Current Domestic Housing Transactions by Foreign Nationality

Chinese Buyers in Bucheon-si, Siheung-si, Ansan Danwon

American Buyers Purchase in Pyeongtaek, Gangnam, Seocho, Yongsan

Amid several years of continuous 'K-Real Estate' shopping by foreigners, it has been revealed that the foreign nationals who purchased the most real estate in South Korea were Chinese. The regions where Chinese buyers conducted the most transactions were Siheung-si and Bucheon-si in Gyeonggi-do.

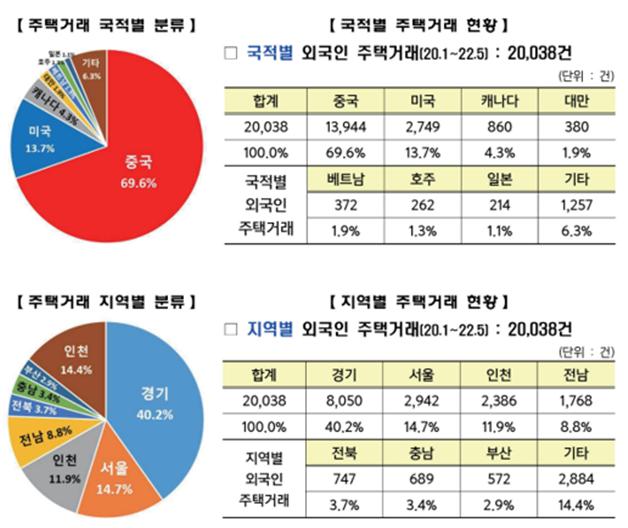

According to the 'Foreign Nationals' Housing Transaction Status by Nationality and Region' data released by the Ministry of Land, Infrastructure and Transport on the 29th, out of 20,038 foreign housing transactions from January 2020 to May this year, Chinese transactions accounted for 13,944, representing 69.6% of the total.

Following were the United States with 2,479 transactions (13.7%), Canada with 860 (4.3%), Taiwan with 380 (1.9%), Vietnam with 372 (1.9%), Australia with 262 (1.3%), and Japan with 214 (1.1%).

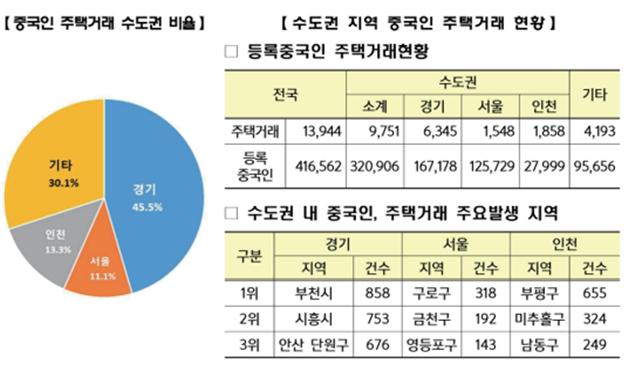

◆Regions Where Chinese Bought the Most: Bucheon-si, Siheung-si, Danwon-gu in Ansan

The purchasing trend of Chinese buyers was particularly concentrated in the Seoul metropolitan area. Out of 13,944 transactions nationwide, 9,751 were in the metropolitan area.

The region where Chinese purchased the most housing was Bucheon-si, Gyeonggi-do (858 transactions). Siheung-si (753 transactions) and Danwon-gu in Ansan-si (676 transactions) followed.

Next were Bupyeong-gu in Incheon (655 transactions), Michuhol-gu in Incheon (324 transactions), Guro-gu in Seoul (318 transactions), Namdong-gu in Incheon (249 transactions), Geumcheon-gu in Seoul (192 transactions), and Yeongdeungpo-gu in Seoul (143 transactions).

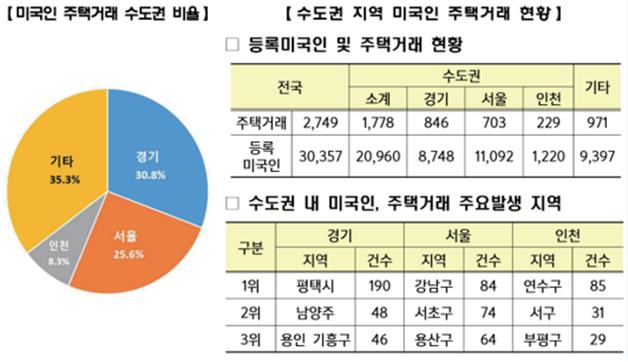

◆Americans Focused on Pyeongtaek, Gangnam, Seocho, and Yongsan

American buyers also concentrated their purchases in the Seoul metropolitan area. Out of 2,746 transactions nationwide, 1,778 were in the metropolitan area. However, there were slight differences by region.

Americans conducted the most transactions in Pyeongtaek-si (190 transactions), followed by Yeonsu-gu in Incheon (85 transactions).

In Seoul, concentrated purchases were made in high-priced housing areas such as Gangnam-gu (84 transactions), Seocho-gu (74 transactions), and Yongsan-gu (64 transactions).

Additionally, there were relatively many transactions in Namyangju, Gyeonggi-do (48 transactions) and Giheung-gu in Yongin (46 transactions).

◆Controversy Over Reverse Discrimination in Foreigners' K-Real Estate Shopping

Meanwhile, foreigners have steadily purchased homes domestically since around 2017, when housing prices began to rise significantly.

While domestic residents have found it difficult to buy homes due to various loan regulations, foreigners have been able to circumvent these restrictions by obtaining loans from banks in their home countries, sparking controversy over reverse discrimination.

In terms of taxation, foreigners are also in a blind spot. Under current law, when a single household acquires two or more houses, an increased acquisition tax rate is applied.

Foreign household identification is conducted through the Registered Foreigners Record or Foreign Registration Card, but omissions often occur due to family members residing abroad. It is difficult to accurately identify household members, leading to frequent omissions in counting the number of houses owned, making it practically impossible to impose increased acquisition tax and capital gains tax.

Ministry of Land, Infrastructure and Transport: "Implementing Measures to Block Foreign Speculation"

The Ministry of Land, Infrastructure and Transport recently completed a planned investigation into foreign housing speculation and is working with related ministries to devise measures to block foreign real estate speculation.

First, regarding the crackdown on the inflow of overseas funds, a permanent cooperation system will be established with the Korea Customs Service. Abnormal transaction data selected through analysis of foreigners' housing financing plans will be shared with the Customs Service semiannually.

The Real Estate Transaction Reporting Act will be amended to require submission of a certificate of foreign registration and designation of a trustee manager when reporting real estate transactions. This is to prevent investigation gaps for foreigners who leave the country after purchasing real estate.

To enhance tax enforcement effectiveness, the ministry plans to promote sharing of foreign household composition data held by the Ministry of Justice and the Ministry of Health and Welfare (National Health Insurance Service) with tax authorities through the 'Foreign Real Estate Related Agencies Council.'

Verification of foreign household members' residence and residency status will also be strengthened. A new foreign housing ownership statistics system will be established to actively respond to speculative transactions.

Furthermore, if abnormal trends are detected in speculative land transactions such as large-scale land purchases by foreigners, splitting of shares, and unusual high or low price purchases, as well as in non-residential transactions like officetels, the planned investigations will be expanded.

Won Hee-ryong, Minister of Land, Infrastructure and Transport, stated, "We will continue to promote institutional improvements to identify the status of foreign real estate holdings, which have been in a blind spot, and to eradicate speculation in order to establish a fair trading order and protect domestic real demand."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.