Peter Wennink ASML CEO "40nm Semiconductors Will Continue to Be Used in the Automotive Market"

Technology Competition Focused on Leading-edge Processes Continues... Mature Process Share Maintained in Foundry

[Asia Economy Reporter Kim Pyeonghwa] As the semiconductor industry’s technological competition centers on advanced processes with high added value, attention to mature processes with lower profitability and technical difficulty is decreasing. However, with semiconductors being embedded in various devices and products, demand for mature processes is expected to continue. Samsung Electronics plans to expand its production capacity (capability) for mature processes in its foundry (semiconductor contract manufacturing) business.

According to the semiconductor industry on the 19th, Peter Wennink, CEO of Dutch semiconductor equipment company ASML, forecasted the automotive semiconductor market at a domestic press briefing held on the 15th at the InterContinental Seoul COEX, stating, "Both advanced and existing semiconductors are growing in the automotive industry."

He explained, "While advanced semiconductors such as 5-nanometer (nm) are needed, 30 and 40 nanometer (nm; 1 nm is one billionth of a meter) semiconductors are also being used." Although the proportion of advanced semiconductors is gradually increasing due to automotive technology development, demand for semiconductors produced using mature processes of 28 nanometers or larger is also continuing.

Semiconductors mass-produced through mature processes include microcontroller units (MCU) used for device control, power management integrated circuits (PMIC) that control power, and display driver ICs (DDI) that render display images. Since these are included not only in most IT devices and home appliances but also in automobiles, they enjoyed a special demand boost during the COVID-19 pandemic.

However, demand has recently decreased due to the economic downturn, and as technological advancements expand the use of high-performance semiconductors, mature processes are becoming less of a major focus in the semiconductor industry. Different production conditions for each product and lower profitability compared to advanced semiconductors are also factors lowering attention.

Nonetheless, experts evaluate that the share of mature processes will continue as there is no need for advanced semiconductors to be used everywhere. Lee Joo-wan, a research fellow at POSCO Research Institute, said, "Semiconductor demand has a wide spectrum, and especially in foundry, the spectrum is even broader," adding, "There is always demand for mature processes."

In fact, Taiwan’s TSMC, the world’s number one foundry operator, responds to demand with a diverse lineup ranging from advanced processes to mature processes of 30 nanometers or larger. Samsung Electronics, the second largest operator, has announced plans to increase capacity not only for advanced processes but also for mature processes. Choi Si-young, President of Samsung Electronics’ Foundry Division, said at a foundry event held domestically last month, "We will expand capacity in the mature and specialty segments by about 2.3 times by 2024," adding, "We will actively respond to diverse customer demands."

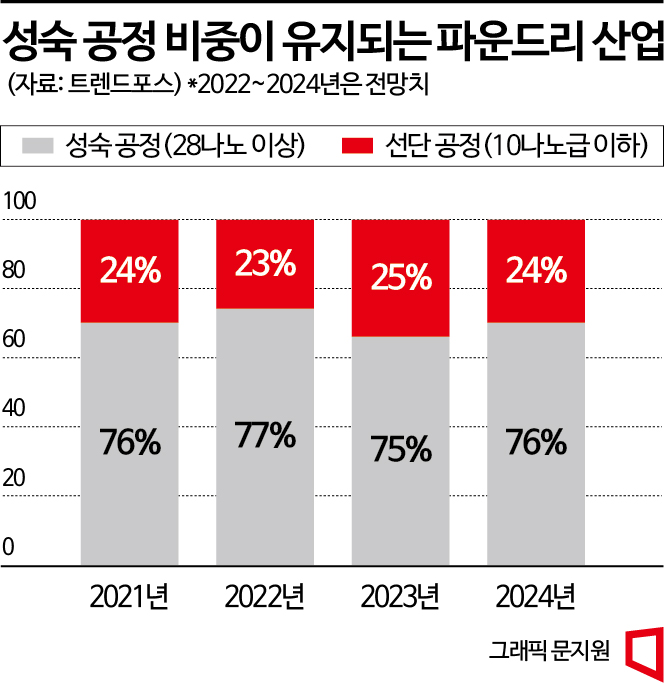

According to market research firm TrendForce, mature processes accounted for 76% of the global foundry industry as of last year. TrendForce forecasts that mature processes will maintain the same proportion in 2024. Regarding the semiconductor industry outlook for next year, it expects the foundry sector to focus on diversifying the development of special processes for mature processes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)