LG Chem, POSCO Chemical, EcoPro BM and Other Cathode Material Companies

Record Quarterly Earnings... Metal Price Increase Reflected in Selling Prices

Cathode Materials, Key Battery Components Determining Driving Range and Output

Amid a complex crisis of high exchange rates, high interest rates, and high inflation, companies have faced a 'performance shock' in the second half of this year, but the performance of battery sector companies, especially those producing the key material cathode active materials (CAM), stands out alone. It is analyzed that the value of cathode active materials, which greatly influence battery performance, has begun to be fully reflected in prices due to the sharp rise in prices of major minerals such as lithium and nickel.

According to the industry on the 4th, leading domestic battery cathode active material companies such as LG Chem, POSCO Chemical, and EcoPro BM recorded their highest quarterly performance ever in the third quarter of this year. Battery prices account for about half of the price of electric vehicles. Cathode active materials account for about 40% of the battery price. Cathode active materials affect battery capacity and average voltage, which are key factors in driving range and output, determining electric vehicle performance. With the opening of the North American electric vehicle market, companies like GM and Ford, along with finished battery cell manufacturers, are among the first to reach out to cathode active material companies.

In the case of LG Chem, the operating profit of the Advanced Materials division surpassed that of the Petrochemical division for the first time on a quarterly basis. This is due to the strong performance of the battery material cathode active materials, their main product, driven by the rapid growth of the electric vehicle market. LG Chem's Advanced Materials division recorded sales of KRW 2.5822 trillion and operating profit of KRW 415.8 billion. Sales growth continued due to expanded shipments of battery materials including cathode active materials and price increases. LG Chem's Advanced Materials division is broadly divided into ▲Battery Materials ▲IT & Semiconductor Materials ▲Engineering Materials, with the Battery Materials segment responsible for 69% of the Advanced Materials division's KRW 2.582 trillion sales in the third quarter. This is double the 33% share in the same period last year.

POSCO Chemical surpassed KRW 1 trillion in quarterly sales for the first time ever. In the third quarter consolidated results this year, it recorded sales of KRW 1.0533 trillion and operating profit of KRW 81.8 billion, representing increases of 108.6% in sales and 159.9% in operating profit compared to the same period last year. It set a record for highest sales for nine consecutive quarters and also recorded the highest quarterly operating profit ever. EcoPro BM also recorded consolidated sales of KRW 1.5632 trillion and operating profit of KRW 141.5 billion in the third quarter. Compared to the same period last year, sales increased by 283% and operating profit by 248%.

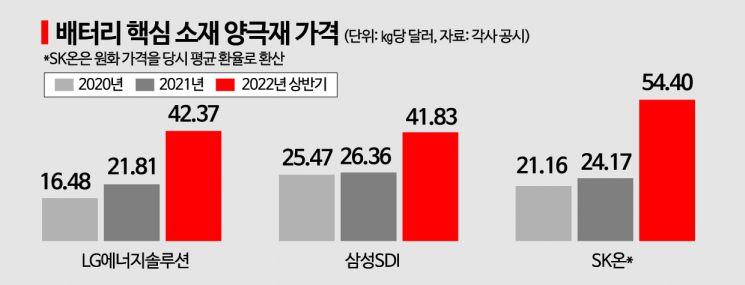

In fact, the purchase price of cathode active materials by the three domestic battery manufacturers producing finished battery cells more than doubled in the first half of the year compared to last year. As of the first half of this year, LG Energy Solution procured cathode active materials at $42.37 per kg (approximately KRW 60,347), which is double the $21.81 per kg (approximately KRW 31,074) price last year. Samsung SDI's price also rose from $26.36 per kg (approximately KRW 37,557) to $41.83 per kg (approximately KRW 59,599) during the same period. SK On's electric vehicle battery cathode active material price increased more than twice from KRW 27,952 per kg to KRW 67,800 per kg.

Although third-quarter prices have not been disclosed, considering that it takes 2 to 3 months for mineral price fluctuations to be reflected in prices, it is expected that the rise in mineral prices such as lithium will continue to be reflected. According to SNE Research, global demand for battery cathode active materials is expected to grow more than 20% annually. Demand is estimated to increase from 990,000 tons last year to 6.05 million tons by 2030.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.