More Sensitive to Economic Cycles and Lower Profitability than DRAM

Conservative Inventory Management Inevitable for Samsung and SK

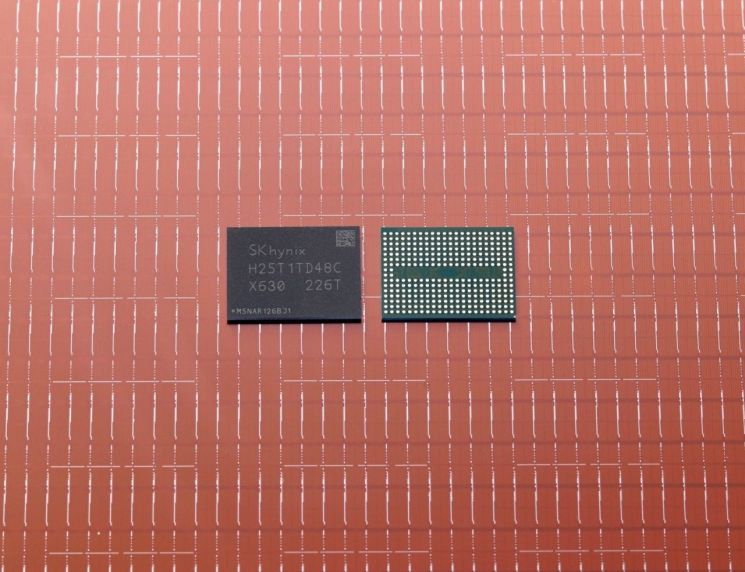

SK Hynix's 238-layer 512-gigabit (Gb) TLC (Triple Level Cell) 4D NAND flash. (Image source=Yonhap News)

SK Hynix's 238-layer 512-gigabit (Gb) TLC (Triple Level Cell) 4D NAND flash. (Image source=Yonhap News)

[Asia Economy Reporter Moon Chaeseok] As prices of representative memory semiconductors, DRAM and NAND flash, have plummeted, concerns in the industry are growing as the macroeconomic uncertainty impact on NAND is expected to be greater than that on DRAM, and the recovery speed slower.

Both Samsung Electronics and SK Hynix, the world's top three memory semiconductor companies, view a short-term recovery in the NAND market as unlikely and are determined to focus on inventory management and accelerating mass production of the most advanced processes.

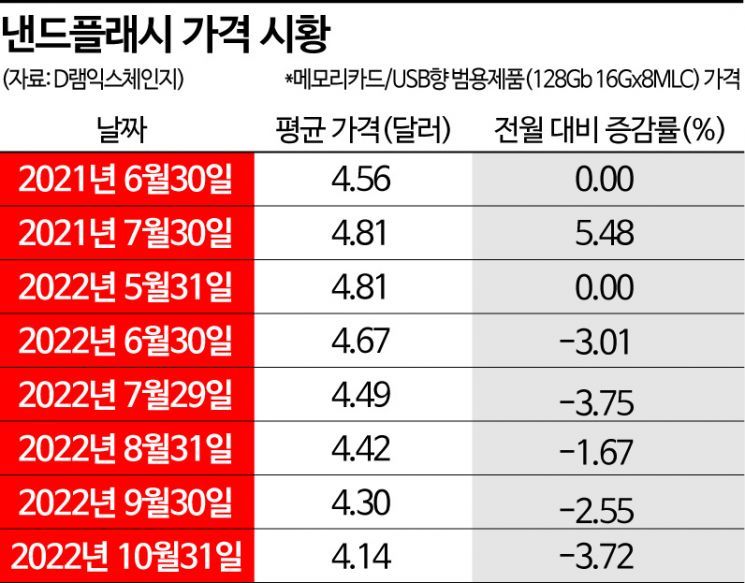

According to market research firm DRAMeXchange on the 1st, the average fixed transaction price of DRAM PC general-purpose products (DDR4 8Gb 1Gx8 2133MHz) last month was $2.21, a sharp drop of 22.46% compared to September ($2.85). During the same period, the fixed transaction price of NAND memory card and USB general-purpose products (128Gb 16Gx8 MLC) remained at $4.14, down 3.73% from the previous month. Although the price drop was larger for DRAM, the period of sluggishness was longer for NAND. DRAM showed a stable trend once in September, but NAND has continued to decline for five consecutive months since June 30.

Notably, both Samsung Electronics and SK Hynix expressed in their Q3 earnings conference calls at the end of last month that the recovery of the NAND market will take longer. SK Hynix President Noh Jong-won said in the Q3 conference call on the 26th of last month, "DRAM is expected to recover soon and return to a healthy state, but NAND will take a little more time." The next day, Han Jin-man, Vice President of Samsung Electronics' Memory Business Division, analyzed in the Q3 earnings call that "NAND performance declined due to macroeconomic uncertainties increasing for server SSDs (data storage devices), leading to inventory adjustments by customers."

Both companies conveyed to stakeholders their commitment to conservative management policies such as appropriate inventory control. Samsung Electronics, which is evaluated to have industry-leading cost competitiveness, also plans to manage inventory. Vice President Han said, "Unlike DRAM, the possibility of NAND market recovery next year is low," and added, "We will manage inventory at an appropriate level."

In SK's case, there is significant concern as the performance of Solidigm, acquired from Intel for a total of $9 billion (approximately 10.83 trillion KRW), has yet to improve. Solidigm, located in San Jose, USA, is responsible for product development, production, and sales in the high value-added SSD business sector. President Noh predicted, "Although NAND market adjustments are expected, the benefits gained within 1-2 years after integrating Solidigm will outweigh the current difficulties."

Ultimately, the 'lean period' is likely to continue until the most advanced process mass production system is fully operational. SK Hynix announced at the Flash Memory Summit (FMS) in Seattle, USA, in early August that it plans to start mass production of the industry's most advanced 238-layer NAND around mid-next year. Even after entering mass production, performance may vary depending on the memory semiconductor market conditions, demand recovery speed, and scale of capital investment.

Both Samsung and SK plan to avoid 'production cuts.' Once a production line is shut down, it takes at least six months to restart, and as the intervals between boom and bust cycles shorten, this is to prevent the risk of a sudden market rebound after production cuts. President Noh estimated, "The shipment volumes of DRAM and NAND in Q4 are expected to be similar to those in Q3."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.