Already Common in Advanced Countries like the US

Representative Domestic Examples: Darak, QStorage

Global Market Expected to Reach 90 Trillion Won by 2026

Growing Demand for Expanding Residential and Work Spaces

The market for 'self storage,' often referred to as shared storage spaces within urban areas, is emerging. Self storage operates by allowing individuals to store various personal items in spaces of desired sizes and pay monthly fees. Most facilities are unmanned systems, enabling convenient 24/7 access year-round. Items that can be stored in self storage range widely, including hobby equipment like camping gear, exhibition and stage equipment, artworks, and even wine.

In developed countries such as the United States, Japan, and the United Kingdom, this industry has grown large and become commonplace to the extent that high-value and large items like yachts and camper vans are stored. According to global research firm Statista, the worldwide self storage market is expected to grow to $64 billion (approximately 90 trillion KRW) by 2026.

According to a report released in June by the Korean branch of global real estate services company JLL, there are about 200 self storage locations in South Korea. Approximately 52% and 32% of these locations are concentrated in Seoul and Gyeonggi Province, respectively, showing a focus on major metropolitan areas. User accessibility is a key consideration, with many facilities located along major city roads or within subway stations.

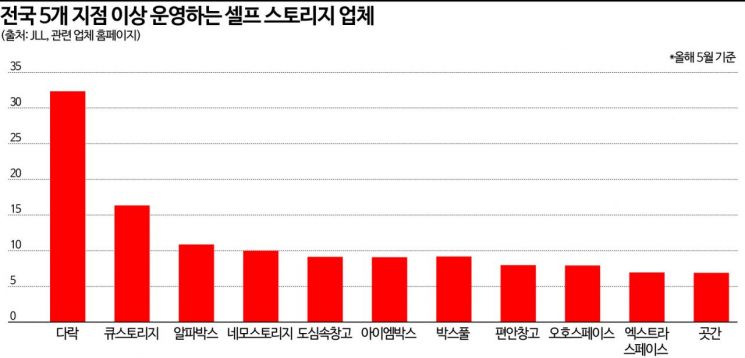

◆Each brand is unique... 'Second Syndrome' has the most locations = Among domestic self storage companies, Second Syndrome has the most locations. As of May, it operates 32 locations (Mini Warehouse Darak). A notable feature is its collaboration with KT to develop a 24-hour unmanned monitoring service using Internet of Things (IoT) technology.

Q-Biz Korea, which operates Q Storage, runs 16 locations as of the same period. Comfortable Warehouse, a self storage brand created by Koscom Tech, a KOSDAQ-listed company, uses patented materials employed in museums to store items sensitive to temperature and humidity. Oho Space, which has eight locations nationwide, operates a wine storage-only warehouse in Garosugil, Sinsa-dong, Seoul.

Other domestic self storage brands include Alpha Box and Dosimsok Changgo. Foreign companies operating in Korea include Singaporean firms Extra Space and StoreHub. Aside from these, most are small-scale companies operating only one or two locations.

◆Potential for domestic market expansion... Increased demand in the post-COVID era = According to the JLL report, five self storage REITs (real estate investment trusts) are listed on the FTSE Nareit US Real Estate Index and are showing growth. The report explains, "Self storage REITs are considered defensive and resilient sectors due to stable operating profits," adding, "Even amid increased financial market volatility, demand for storage remains constant."

The strong performance of the US self storage REIT market also indicates growth potential in Korea. Factors such as Korea's high real estate prices, urban population concentration, and the increase in single-person households contribute to expanding the self storage market. According to the 2020 Housing Survey, the average residential area per person is 33.9㎡, roughly 10 pyeong. In situations where residential space is limited and moving to a larger home is difficult or securing necessary storage space is challenging, self storage can be an alternative.

Especially with the rise of remote work following the COVID-19 pandemic, self storage can meet the demand for expanding living and working spaces. Professor Hyun-Jun Yoo of Hongik University's Department of Architecture stated, "In the post-COVID era, the time spent at home has increased by 1.5 times, so the need for space has also increased by 1.5 times."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.