Won-Dollar Exchange Rate Opens Higher at 1435.4 Won

Yen Nears 150 per Dollar for First Time in 32 Years

Yuan Weakens Amid Concerns Over China’s Economic Slowdown

Asia Crisis Theory Emerges as Northeast Asian Powers Waver

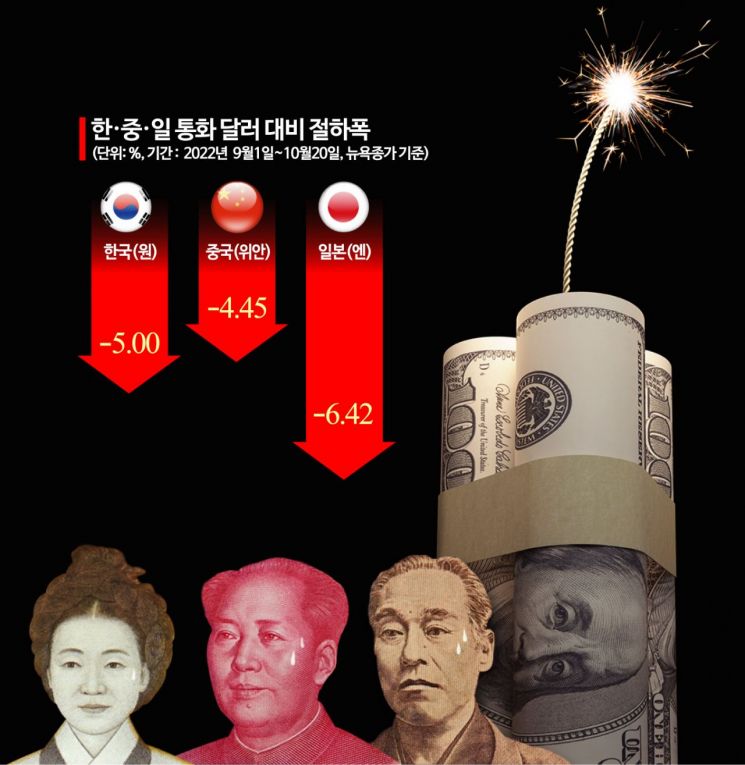

As the dollar's ultra-strong trend continues, the currencies of South Korea, Japan, and China are experiencing sharp declines, highlighting concerns of an 'Asian crisis.' The Japanese yen is on the verge of surpassing 150 yen per dollar for the first time in 32 years, and the Chinese yuan is also struggling amid fears of economic slowdown. While there is a widespread perception that the South Korean economy is still holding up well, experts warn that it is too early to be complacent, as a full-scale outflow of foreign capital from Asia could severely shake South Korea's economy as well.

On the 20th, in the Seoul foreign exchange market, the won-dollar exchange rate opened at 1,435.4 won, up 9.2 won from the previous trading day, showing a sharp rise again within a day. This is interpreted as a result of the UK's September consumer price inflation rate hitting 10.1%, the highest in about 40 years, and hawkish remarks from U.S. Federal Reserve (Fed) officials, which intensified the strong dollar phenomenon.

The currencies of the two major Northeast Asian powers, Japan and China, are also plunging rapidly. On the 19th (local time), the yen exceeded 149.9 yen per dollar in the New York foreign exchange market, approaching the 150 yen level for the first time in 32 years since 1990. Compared to the end of last year, it has fallen 23.18% against the dollar, which is the largest decline among major countries, including the UK, which experienced a sharp fall in the pound due to tax cuts, and Europe, which is facing concerns over an energy crisis. The yen's weakness combined with rising international commodity prices led Japan's Ministry of Finance to announce a trade deficit of 11.0075 trillion yen for the first half of the year. This is the largest ever recorded, and some analyses suggest that Japan could post a current account deficit for the first time in 42 years on an annual basis.

The yuan's depreciation is also intensifying. On the same day, the offshore dollar-yuan exchange rate rose to the 7.23 yuan level during trading. Considering it was only around 6.3 yuan as of January this year, this is a steep increase. Although it is presumed that Chinese authorities are managing the depreciation against the dollar, the yuan has fallen more than 12% this year and remains weak. The U.S. has tightened regulations on China's semiconductor industry, and internally, concerns about economic slowdown are growing due to the real estate market slump, making further yuan weakness likely. The People's Bank of China, which had been pursuing a rate-cutting stance, also paused by keeping the Loan Prime Rate (LPR), which serves as the benchmark interest rate, unchanged for two consecutive months. This freeze is interpreted as a measure to prevent capital outflows caused by interest rate differentials with the U.S.

The problem is that the depreciation of the Japanese and Chinese currencies not only fuels the rise in the won-dollar exchange rate but also increases the possibility of an Asian foreign exchange crisis. The Ministry of Economy and Finance and the Bank of Korea dismiss the possibility of a crisis in South Korea based on foreign exchange reserves and annual current account surpluses, but if the simultaneous weakening of the won, yuan, and yen leads to capital outflows from Asia, the negative ripple effects could be significant. In 1997, the collapse of the Thai baht spread to neighboring countries, triggering South Korea's foreign exchange crisis. Bloomberg recently analyzed that the plunge of the Chinese yuan and Japanese yen could impact Asian markets, and some market participants warn that the yen breaking through 150 yen per dollar could ignite market turmoil.

Kim Tae-gi, Professor Emeritus of Economics at Dankook University, said, "Japan is limited in raising interest rates due to massive debt, and concerns about economic slowdown in China continue to grow. South Korea also lacks appropriate measures to overcome the crisis, such as through exports, so an unstable situation is expected to continue for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.