Regulatory Moves Beyond Main Ministries Like Ministry of the Interior and Safety and Fair Trade Commission

Significant Impact Expected on Platform Operators Including Kakao

Strengthened Corporate Merger Reviews and Announcement of Private Data Centers as National Core Infrastructure

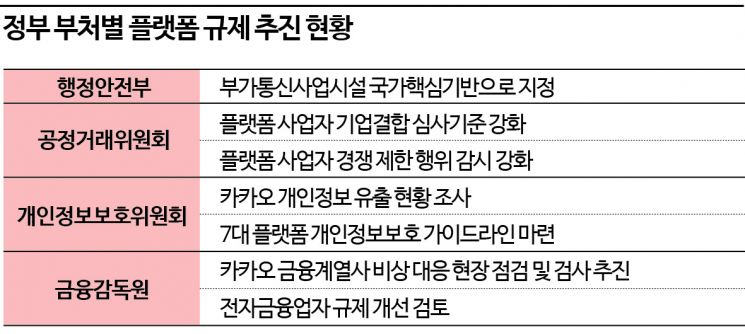

[Asia Economy Reporter Yuri Choi] Following the Kakao outage incident, the government is moving toward comprehensive regulation of the platform industry. As the widespread service disruption caused nationwide damage, not only the Ministry of Science and ICT (MSIT), the main ministry in charge, but also the Ministry of the Interior and Safety (MOIS), the Fair Trade Commission (FTC), the Personal Information Protection Commission (PIPC), and the Financial Supervisory Service (FSS) are reviewing the overall platform market and increasing regulatory pressure in response to this incident.

According to the IT industry on the 28th, the PIPC is investigating whether personal information such as KakaoTalk account details or profiles were leaked during the Kakao service outage period. They have received related materials from Kakao and are directly accepting victim reports.

The PIPC plans to analyze the received reports and conduct follow-up investigations if necessary. If victims seek compensation, they will prepare a mediation plan through dispute resolution. Additionally, they will check the personal information management status of major platform operators and include it in the personal information protection guidelines. In May, the PIPC announced plans to promote voluntary personal information protection regulations in seven online platform sectors: open markets, food delivery, mobility, job recruitment, hospital/clinic appointment booking, real estate, and accommodation.

The financial authorities are conducting a comprehensive investigation of Kakao’s financial affiliates. The FSS has launched a large-scale inspection of Kakao Bank and Kakao Pay to determine whether there were any issues with emergency responses following the incident. After identifying the response measures, on-site inspections and audits are planned. They are also considering strengthening regulations on electronic financial service providers. On the 24th, at the National Assembly’s Political Affairs Committee comprehensive audit, FSS Governor Lee Bok-hyun stated, "When the license was first granted to electronic financial service providers, we did not anticipate the scale would grow this large," adding, "The regulatory threshold is too low and needs improvement."

Several ministries are pushing forward specific regulatory proposals. The MOIS plans to designate facilities of value-added telecommunications service providers such as Kakao and Naver as national critical infrastructure. This was reported at the party-government council meeting held on the 19th, and related legal amendments are being pursued. The aim is to include data centers of value-added telecommunications service providers among the highest level of safety management targets, alongside nuclear power plants and dams, which can directly affect public safety.

The FTC has intensified regulations on online platform monopolies following the Kakao incident. It concluded that the monopolistic position, which lacks competitive pressure in the market, led to negligence in crisis response, prompting decisive action.

According to the "Measures to Secure a Fair Competition Base in the Online Platform Market" reported to the Presidential Office on the 21st, the FTC plans to revise the corporate merger review standards for platform companies. Until now, if there was no concern about competition restriction, a "simplified review" was conducted, verifying only factual matters, but this will be changed to a "general review." This will focus on examining market concentration and market definition to assess competition restrictions. The FTC will prepare detailed plans through research projects by the end of this year and begin revising the review standards early next year.

The FTC also intends to strictly limit anti-competitive behaviors by platform companies. It will strengthen monitoring of acts such as abusing market dominance to favor their own services over competitors or obstructing competitors' businesses. Accordingly, it is expected to accelerate sanctions on unfair practices currently under FTC scrutiny involving Kakao. The FTC is investigating allegations of violation of the financial-industrial capital separation rule by K Cube Holdings, which is 100% owned by Kim Beom-su, head of Kakao Future Initiative Center, and the "call steering" allegations against Kakao Mobility. A plenary meeting will be held soon to decide on sanctions and their severity.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.