[Asia Economy Reporter Kim Hyemin] As Seoul housing prices continue to decline, the value of reserved units, which were once highly sought after, is also falling. Some reserved units have appeared with prices lowered by 100 million KRW compared to the previous price after a failed bid. With the volume of sales transactions dropping to historically low levels, the frozen real estate market is also evident in the reserved unit market.

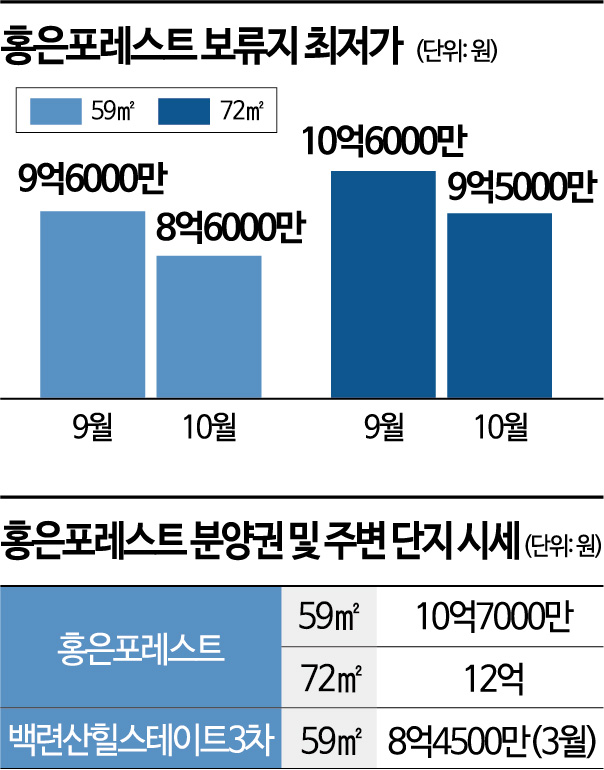

According to the maintenance industry on the 1st, Hills State Hong Eun Forest in Seodaemun-gu, which is conducting bids until the 2nd, set the minimum bid price at 860 million KRW for a 59㎡ exclusive area and 950 million KRW for a 72㎡ exclusive area. At the first reserved unit sale in September, the minimum bid prices were 960 million KRW and 1.06 billion KRW, respectively. After the first reserved unit sale failed, the price was lowered by about 100 million KRW within a month.

This complex, located in the 338-5 area of Hong Eun-dong, Seodaemun-gu, is being developed into a total of 623 households through the reconstruction of Hong Eun-dong 2nd Housing. Construction has been completed, and move-ins begin this month. Currently, the pre-sale rights for this complex are priced at 1.07 billion KRW for 59㎡ and 1.2 billion KRW for 72㎡. This means the reserved unit prices are set about 200 million KRW cheaper than the market listings.

The cooperative's significant price reduction for reserved units appears to reflect the actual transaction status of nearby complexes. Nearby Baekryeonsan Hills State Phase 3 saw a 59㎡ unit traded at 845 million KRW in March, down 80 million KRW from the highest price of 925 million KRW recorded in August last year. Baekryeonsan Hills State Phase 2's 59㎡ unit also dropped more than 100 million KRW over eight months, trading at 800 million KRW in June.

Reserved units refer to the pre-sale units that cooperatives keep in reserve during redevelopment or reconstruction processes to prepare for unforeseen future circumstances. They are usually sold through bids before completion or after move-in but before cooperative liquidation. During the real estate price rise from 2020 to the first half of last year, demand surged regardless of price increases, making reserved units a lucrative income source for cooperatives. For example, in October 2020, an 84㎡ unit at Forena Nowon in Nowon-gu was sold at 1.35999 billion KRW, nearly 200 million KRW higher than the minimum bid price of 1.19 billion KRW. However, the current asking price for that unit has dropped to 1.32 billion KRW.

As the popularity of reserved units wanes, cases of lowering minimum bid prices are being observed in various locations. Taereung Harrington Place in Nowon-gu conducted its 11th reserved unit sale this year last month, lowering the minimum bid price for an 84㎡ unit to 1.17 billion KRW, down 130 million KRW from the initial sale announcement of 1.3 billion KRW. The 74㎡ and 59㎡ units in this complex were also announced with price reductions of 120 million KRW and 93 million KRW, respectively. Eunpyeong-gu's Nokbeon Station e-Pyeon Sesang Castle set the minimum bid price for a 59㎡ reserved unit at 930 million KRW during its sale in August. This complex attempted sales four times since April but repeatedly failed, leading to a 100 million KRW price cut from the initial sale announcement.

Yeokyunghee, Senior Researcher at Real Estate R114, said, "Due to the worsening real estate market, concerns about further price declines are growing, leading to more places lowering their bid prices. Recently, the subscription market's success varies depending on price gains, and the reserved unit market is likely to follow a similar trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.