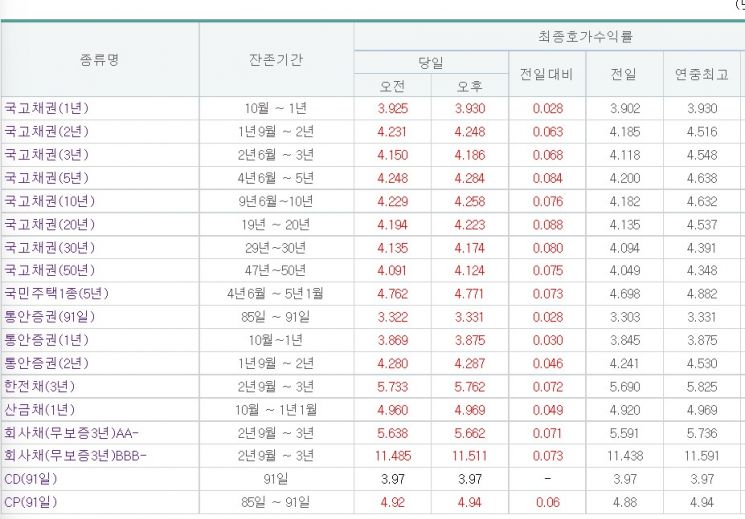

[Asia Economy Reporter Hwang Yoon-joo] On the 7th, government bond yields closed on an upward trend. The 1-year government bond and 91-day commercial paper (CP) both hit new annual highs.

In the Seoul bond market that day, the 3-year government bond yield closed at 4.186% per annum, up 0.068 percentage points (p) from the previous trading day. The 1-year bond closed at 3.930% per annum, up 0.028%p, marking a new annual high.

The 5-year bond closed at 4.284% per annum, up 0.084%p, and the 10-year bond yield rose 0.076%p to close at 4.258% per annum.

The 20-year bond yield increased by 0.088%p to 4.223% per annum. The 30-year and 50-year bonds rose by 0.080%p and 0.075%p respectively, closing at 4.174% and 4.124% per annum.

Meanwhile, the CD rate remained steady at 3.97% per annum, and the CP rate rose 0.06%p from the previous trading day to close at 4.94% per annum, setting a new annual high again.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)