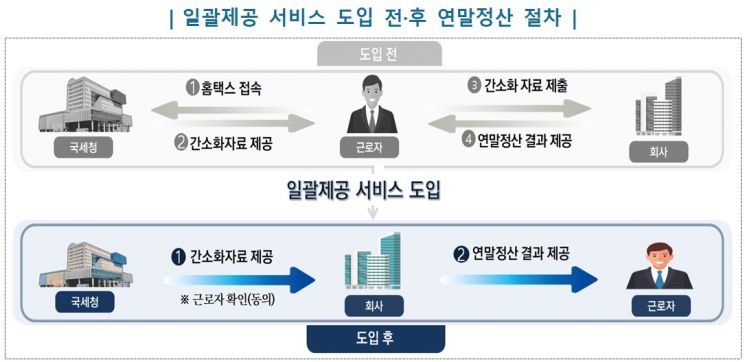

[Asia Economy Sejong=Reporter Kim Hyewon] The National Tax Service announced on the 27th that it will fully implement a service this year that provides simplified year-end tax settlement data for employees directly to companies.

Companies wishing to use the bulk provision service for simplified data must register the list of employees subject to year-end tax settlement on Hometax. The registration period is from today until November 30. If it is unavoidable to add or delete names or if registration is not completed within the deadline, modifications or new registrations can be made until January 14 of next year.

Employees must check (consent to) the data provision at least once on Hometax (or Sontax) from December 1 until January 19 of the following year. The National Tax Service will provide simplified data only for employees who have given consent to the companies. The simplified data of employees who have completed confirmation of data provision will be sequentially provided to companies in a PDF compressed file starting from January 21 of next year.

Companies download the simplified data from Hometax and upload it to their systems to proceed with the year-end tax settlement. Employees only need to submit additional data to the company if there are any additions or corrections. The National Tax Service explained, "Companies can reduce the time and cost required to collect employees' simplified data, thereby lowering the tax cooperation costs for year-end tax settlement."

The National Tax Service has also launched a 'Year-end Tax Settlement Preview Service.' Using credit card and other usage amounts from January to September, employees can check their expected tax amount for year-end settlement. Through big data analysis, about 330,000 young workers in their 20s and 30s will be individually guided on deduction items that are easy to overlook, such as the monthly rent tax credit.

In cases where employees have changed companies, if the previous company submits the payment statement during the year, the 'Mid-year Resigned Employee Payment Statement Service' has been improved so that the resigned employee can immediately check it on Hometax. The National Tax Service requested, "Each company should submit payment statements for resigned employees by the end of the year to avoid the inconvenience of reissuing payment statements to resigned employees during next year’s year-end tax settlement."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)