WTI Down 3.47% from Previous Day

Daily Volatility Still High

Supply Reduction Forecast Alongside Analysis of Increased Crude Oil Demand in China

Demand Surplus Expected in Q1 Next Year, Investment Phase Anticipated

[Asia Economy Reporter Minji Lee] There is a forecast that oil prices will change direction following China's easing of COVID-19 restrictions. Although prices have continued to decline amid growing concerns over demand reduction due to the global economic recession, it is analyzed that supply and demand will tighten if China's economy revives with the easing of restrictions.

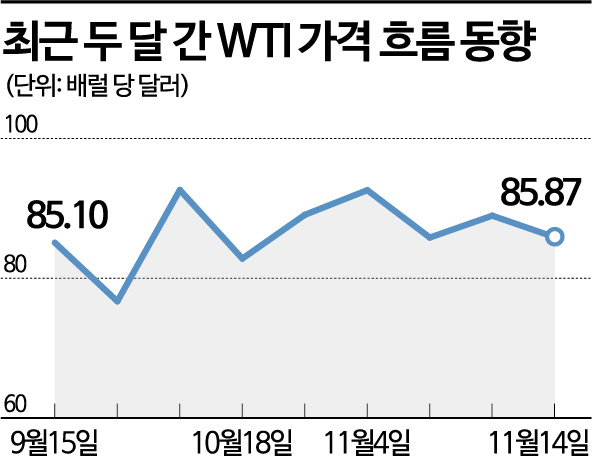

According to the New York Mercantile Exchange on the 15th, West Texas Intermediate (WTI) crude oil recorded $85.97 per barrel on the 14th, down 3.47%. Compared to the low of $76.71 on September 26 due to a strong dollar and recession fears, it has risen about 11%, but still shows high volatility on a daily basis. On the 11th, the previous trading day, it jumped more than 2% reflecting a weaker dollar and expectations for China's easing of restrictions, but volatility increased as no clear upward momentum was sustained.

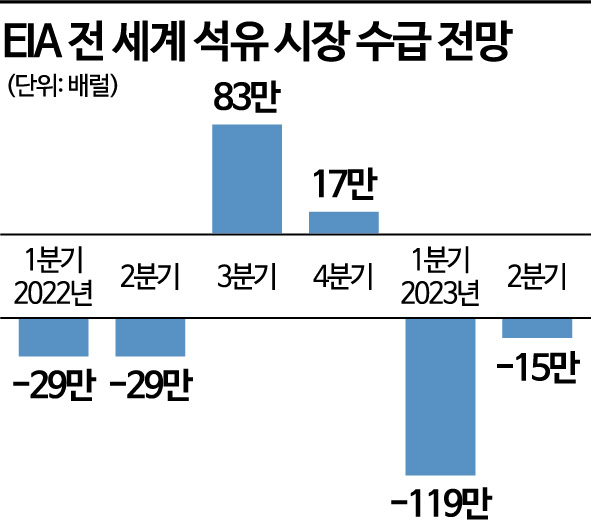

Although a sustained upward trend has not been observed, experts foresee that the time for investing in oil has arrived. It is analyzed that the Chinese government's COVID-19 easing policy, as the world's second-largest oil consumer and largest importer, will lead to economic revitalization policies that will expand crude oil demand. Hwang Byung-jin, a researcher at NH Investment & Securities, said, “Concerns over COVID-19 resurgence and uncertainties about the zero-COVID policy may increase oil price volatility, but oil will enter a supply shortage phase until the first quarter of next year.” He added, “The upward trend in oil prices toward $100 per barrel is expected to continue until the first quarter of next year, recommending an increased weighting, with a price forecast range of $80 to $120 per barrel.” According to a report by the U.S. Energy Information Administration (EIA), although there will be oversupply in the third and fourth quarters of this year, crude oil demand is expected to increase by 1.19 million barrels in the first quarter of next year.

Besides China, there are other factors that could push oil prices up. Global oil supply is expected to decrease further. OPEC+ (the coalition of oil-producing countries including Saudi Arabia and Russia), aiming to stabilize the oil market, shifted its policy to production cuts from October considering demand reduction. Accordingly, a large-scale cut of 2 million barrels per day has been implemented since this month. Since the coalition aims to maintain oil prices at $100 per barrel, concerns about additional production cuts are significant. In a report published yesterday, OPEC estimated daily crude oil demand growth at 2.5 million barrels, lowering its demand forecast. Shim Soo-bin, a researcher at Kiwoom Securities, said, “Although recent oil prices have fluctuated in the $80 per barrel range, lowering the likelihood of additional production cuts in December, OPEC's cuts are a factor supporting tight supply and demand conditions, so careful monitoring is necessary.”

A colder winter than usual is also a factor driving oil prices up. Natural gas prices have risen nearly 50% since the beginning of the year, increasing cost burdens. Researcher Hwang explained, “Entering the heating season, when demand for substitutes like natural gas and coal expands, even if recession concerns are further reflected, the slowdown will be considerably limited.”

If betting on rising crude oil prices, it is worth approaching through ETP products such as ETFs (Exchange-Traded Funds) and ETNs (Exchange-Traded Notes). 'KODEX WTI Crude Oil Futures' is an ETF popular among crude oil investors, tracking the Crude Oil Index calculated by S&P. Additionally, ETN products with lower tracking errors compared to ETFs, such as 'Shinhan WTI Crude Oil Futures ETN,' 'TRUE Bloomberg WTI Crude Oil Futures ETN,' and 'QV Bloomberg WTI Crude Oil Futures ETN,' are also accessible.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.