Neighborhood-Based, Hobby-Sharing Platforms More Popular Than Dating

[Asia Economy Reporter Seungjin Lee] NHN Data analyzed big data on app installations across 16 industries from approximately 28 million Android users, revealing that preference-sharing platforms are gaining significant popularity in the second half of this year.

According to NHN Data's 'Second Half App Trend Report' released on the 4th, the top chat and meeting platform app in the second half of this year was ‘Somoim,’ a neighborhood-based hobby meeting service. Benefiting from the revitalization of offline meetings following the lifting of social distancing, ‘Somoim’ surpassed matchmaking apps like ‘Tinder’ and ‘Whipie’ to rank first in its category with an overwhelming number of installations.

Additionally, the interest-based community service ‘Munto’ showed a sharp increase, with installations rising by 102.2% compared to the first half of the year (as of May). For meeting platform services such as ‘Somoim’ and ‘Munto,’ the 20s and 30s age group accounted for 77% of installations, representing an absolute majority.

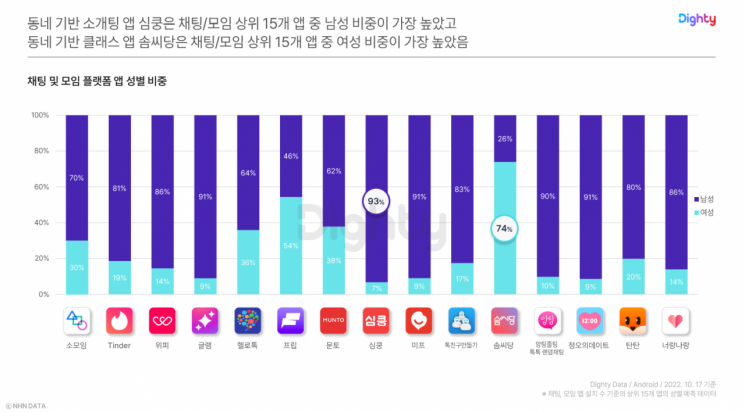

Moreover, the gender ratio among matchmaking app users was overwhelmingly male. While the average male installation ratio for matchmaking apps was 83%, apps like ‘Tantan’ (20%), ‘Tinder’ (19%), and ‘Whipie’ (14%) showed relatively higher female ratios.

The lifting of social distancing also led to a notable increase in reservation and leisure apps such as movie theaters, theme parks, and performance ticketing. Theme park and performance ticketing services, which had seen a continuous decline in installations since COVID-19, showed their first rebound in installations in the second half of this year, attracting attention.

‘Ticketlink’ recorded a 19.6% increase, ranking first in installation growth among reservation and leisure apps, followed by ‘Lotte World’ (16.1%), ‘Everland’ (16.0%), and ‘Interpark Ticket’ (12.6%). Among movie theater apps, Lotte Cinema (4.9%), Megabox (2.2%), and CGV (0.6%) showed steady increases in installations.

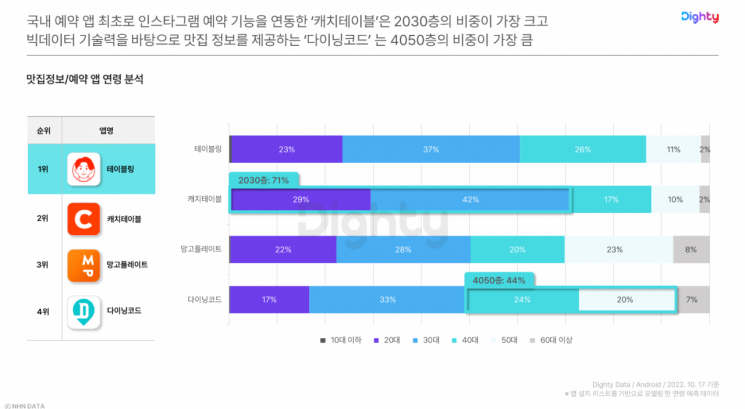

With the recent rapid increase in dining-out demand, real-time restaurant waiting services ‘Catch Table’ and ‘Tabling’ recorded installation growth rates of 65.3% and 44%, respectively, continuing their steep growth. ‘Catch Table’ was found to have nearly 71% of its users in their 20s and 30s, which is attributed to being the first domestic reservation app to integrate Instagram reservation functionality, enhancing convenience.

Additionally, due to soaring inflation, apps offering affordable purchases such as ‘Junggonara’ (20%), ‘AliExpress’ (18%), and ‘Gonggu Market’ (15%) ranked high in installation growth rates within the shopping category in the second half of the year. In particular, AliExpress strengthened its domestic delivery services, accelerating its push into the Korean market and achieving an increase of over 300,000 installations compared to the first half of the year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.