Bank of Korea Raises Base Rate by 0.25%P Unanimously

Expectations for Weaker US Monetary Tightening

Domestic Bond Market Volatility Impact

Growth Forecast Lowered to 1.7% for Next Year

Growth Rate Below 2% for First Time in 13 Years

"Export Decline and Weakened Growth Momentum"

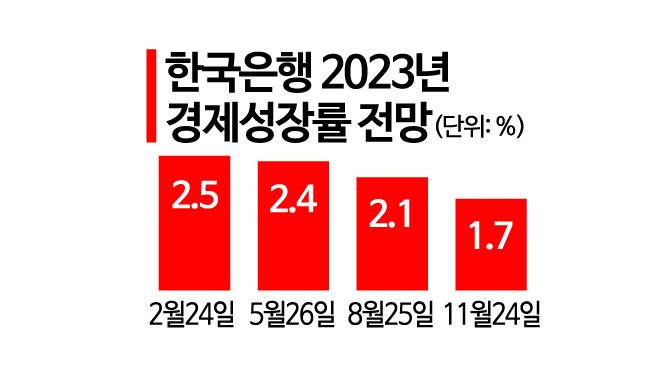

[Asia Economy reporters Seo So-jeong and Moon Je-won] The Bank of Korea (BOK) on the 24th significantly lowered its economic growth forecast for next year to 1.7%, signaling a recession. This is a 0.4 percentage point decrease from the 2.1% forecast released in August and is below the potential growth rate of 2%. Reflecting these downside risks to the economy, the BOK raised the base interest rate by 0.25 percentage points to 3.25% on the same day, signaling a pace adjustment.

The Monetary Policy Board of the Bank of Korea raised the base interest rate from the current 3.00% to 3.25% by 0.25 percentage points at the monetary policy meeting held from 9 a.m. that day. The Monetary Policy Board had consecutively raised the base rate in April, May, July, August, and October meetings this year, and with this last meeting of the year, it set a record for the first-ever six consecutive rate hikes.

The rate hike was continued to narrow the interest rate gap with the United States, which had widened up to 1 percentage point due to the sustained high consumer price inflation rate in the 5% range and the U.S. Federal Reserve's (Fed) four consecutive giant steps (0.75 percentage point hikes). This year, the base rate was raised by 0.25 percentage points each in January, April, and May; 0.50 percentage points in July; 0.25 percentage points in August; 0.50 percentage points in October; and an additional 0.25 percentage points on this day, returning to 3.25% for the first time in 10 years and 4 months since July 2012. The BOK’s decision to slow the pace with a baby step (0.25 percentage point hike) this time reflects growing expectations that the U.S. monetary tightening will ease amid the recent global economic slowdown and ongoing instability in domestic capital markets such as the bond market following the Legoland incident.

Although the high inflation rate in the 5% range remains a burden, the recent stabilization of the won-dollar exchange rate and international oil prices, along with a slight decline in the expected inflation rate for the next year to 4.2% from 4.3% last month, suggest that the BOK is placing more weight on economic sluggishness and financial stability in its monetary policy decisions. BOK Governor Lee Chang-yong said, "A 0.25 percentage point hike is appropriate considering the expected greater economic slowdown compared to the August forecast, the easing of foreign exchange risks, and the contraction of the short-term financial market," adding, "The Monetary Policy Board will continue to monitor growth while ensuring inflation stabilizes at the target level over the medium term and will operate monetary policy with attention to financial stability."

◆ Next Year’s Growth Rate Lowered by 0.4 Percentage Points to 1.7% = In its revised economic outlook, the BOK sharply lowered the growth forecast for next year to 1.7%. This is the first time in 12 years and 11 months since December 2009 (0.2%), excluding the COVID-19 period, that the BOK has forecast economic growth below 2%. The BOK’s growth forecast for next year is lower than most institutions such as the Asian Development Bank (ADB, 2.3%), International Monetary Fund (IMF, 2.0%), credit rating agency Fitch (1.9%), Organisation for Economic Co-operation and Development (OECD, 1.8%), and Korea Development Institute (KDI, 1.8%). It is the same as the Korea Institute of Finance (1.7%).

The consumer price inflation forecast was adjusted downward by 0.1 percentage points to 5.1% for this year and 3.6% for next year compared to the August forecast. Although economic slowdown will act as a downside factor next year, accumulated cost pressures will exert upward pressure, resulting in inflation below the previous forecast.

The current account surplus is expected to be $25 billion this year and $28 billion next year, significantly down from the August forecasts of $37 billion and $34 billion, respectively. This is due to a sharp increase in imports, a significant drop in semiconductor prices?Korea’s main export product?and a worse-than-expected decline in exports to China. Governor Lee said, "Domestic consumption continued to recover, but exports turned to decline, leading to a slowdown in growth," and added, "Going forward, the domestic economy is expected to weaken due to global economic slowdown and rising interest rates."

With the BOK lowering next year’s growth forecast to the 1% range, attention is focused on the impact on future monetary policy. The prolonged Ukraine crisis and interest rate hikes by major countries have led to a global economic slowdown, expanding the decline in exports and weakening growth momentum. The cumulative fatigue from rate hikes in response to high inflation could lead to reduced investment and consumption, strengthening calls for a pace adjustment. Kim Jun-il, visiting professor at Yonsei University Graduate School of International Studies, said, "It usually takes about three quarters for a rate hike to directly affect the real economy. The effects of the current tight monetary policy will fully materialize in the first half of next year, so the economy is bound to face more difficulties."

However, despite recent expectations of a slowdown in the U.S. Federal Reserve’s tightening pace, hawkish remarks from key officials have raised expectations for a higher terminal rate in the U.S., which remains a variable. Although the Monetary Policy Board narrowed the interest rate gap with the U.S. to 0.75 percentage points by raising the base rate by 0.25 percentage points, if the Fed adopts at least a big step (0.50 percentage point hike) next month, the gap will widen again to 1.25 percentage points. A further widening of the Korea-U.S. interest rate gap could increase capital outflow concerns and cause the recently stabilized won-dollar exchange rate to surge.

◆ Inflation in the 5% Range and Household Interest Burden = Inflation stubbornly remaining in the 5% range is also complicating monetary policy decisions. The consumer price index for October was 109.21, up 5.7% from the same month last year. After peaking at 6.3% in July, the inflation rate fell to 5.7% in August and 5.6% in September but rose again after three months.

The significant increase in household interest burden due to the unprecedented six consecutive rate hikes also supports the case for slowing the pace. Mortgage loan rates have already approached 8%, and credit loan rates exceed 6%, so the BOK’s decision will inevitably push commercial bank loan rates higher. Experts warn that the high interest rate effect is likely to continue at least until next year, urging caution about expanding credit risk.

According to the financial sector, the Monetary Policy Board’s 0.25 percentage point hike will increase pressure on commercial banks to raise mortgage and credit loan rates. Currently, the variable mortgage loan rates at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) range from 5.70% to 7.83%, with the upper bound nearing 8%, and the average credit loan rate has surpassed 6%. The COFIX (Cost of Funds Index), a benchmark for rate calculation, hit a record high last month. Despite continued rate hikes, household loans decreased by 30 billion won in the third quarter compared to the previous quarter, but mortgage loan balances increased by 6.5 trillion won, reaching a record high of 1,007.9 trillion won, acting as a potential household debt bomb.

Before the rate hikes began last year, borrowing 400 million won at a 4% variable rate (30-year maturity, equal principal and interest repayment) meant a monthly interest burden of about 1.3 million won initially, but if the rate rises to 8%, it jumps to 2.6 million won. Including principal, the monthly repayment approaches 3 million won.

Industry analysts say that since the U.S. rate hike trend continues, mortgage rates could reach 10% next year, increasing repayment burdens further. According to the BOK, a 0.25 percentage point hike in the base rate increases the total interest burden of all borrowers by about 3.3 trillion won annually. Considering the total 2.75 percentage point increase in the base rate over nine hikes since August last year, household interest payments have increased by about 38 trillion won over one year and three months, averaging 1.8 million won per borrower annually. Ko Jong-wan, president of the Korea Asset Management Corporation, said, "The effects of rate hikes last for two to three years, so multi-homeowners with high interest burdens need to downsize," adding, "For single-homeowners, it is better to endure due to high rent burdens, but depending on loans and regions, disposal should also be considered."

◆ Will the Terminal Rate Be Raised to 3.75%? = With the BOK slowing the pace with a baby step this month, market attention is turning to the terminal rate. Experts expect the rate hike trend to continue until the first half of next year, forecasting a terminal rate between 3.50% and 3.75%. Kang Sam-mo, professor of economics at Dongguk University, said, "Since there is no clear signal that U.S. inflation has been fully controlled, the U.S. is expected to continue raising rates next year, widening the Korea-U.S. rate gap further," adding, "A gap of 1 to 1.25 percentage points is manageable, but if it widens to 1.5 to 1.75 percentage points, it could become difficult to handle."

Regarding the terminal rate, Governor Lee said in response to reporters’ questions, "Opinions among Monetary Policy Board members were divided," noting, "Three members favored a terminal rate of 3.5%, one member thought it would stop at 3.25%, and two members left open the possibility of an increase from 3.5% to 3.75%." He added that discussions on rate cuts should only begin after there is clear evidence that inflation has sufficiently converged to the target level (around 2%), saying, "It is premature to discuss rate cuts now."

Governor Lee explained that although the global economy, including Korea’s, is expected to slow next year, inflation is likely to remain high until the first half of next year, so the rate hike trend should continue for at least three more months. He said that while an excessive Korea-U.S. rate gap is undesirable, domestic factors take priority, and the BOK will adjust the size of hikes considering financial stability and other factors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.