"Discussion on Implementation Measures for the Inflation Reduction Act"

Possibility of Law Application Deferral and Tax Benefits

[Asia Economy reporters Oh Hyung-gil and Choi Dae-yeol] U.S. President Joe Biden has expressed his intention to consider the economic contributions of Korean companies during the implementation of the Inflation Reduction Act (IRA), easing concerns in the automotive and battery industries. This has revived hopes for amendments to the law, which had been subdued amid political controversies following the U.S. midterm elections.

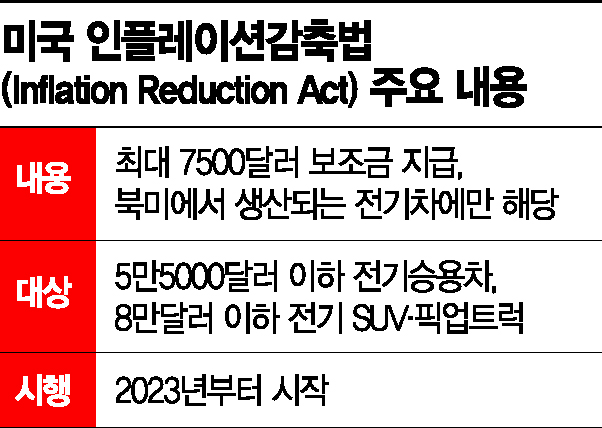

According to related industries on the 14th, discussions on the Inflation Reduction Act are expected to accelerate following the Korea-U.S. summit held yesterday in Phnom Penh, Cambodia. President Biden stated, "Korean companies contribute significantly to the U.S. economy in areas such as automobiles and electric batteries," and confirmed his willingness to discuss implementation measures of the Inflation Reduction Act considering these factors.

This creates room for the U.S. government to reflect grounds for deferral of application or tax benefits during the process of gathering opinions before establishing detailed regulations such as executive orders.

Earlier, Hyundai Motor submitted a statement to the U.S. Treasury Department arguing that "not granting tax benefits to electric vehicles assembled in Korea, a country with which the U.S. has a Free Trade Agreement (FTA), violates the content and spirit of the Korea-U.S. FTA," and insisted that "electric vehicles produced by corporations that made binding commitments to build U.S. electric vehicle plants before the law's enactment should be considered as meeting North American assembly requirements or be granted a grace period."

Electric vehicles currently sold by Hyundai Motor and Kia in the U.S., such as the Ioniq 5, Kona EV, and EV6, are all produced in Korean factories and exported locally. Hyundai plans to modify some lines at its Alabama plant to start local production of the electrified Genesis GV70 model from the end of this year.

Since Hyundai Motor Group's dedicated electric vehicle plant in the U.S. is expected to begin mass production only in 2025, it had been anticipated that price competitiveness would decline and sales would be affected until then.

Through future negotiations, it is expected that the same tax credit requirements for eco-friendly vehicles provided in the North American region will be applied to Korea, or a three-year grace period will be granted for fulfilling eco-friendly vehicle tax credit requirements.

The battery industry also eagerly awaits the reflection of previously submitted opinions regarding the relaxation of battery mineral and component requirements and tax credits for advanced manufacturing facilities in the subordinate regulations of the law.

The 2025 U.S. production capacities of the three domestic battery companies are expected to be approximately 210 GWh for LG Energy Solution, about 150 GWh for SK On, and around 33 GWh for Samsung SDI. Assuming the combined U.S. production capacity of the three companies reaches 390 GWh, domestic battery companies are expected to receive tax credit benefits worth $13.65 billion (approximately 18.8 trillion KRW) annually.

Meanwhile, related stocks are rising in the market today on the possibility of IRA amendments. As of 10:15 a.m. today, Hyundai Motor is trading at 176,000 KRW, up 4,000 KRW (2.33%) from the previous day. Kia is also up 2.50% at the same time. POSCO Chemical surged more than 6% intraday, hitting a 52-week high.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.