Inevitable Fiduciary Duty Controversy in Non-Performing Loan Acquisition

"Large Firms Cannot Unilaterally Bear Losses of Small and Medium Firms"

"Specific Disclosure of Acquisition Criteria, Interest Rates, and Loss Responsibility Needed"

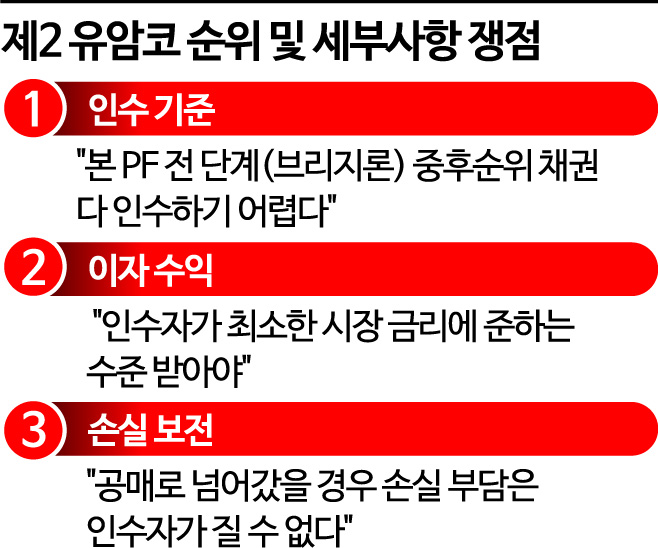

[Asia Economy Reporter Hwang Yoon-joo] It is pointed out that details are crucial for the success of the ‘Second Yuamco.’ This is because there are differing interests in the details such as acquisition criteria, interest rates, and loss responsibility in case of forced sale when purchasing real estate project financing (PF) asset-backed commercial papers (ABCP) from small and medium-sized securities firms with significant liquidity concerns. If non-performing loans are acquired, the securities firms involved cannot avoid allegations of breach of fiduciary duty. Starting next week, practitioners from each securities firm will gather to finalize the details. It is expected that the interests of large and small-to-medium firms will sharply conflict in the specifics.

◆ Small and medium-sized ABCPs with high subordinated loan ratios... Controversy expected if non-performing loans are acquired= The most controversial issue is the acquisition criteria for bonds (PF ABCP). The consensus in the securities industry is that due to the real estate market downturn caused by current interest rate hikes and rising raw material prices, it is difficult to recklessly acquire troubled PF ABCPs.

PF projects are divided into ① land acquisition/permit stage (pre-PF stage) ② construction and sales progress stage ③ completion and occupancy stage. The risk is greater the earlier the project stage. The recently emerging concern is the subordinated bridge loans at the early PF stage.

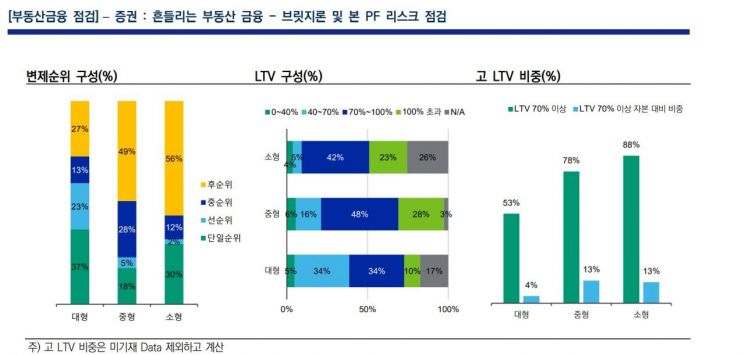

Large securities firms mainly lend during the main PF stage, while small and medium-sized securities firms provide loans at the pre-PF stage, i.e., land acquisition/permit stage. Loans at the pre-PF stage are commonly called ‘bridge loans.’ Although riskier, they offer higher fees and profits. Structurally, bridge loans are classified into senior, mezzanine, and subordinated ranks, with senior loans being safer than subordinated ones because funds are injected later and repaid first.

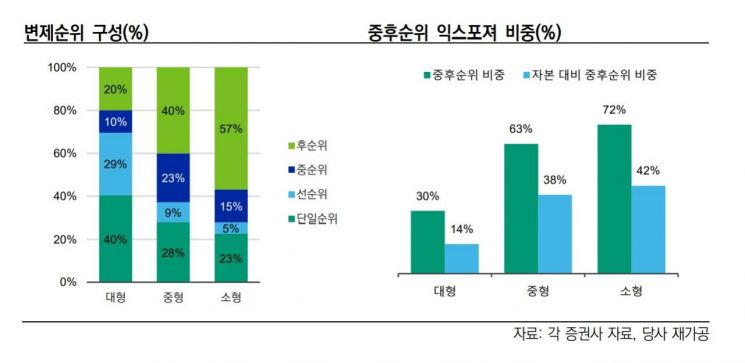

Proportion of Real Estate Exposure by Seniority in Large Securities Firms and Small to Medium Securities Firms (Source: Korea Credit Rating)

Proportion of Real Estate Exposure by Seniority in Large Securities Firms and Small to Medium Securities Firms (Source: Korea Credit Rating)

According to Korea Credit Rating, as of the first quarter, the proportion of subordinated real estate PF loans was 72% for small firms, 63% for medium firms, and 30% for large firms. The proportion of loans with LTV over 70% was 88% for small firms, 78% for medium firms, and 53% for large firms. This indicates that small securities firms bear greater PF risk. The ratio of bridge loan exposure relative to equity capital is similar: Hi Investment & Securities 47%, BNK Investment & Securities 35%, Hyundai Motor Securities 31%, Daol Investment & Securities 31%, Kyobo Securities 29%, Eugene Investment & Securities 26%, DB Financial Investment 18%.

Lee Jae-woo, senior researcher at NICE Credit Rating, pointed out, "There is potential for land value to increase relative to appraised value, and bridge loans can be recovered upon conversion to main PF, but in a declining real estate market, subordinated high-LTV bridge loans carry very high loss risk."

If acquisition criteria for PF ABCPs are not clearly defined, large firms could end up bearing bonds with high loss potential. This is why large firms, while sympathizing with the purpose of establishing the Second Yuamco, do not hide their discomfort. A CEO of a large securities firm said, "Most securities firms are listed companies, so it would be problematic if breach of fiduciary duty allegations arise," adding, "It is hard to accept supporting liquidity for competitors by bearing losses."

A financial industry official said, "In the case of Yuamco, when there was no business feasibility or real estate value decline, purchases were made at a 30-70% discount to the purchase price, and if there was potential for main PF after due diligence, recovery was made several years after project progress." However, in such cases, banks were often involved in both bridge loans and main PF, making it relatively easier to agree on detailed criteria from due diligence to bond sales.

◆ "Market logic must be maintained... Please establish safeguards"= Even if acquisition criteria are agreed upon, many hurdles remain. Interest rates and loss responsibility are representative issues.

There are voices that the Second Yuamco should receive interest comparable to market rates when acquiring PF ABCPs. This means that at least market logic must be maintained to avoid breach of fiduciary duty allegations. Currently, PF ABCP interest rates have declined so much that rates over 10% must be offered to attract investment.

On the 25th, the 3-month asset-backed electronic commercial paper (ABSTB) issued by ‘Floris Retail First SPC’ offered an annual interest rate of 16.83%. On the same day, DB Financial Investment purchased Spellbind 16th tranche (1.3 billion KRW) in the secondary market with 2 days remaining to maturity at a 20% interest rate.

Another CEO of a large securities firm said, "While sympathizing with the purpose of establishing the Second Yuamco, if PF ABCPs are acquired, conditions comparable to market interest rates should be obtained," emphasizing, "It is important that the industry purchases bonds as part of ‘self-help efforts.’"

There are also calls to impose penalties on issuers or create minimum safeguards for acquirers in case losses occur after acquiring PF ABCPs. This is because PF ABCPs of small and medium-sized securities firms are mainly concentrated in ‘bridge loans’ at the pre-main PF stage.

A securities firm official said, "If the proportion of subordinated loans is high, in case of forced sale, the sale price may be lower than the land acquisition price," adding, "Losses can be offset by deducting the loss amount from the Second Yuamco contributions made by the securities firms that provided the loans, thereby protecting other securities firms from losses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)