention. The OpenAI Startup Fund is a $100 million fund managed by OpenAI, an AI research institute co-founded by Elon Musk, CEO of Tesla, and Sam Altman, former president of Y Combinator.

Hodoo Labs, well known for its metaverse (extended virtual world) English education service "Hodoo English," also completed a 13 billion won Series B funding round this month. Major investors included global investment firm NPX Capital, famous for investing large sums in innovative technology companies such as metaverse and blockchain, as well as Capstone Partners and LG Uplus. Hodoo Labs was valued at approximately 60 billion won during this process. Compared to its Series A funding last year, the company has grown more than threefold in just one year.

According to a tally of this year's investments focusing on edutech companies with publicly disclosed investment amounts, about 250 billion won has flowed into edutech firms so far. Following Spik E-Labs, high-value investments in the 30 billion won range were concentrated in Day One Company (35 billion won), NHN Edu (32 billion won), Jaranda (31 billion won), and I Hate Flying Bugs (30 billion won). Although this differs from last year's large-scale investments in Riiid (200 billion won) and Mespraso (56 billion won), considering the investment winter, the atmosphere is distinctly different from other industries. Six companies, including Jjaekakakgeo (16 billion won), Clasum (15.1 billion won), and Team Sparta (13 billion won), also secured investments exceeding 10 billion won. The main sectors of edutech companies receiving large investments include language learning, job skills, coding, childcare, and communication platforms.

Edutech companies are also popular in the public offering market. Ubion, which was listed on KOSDAQ on the 18th, set its public offering price at the top of the desired band (1,800 won to 2,000 won) at 2,000 won during demand forecasting targeting institutional investors. The competition rate was as high as 736.72 to 1, indicating strong institutional demand for Ubion shares.

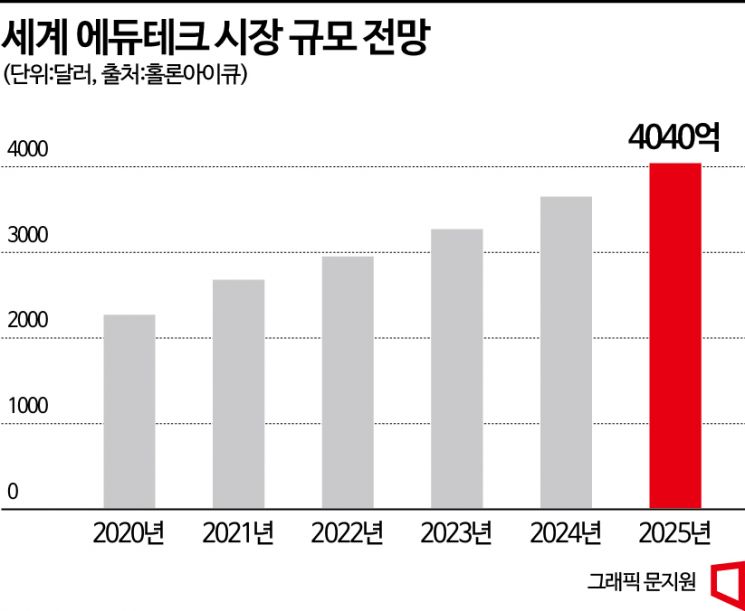

Last year, the domestic edutech market revenue was approximately 7.325 trillion won, growing at an average annual rate of 8.5%, and is expected to reach 9.9833 trillion won by 2025. Edutech is recognized as an industry with high growth potential not only domestically but globally. According to global market research firm HolonIQ, the global edutech market size, which is $295 billion this year, is expected to grow to $404 billion (approximately 538 trillion won) by 2025. A representative of an edutech company stated, "The global edutech industry is evolving not just as simple online or non-face-to-face education but toward providing personalized learning opportunities based on AI and big data," adding, "As the industry grows rapidly, the government must properly organize regulations to provide a foundation for domestic edutech companies to enter the global stage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)