[Asia Economy New York=Special Correspondent Joselgina] As signs confirm that soaring inflation in the United States is slowing down, market attention is turning to the central bank, the Federal Reserve (Fed). There is growing speculation that the Fed will begin to 'slow down' the pace of interest rate hikes starting with the December Federal Open Market Committee (FOMC) meeting. While senior Fed officials have collectively left room for slowing the pace, they have dismissed the possibility of a 'pivot'?a policy shift?citing that inflation remains excessively high.

◆Big Step Gains Momentum After CPI Falls Short of Expectations

After the release of the U.S. Consumer Price Index (CPI) for October on the 10th (local time), the federal funds (FF) rate market sharply increased expectations that the Fed will take a 'big step' by raising the benchmark interest rate by 0.5 percentage points in December. This marks a shift from the Fed’s previous four consecutive giant steps (0.75 percentage points) aimed at curbing inflation, signaling that the Fed may now ease off the tightening accelerator.

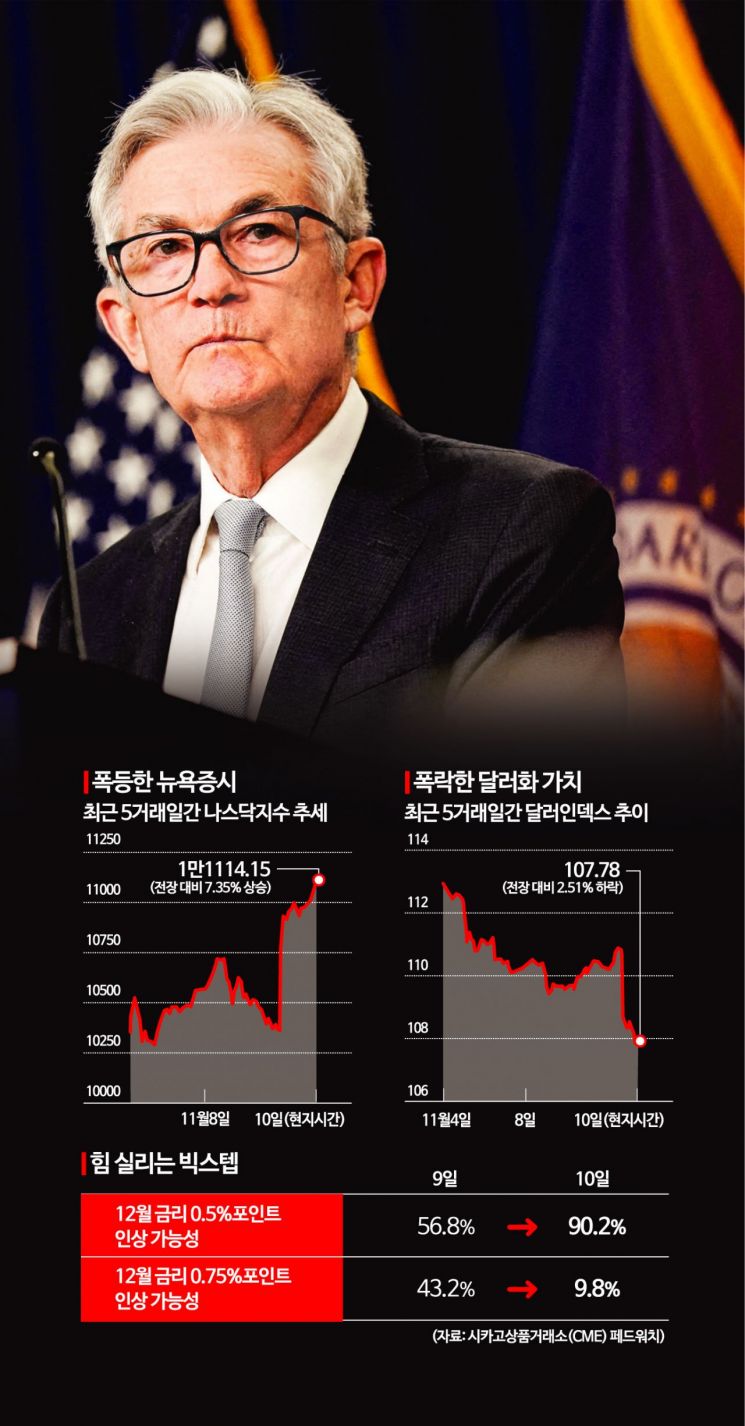

According to the Chicago Mercantile Exchange (CME) FedWatch, the probability of a big step, which was in the 50% range the day before, has now exceeded 90%. Conversely, expectations for continuing giant steps have dropped from 48% a week ago and 43.2% the day before to 9.8% on the day of the report. Some market participants even predict that the final interest rate will not exceed 5%.

This shift is a result of the October CPI increase (7.7%) slowing to the 7% range and falling below expert forecasts (7.9%), raising hopes that U.S. inflation has begun to ease. With the inflation peak confirmed, the Fed has no reason to further weigh down global asset markets with excessive tightening.

The Wall Street Journal (WSJ), which first reported on the Fed’s potential slowdown, stated immediately after the CPI release, "The October inflation report will bolster the Fed’s plan to raise rates by 0.5 percentage points in December." Christopher Rupkey, Chief Economist at FWD Bonds, said, "The Fed’s inflation response has passed an inflection point," and predicted, "The size of rate hikes will gradually decrease going forward."

Financial markets also reacted to expectations of easing tightening. On that day, the Nasdaq index surged more than 7%, with all major indices showing their largest gains since the 2020 pandemic. Meanwhile, government bond yields fell. The dollar’s value dropped by the largest margin in 13 years. John Bricks of NatWest commented, "The market’s reaction shows how much concern there was about the CPI," adding, "Today’s CPI suggests that both inflation and the Fed’s tightening have reached their peak." Tim Courtney, Chief Investment Officer (CIO) at Accential Wealth, evaluated, "Interest rates are driving everything in the market."

◆Fed Signals Slowing Pace but Draws Line on Policy Shift

Fed officials also welcomed the CPI data and left open the possibility of slowing the pace of rate hikes soon. Patrick Harker, President of the Philadelphia Federal Reserve Bank, said in a speech that day, "I expect the pace of rate hikes to slow over the next few months," citing the cumulative tightening so far. Loretta Logan, President of the Dallas Fed, also welcomed the CPI, saying, "Today’s CPI is good news," and supported slowing the pace of rate hikes, stating, "I believe it may soon be appropriate to slow the pace."

However, they clearly warned against expecting a halt or reversal of rate hikes. President Logan pointed out, "A slowdown in the pace does not mean a 'easing' policy," and added, "If the pace slows, the FOMC will need to adjust other factors to maintain tightening conditions." President Harker emphasized that "0.5 percentage points is still a high level," indicating that tightening conditions will continue.

Neel Kashkari, President of the Minneapolis Fed, also highlighted persistently high inflation, stating, "While the pace of rate hikes may slow, it is too early to discuss a pivot." This aligns with Fed Chair Jerome Powell’s November FOMC message that the pace of rate hikes will slow but continue for a longer period and at higher levels.

◆November Inflation and Employment Data Also Key Variables

There are also many voices cautioning that it is difficult to confirm the inflation peak based on a single data point. Mary Daly, President of the San Francisco Fed, pointed out, "One month of data cannot produce a victory in the fight against inflation."

The Fed’s inflation target of the 2% range is still far off. There have been past cases where the CPI growth rate slowed and then accelerated again. Experts also expressed concern that energy prices, which had been declining over the past three months, are rising again when looking at inflation trends in detail. Brian Coulton, Chief Economist at Fitch Group, said, "Considering the high inflationary pressure in the services sector, it is not easy to definitively say the pace will slow."

With the November CPI and employment reports scheduled before the December FOMC meeting, the Fed is expected to review at least two months of data before deciding on the size of the rate hike. Michael Aaron, Chief Investment Strategist at State Street Global Advisors, said, "Investors are waiting for Chair Powell’s pivot, but I’m not sure such news will come soon," and evaluated, "The market’s enthusiasm today is somewhat of an overreaction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)