Jusanyeon, October Housing Business Sentiment Index Forecast

October Housing Business Sentiment Index Trends / Data provided by Housing Industry Research Institute

October Housing Business Sentiment Index Trends / Data provided by Housing Industry Research Institute

[Asia Economy Reporter Hwang Seoyul] While the housing business outlook is expected to slightly worsen, some regions are predicted to improve compared to September. However, this is analyzed as a rebound effect following the very severe deterioration forecast last month.

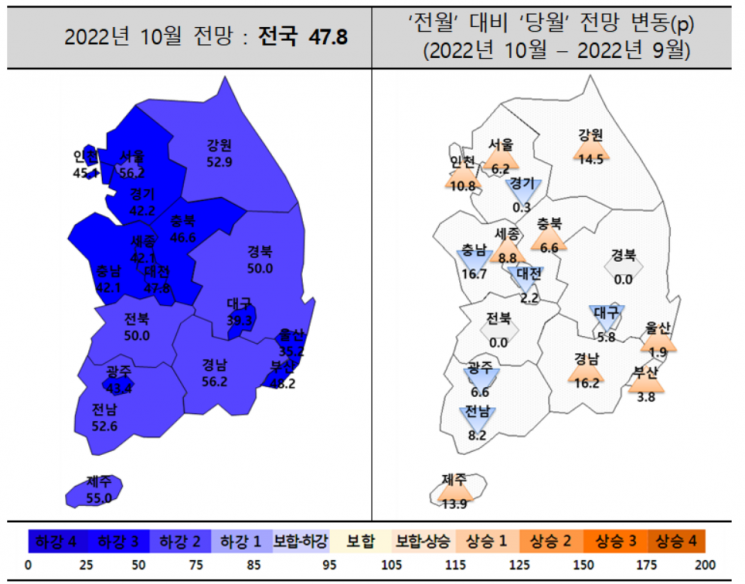

According to the "October Housing Business Outlook Index" released on the 24th by the Korea Housing Industry Research Institute (hereinafter referred to as KHIRI), the nationwide outlook index for this month was 47.8, down 2.8 points from the previous month.

The Housing Business Outlook Index is calculated monthly by surveying housing business operators on their business performance and outlook. It is a supply market indicator that comprehensively assesses the housing business from the supplier's perspective. The survey targets members of the Korea Housing Association and the Korea Housing Builders Association. The index baseline is 100, with below 85 indicating a downturn phase, 85 to less than 115 indicating a stable phase, and 115 or above indicating an upturn phase.

Despite the nationwide decline, the index rose in some regions. In the metropolitan area (47.8), the outlook fell 0.3 points from last year to 42.2, but Seoul and Incheon recorded increases of 6.2 points and 10.8 points, reaching 56.2 and 45.1, respectively.

Non-metropolitan areas were forecasted to rise 3.0 points from the previous month to 47.2. The indices in Gyeongnam and Gangwon, which saw significant increases, rose 16.2 points and 14.5 points to 56.2 and 52.9, respectively. KHIRI views the index increases in these regions as a rebound following the sharp decline in the previous month, and analyzes that Gangwon's rise also reflects expectations related to the commencement of the East-West High-Speed Railway construction.

The region with the largest decline was Chungnam, where the index dropped from 58.8 last month to 42.1.

The material supply index (78.7) and labor supply index (77.9) in October rose 1.6 points and 2.9 points respectively from the previous month, but the financing index (40.2) fell 12.5 points.

KHIRI stated, "The sharp decline in the financing index appears to be greatly influenced by the base interest rate hike," adding, "In particular, this rate hike is the second big step following July, which has placed a significant burden on housing business operators' financing." They further noted, "The worsening liquidity due to avoidance of real estate project financing (PF) loans amid the real estate market downturn is also a major contributing factor."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.