Ministry of Culture Holds '2022 Yesullo Investment' Workshop

Clear Growth in Musical and Art Markets Since COVID-19

"Active Participation of MZ Generation... Integration with Advanced Technology"

[Asia Economy Reporter Kim Bo-kyung] As the MZ generation emerges as the main consumer group in the domestic arts industry, the perception that it is a "profitable" market is increasing. In particular, there are prospects that a high synergy effect can be achieved through convergence with 4th Industrial Revolution technologies. There were also voices that entrepreneurial spirit and the ability to respond to rapidly changing trends are essential virtues for startup founders in the culture and arts sector.

The Ministry of Culture, Sports and Tourism and the Arts Management Support Center held the "2022 Investing in Arts - Arts Sector Investor Workshop" on the 8th at the Grand Mercure Ambassador Seoul in Yongsan-gu, Seoul. After examining recent trends in the cultural and arts investment market, promising startup IRs and networking with venture capital (VC) followed.

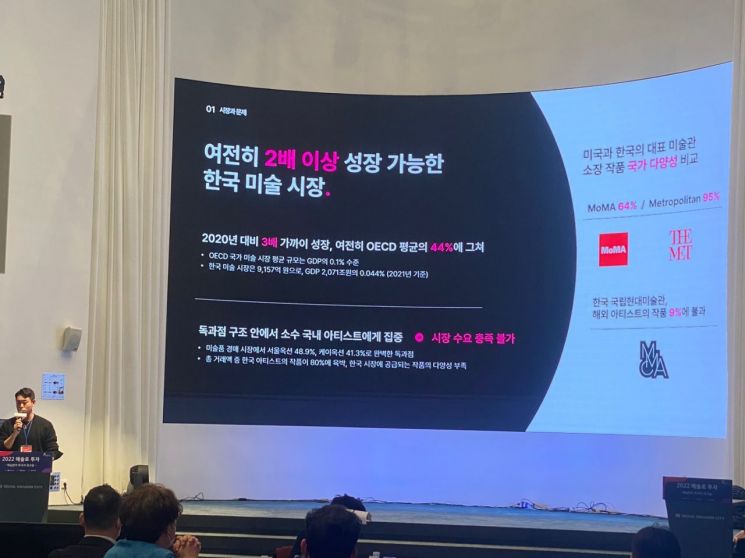

Baek Sang-hoon, director of Ground Up Ventures, who gave the first keynote lecture, focused on the growth potential of the musical and art markets. He said, "Since the COVID-19 pandemic, the musical market in the performing arts sector has grown by nearly 20%, and the art market has expanded from 381.2 billion KRW in 2019 to over 1 trillion KRW this year." Regarding musicals, he analyzed that the recent increase in overseas exports of works created domestically with unique IP (intellectual property) and fandom culture involving K-pop stars contributed to this growth.

The art market is experiencing winds of change as the MZ generation, which values taste and individuality, has established itself as the main consumer group. The way art is enjoyed has also shifted from "passive appreciation" to "active participation." Baek interpreted, "Customers we were unaware of and the market had overlooked have changed the market in their own way." He added, "In the past, art was appreciated by going to a specific place and viewing works hung in a particular space, but now you can see the works you want at the time you want."

He introduced BGA, an art subscription service operator that sends art content every night at 11 p.m. through an application. Jung Yoon-ha, CEO of BGA, majored in UX design and has years of experience working in the IT industry as a service planner. Jang Tae-won, CEO of Lowy Lab Korea, who gave an IR presentation that day, majored in photography. He possesses technology that vividly reproduces offline spaces into virtual spaces and has signed contracts with Samsung Electronics, conducting various projects. In this way, the boundaries between art and technology industries are gradually blurring. Baek said, "Companies that can move back and forth between art companies and tech companies are attractive."

Jung Moo-yeol, executive director of eCROUX Venture Partners, said, "We need to pay close attention to the fact that culture and arts create high synergy through convergence with 4th Industrial Revolution-related technologies." This has made it possible to fill the gaps in existing investments in the arts sector. As environments where various arts can be enjoyed in online settings such as the metaverse are created, the limitations of exhibition spaces are being overcome. Jung said, "Works are shared without restrictions of time and space, and galleries and auctions are transforming into online commerce, creating new business areas." He added, "As of the end of June this year, about 1.2 trillion KRW has been raised in venture funds in the cultural content sector," and "Various cultural content funds are being established through the Korea Fund of Funds."

Jung emphasized that when investing, it is important to examine whether the founder has the ability to quickly respond to trends, entrepreneurial spirit, and the capability to grow and sustain the company. He said, "Collaboration with various industries and fandom culture should make the public more familiar," but also stressed, "It is insufficient to expect growth from the domestic market alone," highlighting that overseas market entry is essential.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.