[Asia Economy Reporter Lee Seon-ae] As the domestic stock market officially enters a 'profit decline cycle' where corporate earnings are falling, investors face increasing challenges in formulating investment strategies. Since the KOSPI index is already set lower than the consensus earnings that have declined, experts advise investors to be more cautious in selecting sectors and stocks throughout the duration of this downward earnings cycle, as a clear stock-specific market is expected to unfold next year.

According to the financial investment industry on the 9th, the downward revision of earnings for domestic companies by major securities firms (based on 12-month forward earnings per share (EPS)) has reached -15% compared to three months ago, marking the largest quarterly decline since the end of Q1 2019.

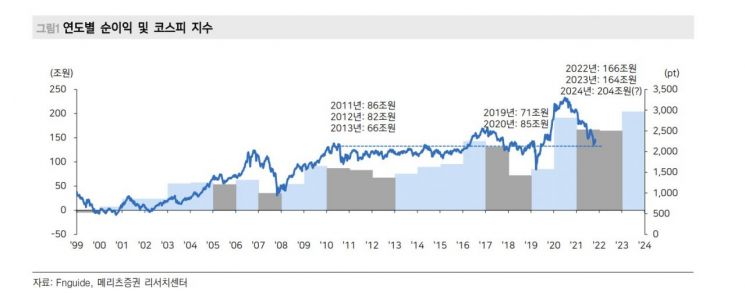

The KOSPI recorded a peak of 3302 in June last year and has been on a downward trend for a year and a half, currently falling to the 2300 level. The KOSPI net profit consensus for this year and next is around 160 trillion KRW (2022: 166 trillion KRW, 2023: 164 trillion KRW), about 10% lower than the previous year but still at an absolutely high level compared to the past. Currently, the index is significantly lower than the earnings consensus. The KOSPI at 2300 was also formed in years when net profits were around 70 to 80 trillion KRW.

The reason for the low index level relative to net profits is largely attributed to significant market participants' distrust of the market. Lee Jeong-yeon, a researcher at Meritz Securities, noted, "At the end of April to early May this year, the KOSPI net profit forecast was 190 trillion KRW, but it was revised downward by 24 trillion KRW to 166 trillion KRW within six months. Especially, the net profit outlook for next year has been revised downward by more than 50 trillion KRW in just six months, indicating high earnings uncertainty for next year compared to this year."

The problem is that the downward cycle is expected to continue until the first half of next year. Looking at the profit decline cycles based on 12-month forward EPS since 2000, the average duration from peak to trough is about one year, with adjustments ranging from -25% to -35%. This year's profit decline cycle has lasted about six months, with an adjustment of around -20%, suggesting it is in the middle phase of the cycle. Therefore, next year is expected to record negative growth for the second consecutive year following this year. Accordingly, the downward trend in 12-month forward EPS due to earnings revisions is likely to continue until April next year.

As an investment strategy, attention should be paid to sectors that have experienced excessive declines. Kwak Byung-yeol, a researcher at Leading Investment & Securities, said, "The stock price reaction of U.S. sector indices during the IT bubble interest rate hikes (2000) provides a good reference for the rapid valuation adjustments during interest rate hike periods," adding, "Sectors that underperformed in the early phase of the rate hikes showed good performance in the mid-to-late phase." He advised that sectors with poor year-to-date returns and extremely undervalued price-to-book ratios (PBR) compared to the market, as part of normalization of excessively declined sectors, deserve attention.

Researcher Kwak identified IT (semiconductors, hardware), automobiles, steel and metals, and financial sectors as fitting this description, emphasizing, "Value stocks that show excess performance in the mid-to-late stages of interest rate hikes should be considered with the valuation (PBR) bottoming out process in mind."

Lee also stated, "If the earnings recovery path in the second half of next year is not steep, the rise in price-to-earnings ratio (PER) alone will not provide sufficient room for index gains," adding, "It is more likely that annual returns will be limited to within 10%, so strategies should focus on stocks that have experienced excessive declines." He further noted, "In past two-year consecutive profit decline cycles, the best-performing investment indicator was 'EV/EBITDA (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization) undervalued stocks,'" explaining, "Although this indicator is mainly used in corporate acquisitions, it is useful for identifying undervalued stocks compared to PER in situations where trust in earnings is low due to the profit decline cycle."

The stocks identified include Samsung Electronics, POSCO Holdings, LG Electronics, Samsung SDS, Samsung Electro-Mechanics, Krafton, LG Innotek, Hankook Tire & Technology, Coway, Orion, Hyundai Engineering & Construction, GS Retail, OCI, Shinsegae, Amorepacific Group, Youngone Corporation, Hyundai Wia, SK Chemicals, Hyosung Advanced Materials, and DL E&C.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.