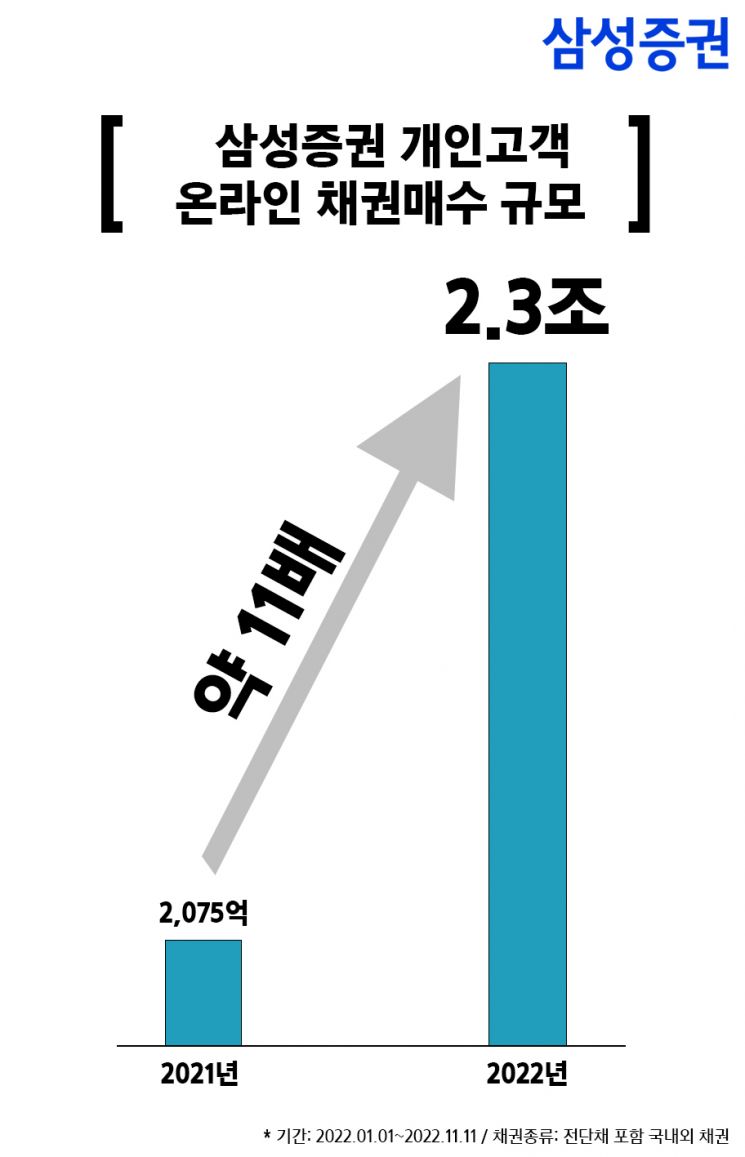

Online Transactions Surge 11-Fold Year-on-Year... 93% of Buyers Are Novice Investors

Riding the Tax-Saving Investment Boom, 90% Choose 'Jeokupon Bonds'... Increased Share of 4050 Generation

[Asia Economy Reporter Lee Seon-ae] The era of bond investment becoming popular among the general public is truly unfolding. As online bond trading becomes possible and the minimum investment amount decreases, individual investors' bond investments are rapidly increasing.

Samsung Securities announced on the 23rd that the scale of bonds purchased online by individual investors reached 2.3 trillion KRW as of November 11 this year. This is about 11 times the purchase scale of 200 billion KRW for the entire last year. This year, more than half (56%) of the per-transaction investment amount by online bond retail investors was 'under 10 million KRW,' indicating that small investors are leading the trend of online bond investment.

Samsung Securities explained, "Breaking the prejudice that 'bonds are purchased in large amounts at branches,' we have continuously improved services such as establishing a convenient online bond trading system and lowering the minimum bond investment amount to popularize bond investment, which is the background for expanding our customer base."

In September, Samsung Securities launched a system enabling mobile trading of overseas bonds and lowered the minimum investment amount from the existing 10,000 USD to 100 USD. Additionally, they created bond-related YouTube content to enhance the understanding of bonds among general individual investors. A representative example of bond-related YouTube content is 'Bond Locker,' conducted in a live commerce format last August, which currently has nearly 60,000 views. 'Bond Locker' features Samsung Securities' product experts who explain bonds that have recently gained great popularity among investors in an easy-to-understand manner using a live commerce format. A distinctive feature is that viewers can inquire through Samsung Securities branches or call centers if they need consultation while watching the content.

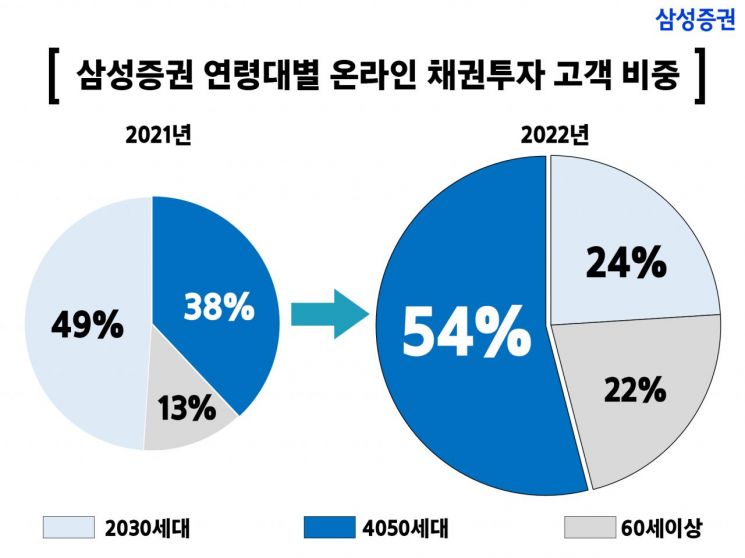

In fact, according to Samsung Securities' analysis, 93% of investors who purchased bonds using online channels this year had no prior bond purchase experience. By age group, the 40s and 50s, the main pillars of the economy, accounted for 54% of all investors, leading the online bond purchase trend. This contrasts with last year when the 40s and 50s accounted for only 38%, lower than the 20s and 30s (49%). This is analyzed as a result of the online trading system becoming more convenient, enabling the 40s and 50s to easily invest in bonds online just like the so-called 'digital natives' in their 20s and 30s.

By bond type, nine out of the top ten most purchased bonds were low-coupon bonds issued in 2019 and 2020. Among them, the most purchased bond was a long-term low-coupon government bond maturing in 2039, 'Gukgochaegwon01125-3906(19-6),' which attracted attention.

When interest rates fall, bond prices rise, and when interest rates rise, bond prices fall, so interest rates and prices in the bond market move inversely. Generally, the longer the maturity and the lower the coupon rate, the more sensitive the price movement. Therefore, the strong purchase of long-term low-coupon government bonds suggests that online bond investors believe the current interest rate hike cycle will soon come to an end and are proactively preparing for a subsequent interest rate decline.

Kim Seong-bong, head of product support at Samsung Securities, said, "We feel rewarded to have opened the era of popularizing bond investment," and added, "We will continue to present various investment alternatives that satisfy investors."

Meanwhile, Samsung Securities is conducting the 'Secret Weapon Bond Trading' event for customers who trade domestic and overseas bonds online until the 30th. The first event gives a coffee gifticon to customers who net purchase overseas bonds online for more than 1,000 USD. The second event, until October 3, rewards customers with no prior bond trading experience who net purchase domestic over-the-counter bonds for more than 100,000 KRW with a 5,000 KRW department store gift certificate. The last third event offers department store gift certificates up to 200,000 KRW based on the cumulative net purchase amount of domestic over-the-counter bonds during the event period.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.