Wine Import Value Reaches 626 Billion KRW in September, Up 6.7% YoY, Import Volume Down 7.7%

Increasing Wine Consumption Experience Leads to Sophisticated Preferences in Varieties and Styles

Rising Expectations Drive Industry Efforts to Secure Premium Segments

Market Growth Spurs IPO Moves by Narasella and Others for Capital Raising

[Asia Economy Reporter Koo Eun-mo] The domestic wine market is entering a mature phase alongside premiumization. While this year’s wine import value is breaking records for the second consecutive year, import volume has decreased. It appears that domestic consumers are evolving from ‘wa-al-mot’?those who simply tasted low-priced, cost-effective wines?to ‘wa-jal-al,’ who enjoy aromas and flavors by considering grape varieties and regions.

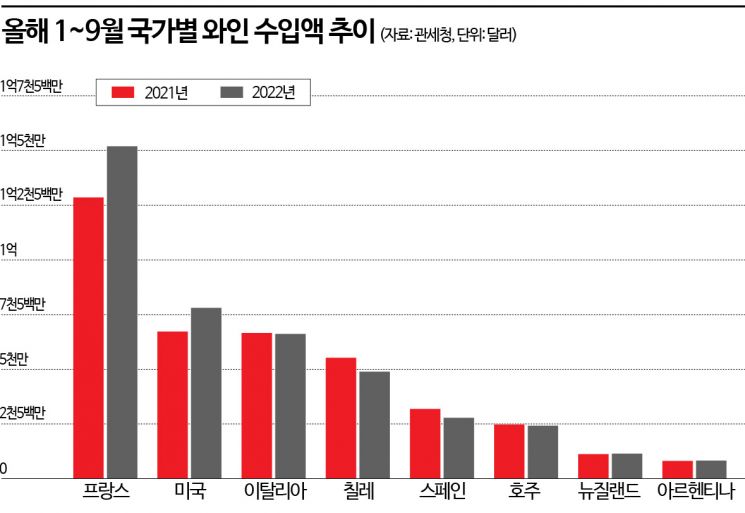

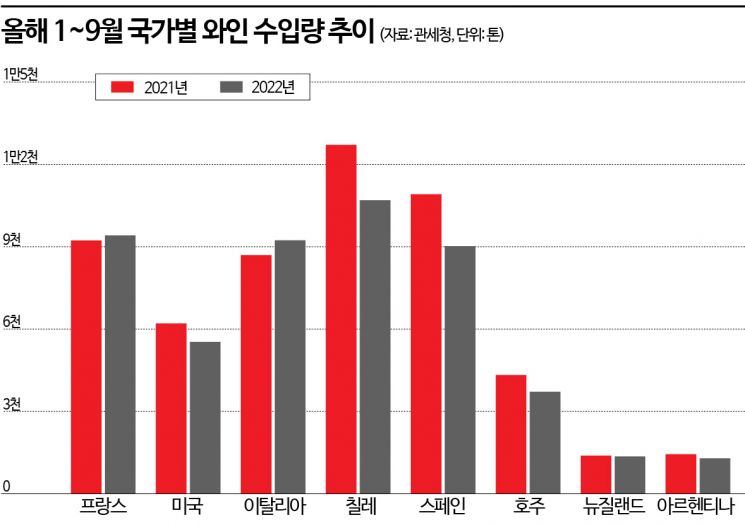

According to customs export-import trade statistics on the 26th, the import value of French wines, including premium wine regions such as Bordeaux and Burgundy Grand Cru, reached $151.96 million (approximately 219.4 billion KRW) from January to September this year, an 18.2% increase compared to the same period last year ($128.57 million). During the same period, the import value of American wines, mainly from the premium Napa Valley region in California, also rose 16.2% to $78.06 million (approximately 112.7 billion KRW) from $67.20 million the previous year.

Although the import value of these two countries increased significantly within a year, import volume either decreased or did not increase substantially. During this period, the import volume of American wines was 5,533 tons, down 10.8% (669 tons) from 6,202 tons in the same period last year, while French wine import volume increased only 2.0%, from 9,227 tons to 9,410 tons. Meanwhile, Chile, a relatively inexpensive region, had the highest import volume at 10,690 tons this year, but its import value decreased 11.5% to $48.85 million (approximately 7 billion KRW) compared to $55.20 million in the same period last year, amounting to only about one-third of France’s import value.

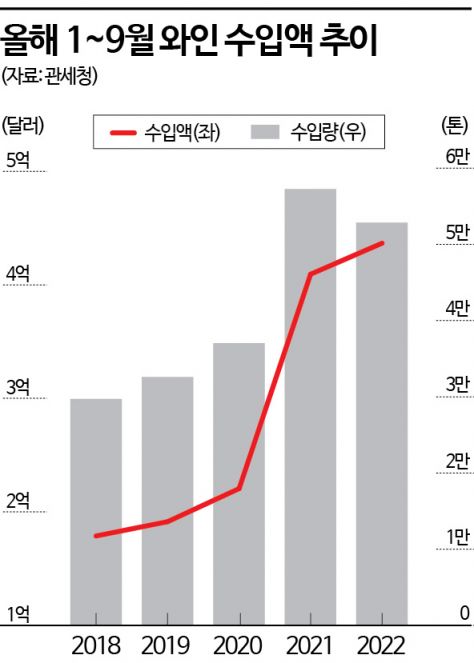

The premiumization trend in domestic wine consumption can also be seen through total import value and volume. As of the end of September, the domestic wine import value was $436.68 million (approximately 626 billion KRW), a 6.7% increase compared to $409.37 million in the same period last year. The domestic wine import value, which had been increasing slightly over recent years, nearly doubled compared to the previous year ($220.52 million) as of the third quarter last year, setting a record high. This year, despite last year’s high growth, the momentum continued, breaking records again.

On the other hand, import volume, which had steadily increased alongside import value during the same period, saw its growth slow down this year. Wine import volume this year was 52,855 tons, down 7.7% from 57,265 tons in the same period last year. Despite the increase in import value, import volume decreased, which is interpreted as consumers expanding their preferences beyond simply drinking cost-effective wines to exploring various production regions and grape varieties as wine accessibility and drinking experience improve.

An industry insider said, “The experience of drinking wine is rapidly increasing year by year, and perceptions of wine as an alcoholic beverage are changing. Since wine has a wide variety of grape varieties and styles, as drinking experience increases, consumers naturally seek more diverse and higher-quality products. It seems the Korean market is entering that stage.” In fact, premium wines priced in the hundreds of thousands of won, showcased as representative wines in discount events at large marts and markets, are selling out quickly, earning the nickname ‘queue wines.’

As domestic consumers’ standards rise, there is also a growing effort to secure rare premium wines. Shinsegae acquired the Napa Valley winery ‘Shafer Vineyard,’ famous for high-quality cult wines, in February, and in August, it additionally purchased vineyards in the Stags Leap District to start direct production. Hyundai Department Store established the import and distribution company Vino H and is focusing on exclusively importing organic premium wines into the domestic market rather than mass-importing mid- to low-priced wines. Currently, it has imported about 100 types of wines from 10 wineries in France and Italy, with plans to expand the import lineup to around 300 types.

Following the premiumization trend in wine, the home appliance industry is also targeting consumers with premium wine cellars. Samsung Electronics improved the ‘Sommelier at Home’ feature, which supports systematic management by simply photographing wine labels with a mobile phone, to be usable on its Bespoke refrigerators. LG Electronics launched the ‘LG Dios Objet Collection Wine Cellar,’ which, when linked with the LG ThinQ app on a smartphone, allows users to photograph wine labels and check information such as name, type, production region, and price.

Additionally, Carrier Refrigeration opened a standalone store for the premium wine cellar brand ‘Eurocave’ last month at Shinsegae Department Store Gangnam branch. Eurocave, established in 1976 as the world’s first wine cellar brand, is also registered as an ‘Existing Cultural Asset (EPV)’ by the French government, awarded to companies representing specific regions based on technology, tradition, and craftsmanship.

As the domestic wine market grows, related companies are accelerating their movements in the capital market for funding and other purposes. According to the Korea Exchange, wine import and distribution company Naracella filed a preliminary review for listing with the KOSDAQ Market Headquarters on the 14th. The total number of shares planned for listing is 6,478,038, of which 1.5 million shares are for public offering. Considering the preliminary review period, the public offering is expected to take place around the first quarter of next year. Besides Naracella, Kumyang International is also reportedly preparing for listing next year, and Shinsegae L&B and Ayoung FBC are considered potential pre-listing companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)