MSCI Semiannual Review Next Month

High Possibility of Hyundai Mipo Dockyard Inclusion

While Kakao Pay and Others May Be Excluded

On the 17th, the KOSPI opened at 2,187.17, down 25.38 points (1.15%) from the previous trading day, as employees were busy working in the Hana Bank dealing room in Jung-gu, Seoul. The won-dollar exchange rate started at 1,440.9 won, up 12.4 won. Photo by Kim Hyun-min kimhyun81@

On the 17th, the KOSPI opened at 2,187.17, down 25.38 points (1.15%) from the previous trading day, as employees were busy working in the Hana Bank dealing room in Jung-gu, Seoul. The won-dollar exchange rate started at 1,440.9 won, up 12.4 won. Photo by Kim Hyun-min kimhyun81@

[Asia Economy Reporter Junho Hwang] The semi-annual MSCI (Morgan Stanley Capital International) index review will take place next month. The announcement date is December 1. Stock selection will be made near the closing price on November 30. There is interest in whether this can be a ray of light in a bear market.

MSCI Semi-Annual Review

The main target of this review is the inflow effect of index funds. According to MSCI, as of last June, the total assets under management (AUM) of all passive funds tracking the MSCI Emerging Markets (EM) index was about $320 billion. Given the large scale of tracking funds, stock price increases can be expected through supply and demand inflows and outflows. Domestically, it is considered one of the most notable events alongside the regular changes in KRX stocks.

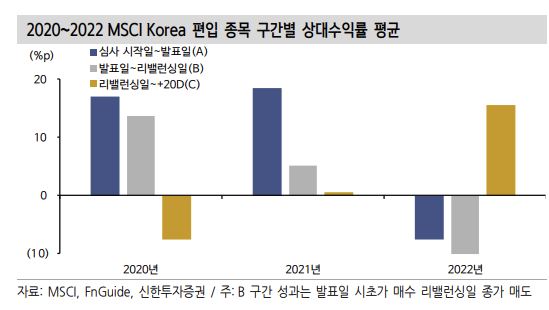

In the semi-annual reviews (May and November), the universe is updated and the inclusion and exclusion criteria thresholds are lowered. More stocks are added and removed compared to quarterly reviews, and the impact on the market is greater than that of quarterly reviews. In the past, portfolios of included and excluded stocks showed contrasting performance based on the rebalancing date.

What Will Be Included?

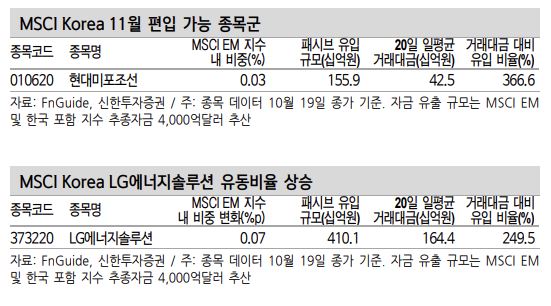

Shinhan Financial Investment expects Hyundai Mipo Dockyard to be upgraded and included in the MSCI Korea Small Cap Index. The passive buying demand due to index inclusion is estimated to be around 150 billion KRW. The index effect is expected to be about 366% relative to the average daily trading volume inflow ratio.

LG Energy Solution is expected to see an increase in its free float ratio due to the unlocking of institutional investor lock-up shares and an expansion of its weight within the index. The inflow ratio relative to trading volume is estimated to be about 250%.

Typically, the MSCI regular index change effect appears due to the supply and demand of passive funds such as global funds and exchange-traded funds (ETFs) that benchmark the MSCI index. To confirm this, it is necessary to refer to foreign investor supply and demand. The net foreign buying ratio relative to market capitalization for Hyundai Mipo Dockyard, which is almost certain to be included, is about 0.1%. Hyundai Mipo Dockyard has continuously seen net foreign buying inflows since the second half of the year.

Researcher Donggil Noh of Shinhan Financial Investment said, "MSCI included stocks generally showed superior relative performance from the start of the review to the rebalancing date." However, he added, "The period from the start of the review to the announcement date includes some performance of stocks that rose significantly during the review period, so caution is needed in interpreting causality."

KakaoPay and Hanwha Aerospace Have Low Inclusion Probability

On the other hand, the inclusion possibility of defense-related stocks such as KakaoPay and Hanwha Aerospace, which were expected to be included, is considered low. KakaoPay falls short in free float market capitalization, and Hanwha Aerospace and Hyundai Rotem fall short in market capitalization inclusion criteria.

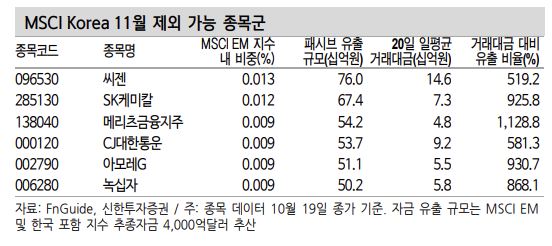

Stocks expected to be removed from the index in the November regular change include Seegene, SK Chemicals, Meritz Financial Group, CJ Logistics, AmoreG, and Green Cross. Stocks that may experience volatility due to passive selling demand on the rebalancing day are Meritz Financial Group and AmoreG, in that order. Passive selling demand of 54.2 billion KRW and 51.1 billion KRW is expected, respectively. The fund outflow ratio relative to average daily trading volume is 1,128% and 930%, which could exert downward pressure on stock prices.

Researcher Noh analyzed, "The stocks excluded from the index underperformed the KOSPI from the start of the review to the rebalancing date." He added, "The relative return underperformance became even larger after the announcement date."

He continued, "This is the result of continued individual stock price decline momentum combined with increased selling demand due to index exclusion. Predicting excluded stocks and conducting preemptive trading can reduce losses or be used to increase expected returns through Long-Short strategies," he advised.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.