Application of 2020 Level Realization Rate in Next Year's Official Price Assessment

Reduction of Property Tax Burden for Single-Homeowners through Lower Fair Market Value Ratio

[Asia Economy Reporter Cha Wanyong] The government will lower the real estate official price realization rate for next year to the 2020 level. Accordingly, the tax burden such as holding tax for homeowners and landowners is expected to decrease significantly compared to this year.

On the 23rd, the government (Ministry of Economy and Finance, Ministry of the Interior and Safety, Ministry of Land, Infrastructure and Transport) announced the establishment of the 'Revised Plan for Official Price Realization' and the '2023 Housing Property Tax Imposition and System Improvement Plan' to ease the public's holding tax burden to the 2020 level.

The government judged that since the implementation of the official price realization plan, the rate of change in official prices has increased excessively over the past two years, thereby increasing the public's holding burden.

It also considered concerns that if the recent real estate market downturn continues next year, a reversal phenomenon may occur where the official price, which is the tax base, becomes higher than the actual transaction price, lowering public acceptance.

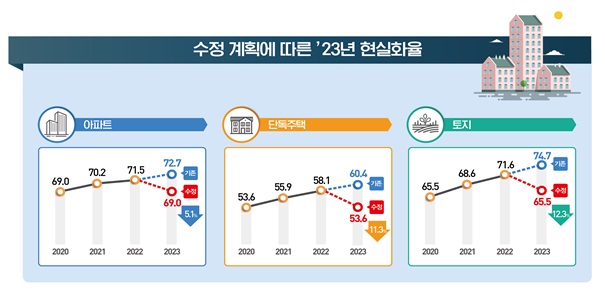

The official price realization rate varies by individual housing, but the realization rate for apartment-type multi-family housing next year will decrease from 71.5% this year to an average of 69.0%, the 2020 level. By price range, for properties under 900 million KRW, it will decrease from 69.4% this year to 68.1% in 2020; for 900 million to under 1.5 billion KRW, from 75.1% to 69.2%; and for 1.5 billion KRW and above, from 81.2% to 75.3%.

For detached houses, since the increase in realization rate over the past two years was smaller compared to apartments, the reduction will be relatively modest. The average realization rate for detached houses this year is 58.1%, and lowering it to the 2020 level will bring it down to an average of 53.6%. For detached houses under 900 million KRW, it will drop from 54.1% to 52.4%; for 900 million to under 1.5 billion KRW, from 60.8% to 53.5%; and for 1.5 billion KRW and above, from 67.4% to 58.4%.

The realization rate for land also varies by usage, but the average will decrease from 71.6% this year to 65.5% in 2020.

Due to the effect of lowering the realization rate according to this revised official price realization plan, the official price change rate for next year (compared to this year) is expected to decrease on average by 3.5% for multi-family housing, 7.5% for detached houses, and 8.4% for land, respectively, and the final official price will be determined reflecting this year's real estate market price fluctuations.

The official price realization plan to be applied long-term from 2024 onwards will be prepared in the second half of next year, comprehensively considering expert opinions that the real estate market situation and economic conditions are highly uncertain and that improvements in the accuracy of market price surveys need to precede.

Next year's property tax for single-homeowners, who are actual home users, will also be restored to the pre-2020 level considering the recent decline in housing prices and the burden on low-income households. Earlier, in June, the government amended the 'Local Tax Act Enforcement Decree' to reduce the fair market value ratio for single-homeowners from 60% to 45%.

Next year, to alleviate the property tax burden on low-income households, the government plans to maintain the policy of lowering the fair market value ratio for single-homeowners and further reduce it to a level lower than 45%, reflecting the effect of official price declines due to falling housing prices. The specific reduction rate will be finalized around April next year after the housing official prices are disclosed.

Additionally, the government will actively strive to have the comprehensive real estate tax reform plan announced last July passed by the National Assembly. If the government’s reform plan is implemented, the amount and number of taxpayers for the comprehensive real estate tax next year are expected to return to the 2020 level.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.