[Asia Economy Reporter Kim Hyemin] The real estate market has lost its momentum from redevelopment projects. As the decline in housing prices deepens, not only reconstruction and redevelopment but also remodeling projects no longer serve as incentives to drive up home prices. In particular, remodeling is criticized for having higher association fees compared to reconstruction, resulting in less demand for available properties.

According to the maintenance industry on the 4th, apartment remodeling projects in the Seoul area are progressing smoothly. Several associations are accelerating their establishment, and some complexes capable of vertical extension have emerged.

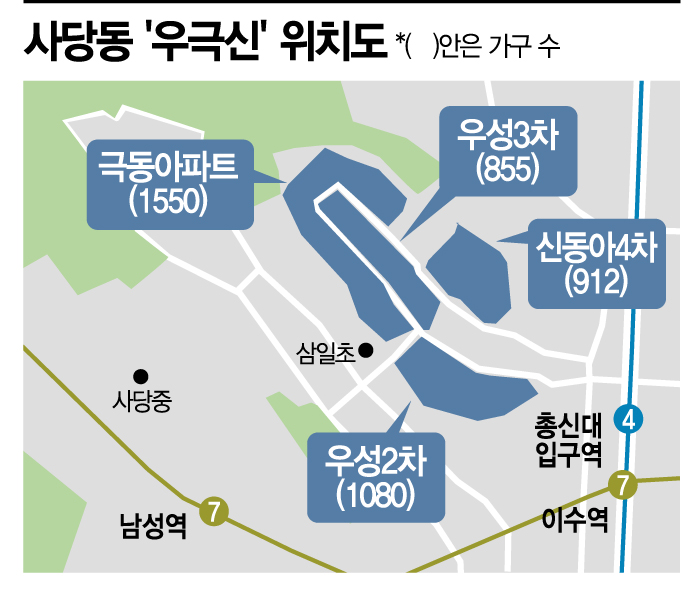

In Sadang-dong, Dongjak-gu, Ugeuksin (Woosung 2nd & Woosung 3rd, Geukdong, Sindonga 4th) will hold a general meeting on the afternoon of the 5th to establish an association. The remodeling promotion committee plans to obtain association establishment approval within this year and select a construction company by the first half of next year. Through integrated remodeling, this complex is expected to be reborn as a mammoth complex with 5,054 households from a total of 4,397 households, with the project cost estimated to reach around 1.5 trillion KRW. It has attracted much attention as the largest integrated remodeling project in the country.

However, such positive news has not been reflected in recent housing prices. For example, a 60㎡ unit in Woosung 3rd was traded for 1.01 billion KRW in August. This marks a 180 million KRW drop in four months from the peak price of 1.19 billion KRW in April. Similarly, a 108㎡ unit in Woosung 2nd, which rose to 1.64 billion KRW in September last year, was traded down to 1.42 billion KRW (1st floor) in May this year.

Songpa-gu Garak Ssangyong 1st, known as the largest and highest-value remodeling project in Korea, is also accelerating by selecting a construction company and preparing for architectural review, but housing prices remain sluggish. A 60㎡ unit was traded for 1.09 billion KRW this month, down 250 million KRW from the previous transaction price of 1.36 billion KRW in May. Considering the record high of 1.47 billion KRW reported in October last year, housing prices have experienced a rollercoaster ride within a year.

Daechi 1st Hyundai, which passed the second safety review for vertical extension last month, saw an 85㎡ unit traded for 2.46 billion KRW in June, but current asking prices range from a minimum of 2.15 billion KRW to a maximum of 2.5 billion KRW. Vertical extension can increase the size of the complex, making it more profitable than horizontal extension, but it is difficult to pass the safety inspection due to strict screening. Despite such positive factors, asking prices have remained stagnant.

An industry insider said, "Remodeling has fewer concerns about project delays due to unsold units because the number of general sale units is small, but construction costs and association fees are higher compared to reconstruction. If the current atmosphere of lost expectations for housing price increases continues, the impact could be greater than in reconstruction-promoting complexes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.