Government Takes Tough Action to Cancel Frequency Allocation

Three Telecom Companies to Undergo Hearing Procedure Next Month

Cancellation Reversal Seen as Difficult

Responsibility for Policy Failure Raised

Government Cites US and Japan Business Cases

62 Billion Won Network Construction Cost Left Hanging

[Asia Economy Reporter Cha Min-young] As the unprecedented situation of the government reclaiming the frequencies allocated to the three major telecom companies unfolds, conflicts between the government and the telecom companies are intensifying. The government insists on principles, stating that "the three telecom companies did not keep their promises when the frequencies were allocated," but there is also considerable opposition arguing that "the burden on operators due to the initially uncertain demand for the 5G 28㎓ policy should be taken into account."

The Three Telecom Companies That Gave Up 5G 28㎓ to Express Their Positions at the December Hearing

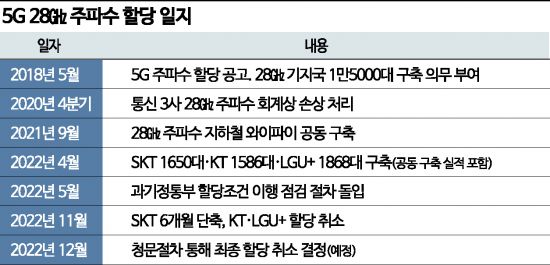

According to the industry on the 24th, the three telecom companies (SK Telecom, KT, LG Uplus) are expected to express their positions at the December hearing regarding the recent decision by the Ministry of Science and ICT to cancel the allocation and shorten the usage period of the 5G 28㎓ frequency. Since the government has stipulated that there must be a "substantial reason," it is expected to be difficult to overturn the government's decision.

In the third-year performance review of the 5G 28㎓ frequency allocation, the three telecom companies fell significantly short of the mandatory number of installations. Combining quantitative and qualitative evaluations, the final scores were 30.5 for SKT, 28.9 for LG Uplus, and 27.3 for KT, with LG Uplus and KT, both scoring below 30 points, becoming candidates for disqualification. The total number of installations by the three companies was 5,059 units, which is only about 10% of the originally mandated 15,000 units for all three companies.

The government also pointed out that domestic efforts to build 5G 28㎓ base stations are insufficient compared to overseas counterparts such as the United States and Japan. With the importance of ultra-high frequency (mmWave) increasing ahead of the 6G era, the immature domestic 28㎓ band ecosystem compared to overseas is seen as a potential problem.

Ministry of Science and ICT: "US and Japan Rapidly Building 5G 28㎓ Base Stations"

As responsibility for the 'policy failure' surfaced, the Ministry of Science and ICT unusually disclosed some results of an overseas millimeter-wave field survey conducted by a public-private working group formed in August. Verizon in the United States stated in a meeting with the Korean government that it plans to build 45,000 millimeter-wave base stations this year and expand this over the next four years. According to Japan's Ministry of Internal Affairs and Communications, the four Japanese telecom companies had built more than 20,000 millimeter-wave base stations as of July. NTT Docomo also stated that it is building millimeter-wave base stations faster than planned in its frequency utilization plan.

The government judged that there is also a gap with domestic conditions because in countries like the US and Japan, consumer-to-business (B2C) services using the 28㎓ band are being provided. In Japan, more than 10 devices supporting the 28㎓ band include Samsung Electronics' Galaxy S22, Galaxy Z Flip4, Galaxy Z Fold4, and Sony's Xperia Pro. According to US semiconductor company Qualcomm and global market research firm Strategy Analytics (SA), more than 50 manufacturers worldwide have released over 150 millimeter-wave supported devices.

From the telecom companies' perspective, which paid an initial 620 billion KRW for the 28㎓ network construction, the situation feels somewhat unfair. LG Uplus, expressing regret, said, "If the allocation is canceled, customer damage is expected due to the suspension of 28㎓ services already provided in public Wi-Fi, subway Wi-Fi, sports stadiums, and public institutions," and added, "We hope that measures to protect users will be prepared." SK Telecom stated, "We will consult with the government regarding future business directions," and KT bowed its head, saying, "We sincerely apologize for not meeting expectations." Regarding customer damage caused by business suspension, the Ministry of Science and ICT drew a line, stating, "We will complete the subway Wi-Fi construction in consultation with operators like SK Telecom who avoided allocation cancellation."

Experts: "The Confrontational Structure Between Government and Operators Is Not Good... Policy Reinforcement Needed"

The three telecom companies bore the burden of initial 28㎓ network construction as the 5G project was led by the state under the title of the "world's first 5G era." The amount paid by the three telecom companies for usage rights reached 620 billion KRW, but in the fourth quarter of 2020, about 570 billion KRW was accounted for as impairment losses related to the usage rights. Impairment loss refers to reflecting in the financial statements and income statement when the value of assets held by a company falls below the book value. An industry insider expressed frustration, saying, "How can companies install equipment when there is no demand?"

Experts diagnose that an analysis of the causes of the failed demand forecast and policy reinforcement to increase operators' business freedom should be carried out together. They point out that it is not right to proceed with a confrontational and conflictual structure between the government and operators. Professor Shin Min-soo of Hanyang University said, "Since the frequency auction price is determined based on the expected revenue, it was assumed there was demand, but a problem with demand forecasting occurred," adding, "It is time for the government to carefully analyze policy outcomes and consider why demand forecasting did not work properly, so that consumer trust in telecom companies is not broken."

Meanwhile, as the government has officially announced that it will auction the frequency band of one of the two operators whose allocation cancellation was confirmed after the hearing process, competition for one band is expected to be fierce. It is also anticipated that SpaceX, a US satellite communication company operated by Elon Musk, may seek indirect entry through equity investment. The possibility of the three domestic telecom companies giving up also seems low. Kim Hong-sik, a researcher at Hana Securities, said, "The possibility that any of the three domestic telecom companies will fail to secure the 28GHz frequency in the 2023 additional 5G frequency auction is low," explaining, "Looking back over the past 20 years, many technologies that the industry initially judged as difficult to commercialize eventually became commercialized over time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.