KakaoBank Joins as Last Entrant Among 3 Internet Banks... Covering Loans, Accounts, and Cards

Naver Financial Partners with Financial Firms for Korea's First Personal Business Loan Comparison

Voices Rise as Financial Sector Battle Between Naver and Kakao Intensifies

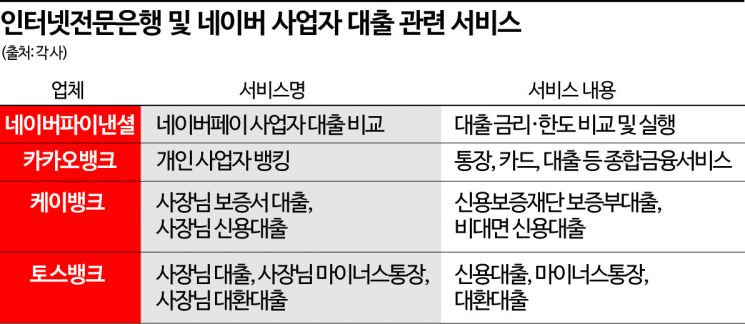

[Asia Economy Reporter Minwoo Lee] Following Kakao Bank, the last among internet-only banks to launch a loan product for individual business owners, Naver Financial has also introduced a related service. It is interpreted that, judging the household loan market alone to have limitations at this point, they are diversifying their business with an eye on entering the corporate loan market in the future.

According to the financial industry on the 2nd, Kakao Bank launched various financial services for individual business owners, including loans, the day before. They plan to provide ‘full banking’ covering not only loans but also deposit products (accounts) and payment services (cards). Since Toss Bank and K Bank started individual business owner loans early on, Kakao Bank is launching a ‘full-scale offensive’ by offering more comprehensive services based on the ample funds secured through its earlier listing.

Kakao Bank emphasized ‘simplicity.’ There is no need to install a separate application; both personal and individual business owner banking can be used through the Kakao Bank app alone. Individual business owner accounts can be opened without submitting separate documents by utilizing scraping and public MyData. Various fees such as transfers, ATM deposits and withdrawals, and issuance of certificates necessary for business, as well as the key product of this business, individual business owner loans, will have all prepayment penalties waived unconditionally.

Among the three internet banks, the ‘giant’ Naver Financial, which had been relatively quiet recently, is also focusing on the market for individual business owners. After early launching the ‘Smart Store Business Owner Loan’ in 2020 in partnership with Woori Bank and Mirae Asset Capital, on the 30th of last month, it released ‘Naver Pay Business Loan Comparison,’ the first in Korea to allow comparison of business credit loan products across all industries including banks.

Naver Financial also emphasized simplicity through platform utilization. Linked with the Naver Certificate, accurate income and sales information is used from the loan comparison stage, eliminating the need for business owners to manually input data, allowing them to check interest rates and limits of available loan products within two minutes. Subsequently, loan screening is also conducted non-face-to-face without additional document submission. Additionally, services like ‘Loan Safety Care’ are provided free of charge for one year. Through this, if a business owner suffers severe aftereffects or accidental death, the remaining loan balance will be repaid up to 100 million KRW on their behalf.

They have also secured various allies. Even before launch, they partnered with first-tier financial institutions such as Woori Bank, Jeonbuk Bank, Toss Bank, and K Bank, as well as multiple financial companies across sectors including KB Kookmin Card, Lotte Capital, Welcome Savings Bank, Korea Investment Savings Bank, and OK Savings Bank. Hyundai Capital is also scheduled to join in the future.

The reason internet banks and Naver Financial are putting so much effort into the individual business owner loan market is that they see great growth potential. Until now, it was difficult to assess credit ratings for individual business owner loans compared to existing corporate loans. However, with the development of various credit scoring systems (CSS), the trend is shifting toward more precise and accurate differentiation of credit rating intervals. In fact, the three internet banks are hastening to advance their respective CSS. Especially since internet banks still heavily rely on the household loan sector, diversifying their business and expanding their scale through individual business owner loans is necessary to expand into the corporate loan sector in the future.

Meanwhile, there are also forecasts that the financial competition between Kakao and Naver will intensify following this. The timing of Naver Financial’s launch of the individual business owner loan comparison service (on the 30th of last month) is only two days apart from Kakao Bank’s launch of individual business owner banking (November 1). Although Naver Financial is not an internet-only bank, considering that it shares profits from business loans with partner financial companies, it is effectively entering the same market. Notably, among the partner financial companies are Toss Bank and K Bank. This has led to reactions that a competitive structure has been formed between the alliance of Naver Financial, Toss Bank, and K Bank, and Kakao Bank.

A financial industry official said, “As calls for deregulation of the separation between finance and industry (geumsan separation) have been growing recently, if collaboration between platforms and financial companies becomes more frequent, the competition between Naver Financial and Kakao Bank will become even fiercer.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)