Legislative Research Office 'A Study on Factors Increasing Household Debt and Management Measures'

[Asia Economy Sejong=Reporter Kwon Haeyoung] It has been revealed that the debt repayment burden of households in South Korea is increasing rapidly. Among the top five countries with high household debt burdens over the past five years, South Korea was the only country where the repayment burden steadily rose.

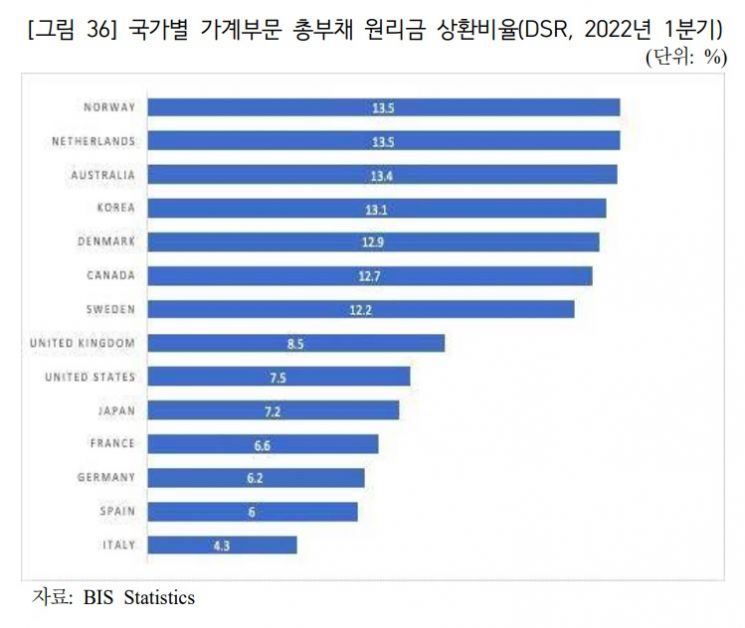

According to the "Study on Factors Increasing Household Debt and Management Measures" released on the 17th by the National Assembly Legislative Research Office, based on the Bank for International Settlements (BIS) statistics, South Korea's household sector total debt service ratio (DSR) in the first quarter of this year recorded 13.1%. This ranks fourth after Norway (13.5%), the Netherlands (13.5%), and Australia (13.4%), which have the highest household sector DSR. It is about twice the level of the United States (7.5%), Japan (7.2%), France (6.6%), Germany (6.2%), and Spain (6%).

The DSR is the ratio of loan principal and interest payments to annual income. The household sector DSR includes all principal and interest payments such as mortgage loans, car loans, and student loans. In South Korea's case, it means that if a household earns 1 million won in a year, 131,000 won must be used to repay loans.

The concerning point is that among the top five countries with the highest household sector DSR, South Korea is the only country where this ratio has steadily increased. South Korea's household sector DSR rose by 1.7 percentage points from 11.4% in the first quarter of 2017 to 13.1% in the first quarter of this year. In contrast, Norway's DSR fell by 1.3 percentage points from 14.8% to 13.5% over the past five years, and the Netherlands and Australia also decreased by 3.2 percentage points and 2.0 percentage points, respectively. Denmark, which has the next highest household sector DSR after South Korea, also fell by 2.5 percentage points. Only South Korea's household debt repayment burden continues to increase.

The household debt-to-GDP ratio was also the fourth highest among 43 countries covered by BIS statistics, at 105.4%. Only Switzerland (128.5%), Australia (118.4%), and Canada (105.9%) had higher household debt-to-GDP ratios than South Korea.

The Legislative Research Office pointed out, "Even if the household sector DSR level is the same, the perceived burden and risk of households vary depending on how well pension and social security systems, which can act as buffers, are organized in situations where macroeconomic shocks such as interest rate hikes and economic downturns increase household debt burdens." They added, "The actual risk of household debt in countries with well-established social safety nets like Norway and Denmark may differ from that in South Korea."

Since the rapid rise in loan interest rates due to the base interest rate hike is increasing the burden on households, they also suggested a policy mix that includes slowing the pace of interest rate hikes and an active fiscal policy focused on vulnerable groups.

The Legislative Research Office stated, "If the base interest rate follows the U.S., the rapid increase in household interest burdens could lead to household insolvency, making a gradual increase in the base interest rate inevitable." They emphasized, "If the government strictly follows fiscal rules, there may be difficulties in flexible and proactive policy responses," and added, "It is important to maintain an active fiscal policy stance to prevent an economic recession that may occur during the process of reducing household debt."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.