Seoul, Capital Area, and Provinces All See Largest Drop for 3rd Week

Continued Cautious Stance Amid Interest Rate Hikes and Price Decline Concerns

Apartment sale and jeonse prices in Seoul, the metropolitan area, and provinces have once again recorded the largest decline in history. Despite the government's successive deregulation policies, the downward trend shows little sign of stopping. With the Bank of Korea implementing six consecutive base rate hikes, further declines in housing prices are expected to continue for the time being.

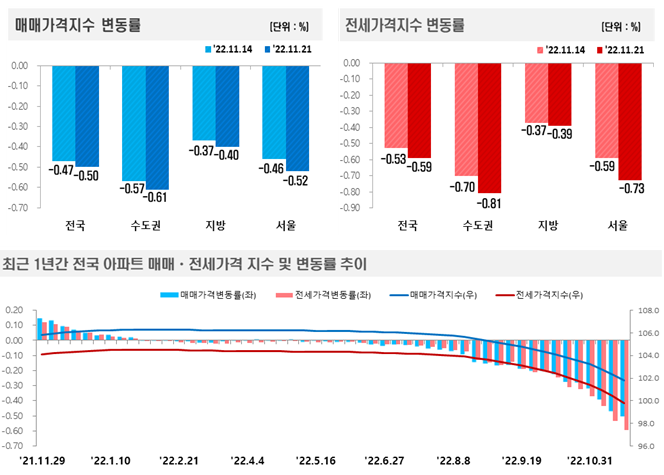

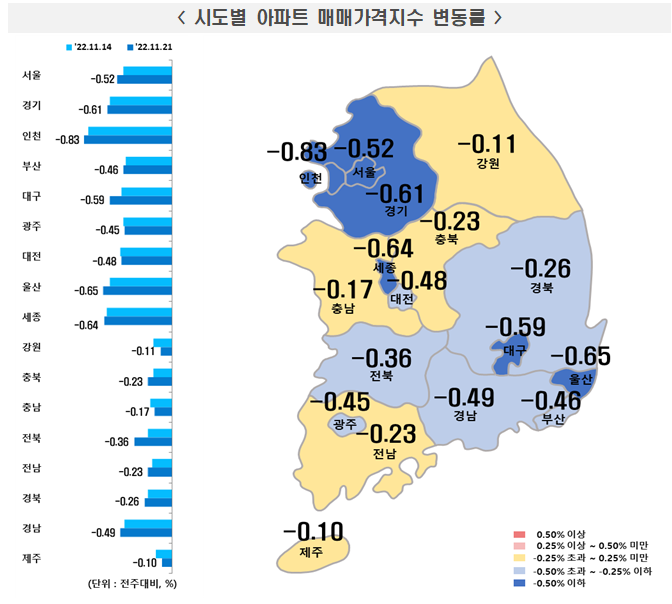

According to the 'Weekly Apartment Price Trend for the 3rd Week of November' released by the Korea Real Estate Board on the 24th, apartment prices in Seoul fell by 0.52% compared to last week (-0.46%). This marks the 26th consecutive week of decline and breaks the record for the largest drop for three consecutive weeks since the Real Estate Board began surveying prices in May 2012.

Looking at the regions, the decline was particularly notable in the 'Nodogang' (Nowon, Dobong, Gangbuk districts) area. Apartment prices in Nowon-gu fell by 0.88%, the largest drop in Seoul, followed by Dobong-gu at 0.83% and Gangbuk-gu at 0.74%.

In the Gangnam area, Gangnam-gu (-0.37%) and Gangdong-gu (-0.55%) saw slightly larger declines compared to last week (-0.36%, -0.49%), while Seocho-gu (-0.27%) and Songpa-gu (-0.57%) experienced smaller decreases than last week (-0.30%, -0.60%).

As a result, the entire southeastern region fell by 0.43%, slightly less than last week's decline of 0.44%.

The Real Estate Board analyzed, "Buyers are adopting a wait-and-see attitude, anticipating further price drops due to expected interest rate hikes and price decline concerns," adding, "The market situation continues with sporadic transactions mainly for urgent sales, leading to an expansion in the rate of decline."

The metropolitan area (-0.61%) and provinces (-0.40%), which had hoped for a turnaround due to deregulation benefits, continue to see expanding declines.

Apartment prices in Gyeonggi-do increased their decline from -0.59% last week to -0.61% this week, while Incheon’s drop widened from -0.79% to -0.83%.

Within the regulated areas of Gyeonggi-do, only Seongnam Sujeong (-0.53%) and Bundang-gu (-0.49%) showed a slight easing compared to last week (-0.63%, -0.53%), whereas Gwacheon fell by 0.89%, a larger drop than last week's -0.83%.

Gwangmyeong’s decline expanded into the 1% range, recording -1.11% this week compared to -0.95% last week.

Similarly, Sejong City, which was deregulated, saw its decline widen from -0.62% last week to -0.64% this week, contributing to a nationwide drop of -0.50%, continuing the record-breaking downward trend.

The jeonse market also remains in a stagnant phase.

Jeonse prices nationwide (-0.59%), in the metropolitan area (-0.81%), and in Seoul (-0.73%) are all experiencing the largest declines in history.

The Real Estate Board explained, "As loan interest rates rise, the burden of financing jeonse deposits increases, causing a sharp drop in jeonse demand," adding, "Meanwhile, the accumulation of listings intensifies, increasing downward pressure on prices, resulting in an expanded rate of decline compared to last week."

Meanwhile, the Bank of Korea’s Monetary Policy Committee raised the base rate from 3.00% to 3.25% on the same day. Although the Bank’s decision to moderate the pace amid an anticipated rate hike is fortunate, the prevailing view is that the increased financial interest burden will inevitably lead to a contraction in the real estate market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.