[Asia Economy Reporter Kim Hyemin] As real estate transactions have come to a halt, the transaction turnover rate, which indicates buying activity, has recorded an all-time low. The rapid interest rate hikes, steep decline in housing prices, and economic recession have combined to quickly dampen real estate buying sentiment. With no signs of the interest rate hike rally ending, the real estate market is expected to remain in a slump for some time.

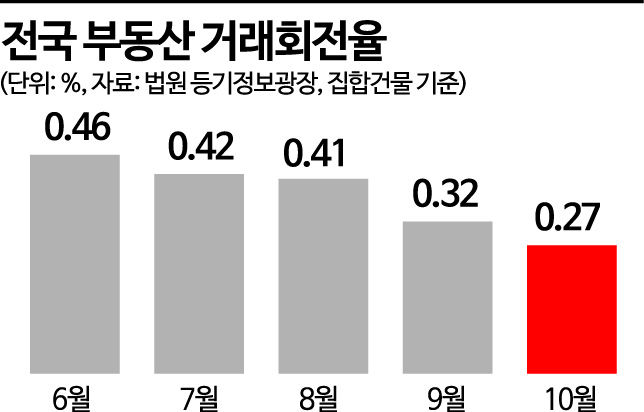

According to the Court Registry Information Plaza on the 8th, the transaction turnover rate for apartments and other collective buildings nationwide last month was 0.27%. This is 0.07 percentage points lower than the previous month (0.34%) and is the lowest since the survey began in 2010.

The transaction turnover rate for collective buildings is an indicator that reflects the activity level in the apartment, multi-family/row house, and officetel sales markets. It refers to the number of properties for which ownership transfer registration has been completed among collective buildings where ownership transfer is possible. A lower turnover rate means fewer transactions relative to the total number of real estate properties. A rate of 0.27% means that only 27 out of every 10,000 valid collective buildings were traded.

This is the first time the index has fallen to the 0.2% range. The previous lowest was 0.32% in January 2013, but this record has now been broken. Notably, at that time, the previous month, December 2012, had a high turnover rate of 1.04%, which caused a sharp drop in transaction volume, followed by a rebound, creating a very different atmosphere from now. This year, the rate stayed in the 0.4% range from January's 0.5% until August, but the decline has accelerated in the last two months.

The decrease is especially pronounced in Seoul and Sejong. As of October, the turnover rates in these areas were 0.17% and 0.14%, respectively, significantly below the national average. In Seoul’s Nowon-gu and Yangcheon-gu districts, the rates were 0.05% and 0.09%, meaning fewer than 10 transactions per 10,000 properties. Outside Seoul, in the metropolitan area, Uiwang-si recorded 0.09%, also below 10 transactions per 10,000 properties.

Experts agree that the sharp decline in transactions is likely to continue for the time being. Although the government lifted the 1.5 billion KRW loan restriction last month, leading to some buying inquiries focused on quick-sale properties in certain Gangnam areas, it is pointed out that this will not affect the overall trend. Lim Byungcheol, head of the Real Estate R114 Research Team, said, "With the U.S. Federal Reserve implementing four consecutive giant steps (0.75 percentage point hikes in the base rate), it is highly likely that the Bank of Korea will raise the base rate again on the 24th. Given the ongoing high interest rate environment, easing loan regulations alone will have limited impact on changing market sentiment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.