This Year, the Number of 'Multi-Homeowners' Subject to Tax Notice Surpasses 500,000 for the First Time... Average Tax Amount for Multi-Homeowners Significantly Decreases

[Asia Economy Sejong=Reporter Son Seon-hee] This year, the number of taxpayers subject to the comprehensive real estate holding tax (종합부동산세, 종부세) on housing significantly increased compared to last year, while the average tax amount per person decreased by about 30%. Despite the heavy taxation on multiple homeowners, the number of notified multiple homeowners surpassed 500,000, increasing by nearly 100,000 from last year.

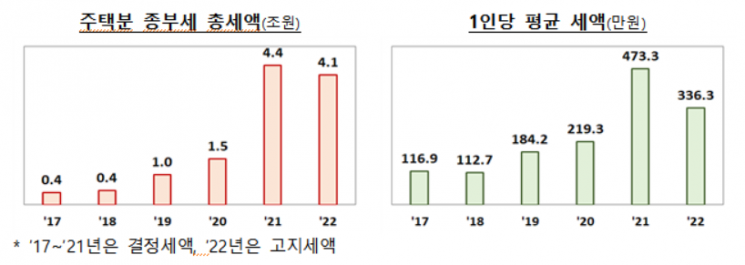

According to the Ministry of Economy and Finance on the 22nd, the number of taxpayers notified for the housing portion of the comprehensive real estate holding tax this year is 1.22 million, with a total notified tax amount of 4.1 trillion KRW. The average tax amount per person is 3,363,000 KRW, which is 1,370,000 KRW (28.9%) less than last year. However, it remains at a high level compared to the average tax amount from 2017 to 2020.

The decrease in the housing portion of the comprehensive real estate holding tax this year, despite rising house prices, is due to the government's tax burden relief measures such as ▲ lowering the fair market value ratio ▲ special cases for temporary two-homeowners. Initially, the housing portion of the comprehensive real estate holding tax was estimated to be around 9 trillion KRW, but the government reduced the fair market value ratio from 100% to 60% and introduced special cases like temporary two-homeowners, easing the total tax amount to about 4.1 trillion KRW.

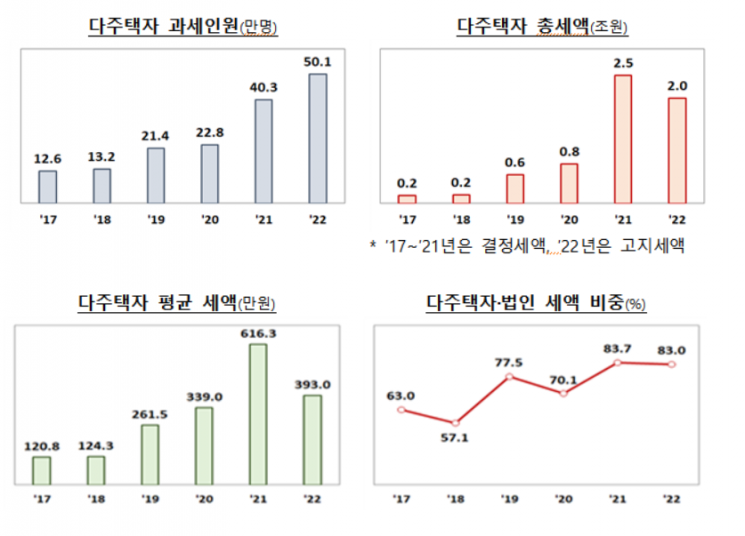

Although the government applied stringent heavy taxation on multiple homeowners, the number of notified multiple homeowners was 501,000, maintaining an increasing trend with a rise of 99,000 people compared to last year. The average comprehensive real estate holding tax amount for multiple homeowners was 3.93 million KRW, which is 2,233,000 KRW less than last year.

The total number of taxpayers notified for the comprehensive real estate holding tax, including land as well as housing, is 1.307 million, with a notified tax amount of 7.5 trillion KRW.

The number of taxpayers notified for the housing portion increased by 289,000 compared to just one year ago, marking a growth rate of 31%. Compared to 2017, the first year of the Moon Jae-in administration, it has increased about fourfold. The proportion of taxpayers also rose significantly from about 2% in 2017 to around 8% this year.

This increase in the number of taxpayers notified for the comprehensive real estate holding tax is attributed to the rise in officially announced property prices decided earlier this year. Due to the surge in house prices, the official price of apartment complexes rose by 17.2% compared to last year.

The Ministry of Economy and Finance stated, "The comprehensive real estate holding tax has become a tax that ordinary citizens, not just high-net-worth individuals, can pay," and added, "Considering the average household size (2.37 persons in 2020), the number of people directly or indirectly affected by the comprehensive real estate holding tax is expected to be even larger."

The most concerning point is that this tax burden could potentially be passed on to housing tenants. Accordingly, the government submitted a special deduction bill to raise the tax imposition threshold for single-homeowners from the existing 1.1 billion KRW to 1.4 billion KRW, an increase of 300 million KRW. However, it was not accepted due to opposition from opposition parties holding a majority in the National Assembly. The Ministry of Economy and Finance explained that if the bill had passed and been applied, the number of notified taxpayers would have decreased by about 100,000, and the notified tax amount would have been reduced by about 90 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.