[Asia Economy Reporter Buaeri] As the upper limit of mortgage loan interest rates at major commercial banks surpassed 7%, and forecasts suggest it will reach the 8% range by the end of the year, the financial worries of "young all-in" borrowers are deepening. For a loan amount of 400 million KRW, the monthly repayment amount is approaching 3 million KRW.

According to the financial sector on the 10th, the variable interest rates for mortgage loans at major commercial banks such as KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup stood at 5.09% to 7.688% annually as of the previous day. Compared to the end of last year (3.71% to 5.07%), this is an increase of 2 percentage points. The highest mortgage loan interest rate, which has already surpassed 7%, is expected to reach 8% by the end of the year and 9% next year. The COFIX (Cost of Funds Index), which serves as an indicator for variable mortgage loan interest rates, rose by 0.44 percentage points to 3.4% based on new transactions in September, marking the highest level in 10 years and 2 months.

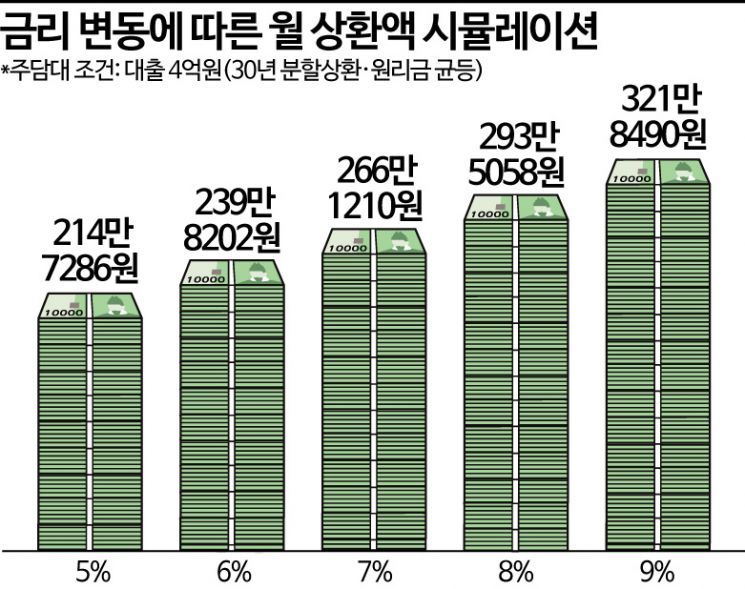

A simulation conducted through a commercial bank showed that for a loan amount of 400 million KRW (30-year installment repayment, equal principal and interest method), the monthly repayment amount was approximately 2.15 million KRW at a 5% interest rate, 2.4 million KRW at 6%, and 2.66 million KRW at 7%. This means that the monthly repayment to the bank already accounts for about half of the monthly salary. According to Statistics Korea, the average monthly household income in the second quarter of this year was 4.831 million KRW. If the loan interest rate reaches 8%, the monthly repayment amount will be about 2.94 million KRW, approaching 3 million KRW. This is an increase of more than 780,000 KRW compared to when the interest rate was in the 5% range. At 9%, the repayment amount would be around 3.22 million KRW.

With the upper limit of jeonse loan interest rates also exceeding 7%, the interest burden on jeonse loan borrowers has increased. The interest rates for jeonse deposit loans at KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup (based on new COFIX linked for 6 months) range from 5.17% to 7.437% annually. Compared to the end of last year (3.39% to 4.799%), the upper and lower limits have risen by approximately 1.78 and 2.638 percentage points, respectively. The highest interest rates for unsecured loans at commercial banks have also reached the 8% range.

With the base interest rate rising, loan interest rates are expected to continue their upward trend for the time being. The U.S. Federal Reserve (Fed) pushed through a "giant step" by raising the base interest rate by 0.75 percentage points at the Federal Open Market Committee (FOMC) regular meeting held earlier this month. This marks the fourth consecutive increase following June, July, and September. Accordingly, the Bank of Korea is also expected to raise the base interest rate at the Monetary Policy Committee meeting scheduled for the 24th. A representative from a commercial bank said, "Although each bank applies preferential interest rates, so not many people will actually take out loans at 8-9% interest rates, it is true that the interest burden has significantly increased."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.