FKI Announces Report on 'Economic Impact Analysis of Corporate Tax Cuts'

[Asia Economy Reporter Kim Pyeonghwa] A claim has emerged that lowering the corporate tax rate promotes corporate investment and employment, thereby increasing corporate tax revenue. It is also explained that the effect of reducing the top tax rate appears not only in large corporations but also in small and medium-sized enterprises (SMEs).

On the 23rd, the Federation of Korean Industries (FKI) announced this through a report titled ‘Economic Effects Analysis of Corporate Tax Cuts’ commissioned to Professor Hwang Sang-hyun of Sangmyung University.

This report is based on financial indicators and nominal top corporate tax rates (including local taxes) data of externally audited companies (excluding financial industries) from the 1998 foreign exchange crisis to last year, and estimates the impact of changes in corporate tax rates on corporate investment (increase in tangible assets) and employment (number of employees) through regression analysis.

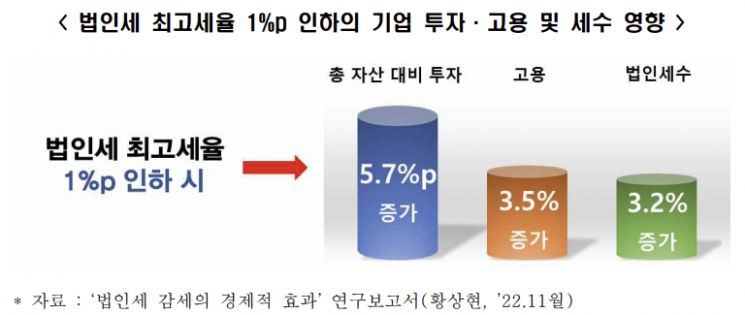

The report analyzed that lowering the top corporate tax rate by 1 percentage point increases the investment ratio relative to total assets by 5.7 percentage points. It also added that the investment ratio relative to total assets increases by 6.6 percentage points for large corporations and 3.3 percentage points for SMEs, respectively.

Lowering the top corporate tax rate by 1 percentage point was found to increase employment by 3.5%. Specifically, employment in large corporations could increase by 2.7%, and in SMEs by 4.0%.

Additionally, the report’s analysis shows that lowering the top corporate tax rate by 1 percentage point increases corporate tax expenses by 3.2%. Corporate tax expenses for large corporations increase by 8.1%, and for SMEs by 1.7%, respectively.

The FKI argued that since the effect of lowering the top tax rate appears not only in large corporations but also in SMEs, it differs in nature from the so-called tax cuts for the wealthy mentioned by some. As the domestic potential growth rate is expected to continue declining, it is necessary to create a virtuous cycle by increasing corporate investment and employment through lowering corporate tax rates, thereby promoting economic growth and leading to increased tax revenue.

Choo Kwang-ho, head of the FKI Economic Headquarters, said, “In a situation where domestic and international uncertainties are increasing, high corporate taxes act as a significant burden on corporate management,” adding, “It is time to support companies to overcome the crises of high inflation and high interest rates they face through corporate tax cuts.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)