Price Increase of Royal Canin and Hill's Pet Food

Price Hikes Domino Effect This Year... Harim Pet Food and Cargill Also Join

Sharp Rise in Raw Material Costs for Vegetables, Grains, and Meat Causes Increase

[Asia Economy Reporter Song Seung-yoon] Amid widespread price increases in the food industry, including processed foods and dairy products, pet food has also joined the ranks of price hikes.

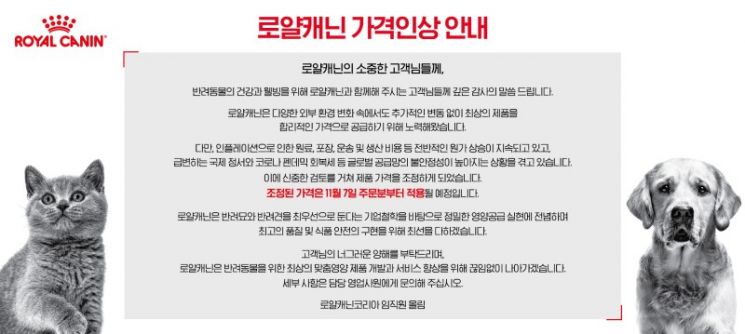

According to the industry on the 7th, Royal Canin, the market leader in pet food, plans to raise prices of some products, including cat and dog food and snacks, by around 10% starting today. The company cited difficulties in absorbing overall cost increases, including raw material costs, logistics expenses, packaging, and production costs. Royal Canin stated, "After careful consideration amid rapidly changing international circumstances and increasing global supply chain instability due to COVID-19, we have decided to adjust product prices," adding, "We ask for your generous understanding and will strive to improve product development and services."

Another overseas pet food brand, Hill's, is also expected to raise prices of some pet food products by about 10% starting this month. Earlier in July, Harim Pet Food raised prices of its 'Bapiboyak' line by a minimum of 8.4% and up to 18%. Cargill Agri Purina also increased prices this year for its pet food brands 'Health Report,' 'Benetive,' and 'Bistro,' while domestic pet food brands 'PetHoo' and 'Natural Balance Korea' have also joined the price hike trend this year.

The overall price increase in the pet food industry is mainly attributed to significant rises in the prices of raw materials such as vegetables, grains, fish, and meat used in pet food, as well as increased logistics costs due to the high exchange rate environment. This phenomenon has even been dubbed "Petflation" (Pet + Inflation).

In fact, prices for grains used in pet food have remained at high levels. According to the 'International Grain November Issue' recently released by the Korea Rural Economic Institute, the grain import unit price index for the fourth quarter of this year is projected to be 185.2. Compared to the first quarter of last year, when the grain import unit price index for feed was 99.8, this represents more than a 1.8-fold increase. The grain import unit price index rose from 143.6 in the first quarter of this year to 158.8 in the second quarter, an increase of 15.2, and further increased by 32 to 190.8 in the third quarter. For the fourth quarter, due to factors such as the resumption of grain exports from the Black Sea, the strength of the US dollar, and concerns over weak demand caused by economic recession, futures prices fell compared to the third quarter, so a slight decline compared to the previous quarter is expected. However, due to factors such as the rise in the won-dollar exchange rate, the decline is not expected to be significant.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.