Server DRAM Growth Rate 7% Next Year

Single-Digit Growth Forecasted for the First Time in 7 Years

Industry Faces Challenges Due to Server DRAM Slump

Rebound Expected in Second Half with DDR5-Supported CPUs

[Asia Economy Reporter Kim Pyeonghwa] Warning signals are sounding in the server DRAM sector, which has been regarded as a stable high value-added business in the memory semiconductor industry. With the server DRAM market's growth rate expected to remain in the single digits next year, concerns are deepening within the domestic memory industry. Experts predict that the DRAM market next year will not be able to avoid the overall economic downturn trend. However, the outlook for market recovery in the second half of next year is seen as a positive factor.

Server DRAM Growth Rate Limited to 7% Next Year

On the 20th, market research firm TrendForce forecasted the server DRAM market growth rate for next year at 7%. This marks the first time in seven years since 2016 that the growth rate will fall below 10%. TrendForce noted that the growth rate of server shipments next year could be 3.7%, lower than this year's 5.1%, indicating that demand for server DRAM may also slow down. Due to inflation and economic downturn, demand companies are showing conservative investment tendencies, and even server DRAM, which was relatively less affected by economic fluctuations, is entering the influence zone of industry sluggishness.

Previously, TrendForce predicted that the DRAM market could face a severe oversupply next year. If the DRAM demand bit growth (shipment increase rate converted to bit units) is 8.3% next year, the supply bit growth is expected to be 14.1%, widening the gap compared to this year. It will be the first time that demand bit growth is below 10%. Securities firms pointed out that following weak demand for consumer products such as PCs and mobiles, even server customers who had maintained stable demand are now focusing on inventory depletion, causing related demand to decline rapidly.

Kim Yangpyeong, a senior researcher at the Korea Institute for Industrial Economics & Trade, said, "The most referenced indicator when forecasting semiconductors is the global Gross Domestic Product (GDP). Given the unfavorable global economic situation next year, it is unreasonable to expect demand to increase only for semiconductors or server DRAM." He added, "With semiconductor inventories accumulating, servers have no particular need to increase demand next year, and the server demand that surged due to the advent of a contactless society is expected to stabilize."

Server DRAM, Once Driving Performance, Stalls... "Rebound in Second Half of Next Year" Predicted

As server DRAM demand is expected to fall short of expectations next year, concerns within the memory semiconductor industry, already feeling the impact of sluggish market conditions, are deepening. Server DRAM is a relatively high value-added product due to its high-performance requirements. Demand has rapidly increased, playing a key role in driving the earnings of Samsung Electronics and SK Hynix. According to market research firm Omdia, last year, the server DRAM sales of the two companies were $11.239 billion for Samsung Electronics and $10.857 billion for SK Hynix, up 47% and 29% respectively from the previous year. Last year, server DRAM accounted for a significant portion of total DRAM sales, with Samsung Electronics at 28% and SK Hynix at 40%.

The market is paying close attention to whether additional price declines will continue if server DRAM demand remains sluggish through next year. There are already forecasts that server DRAM prices could notably drop in the upcoming fourth quarter. TrendForce predicted that server DRAM prices in Q4 could fall by up to 18% compared to the previous quarter. This decline is larger than the maximum 15% price drop forecasted for PC and graphics DRAM. According to DB Financial Investment, DRAM prices next year could decrease by 16.5% compared to this year. Especially from Q3 this year through Q2 next year, DRAM prices are expected to show negative growth compared to the previous quarter.

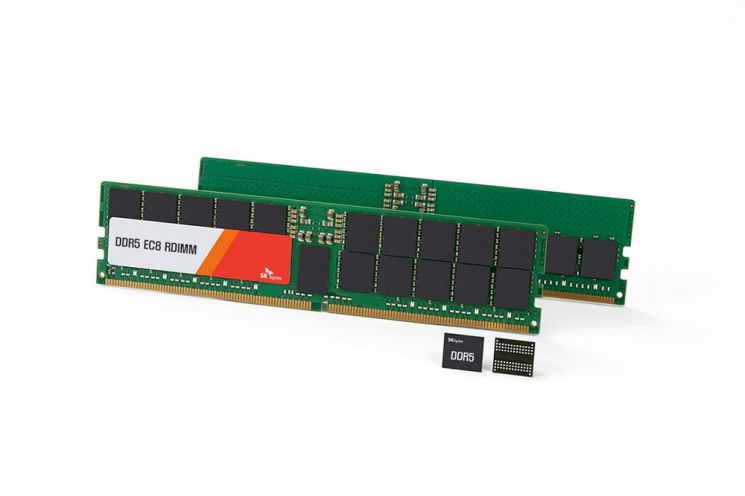

The DRAM market, including server DRAM, is expected to rebound in the second half of next year, which is a positive sign. The upcoming release of Intel's server CPUs supporting DDR5, the latest DRAM standard known for its high value-added features, scheduled for the first half of next year, is also raising hopes for industry profit improvement. Samsung Electronics and SK Hynix have stated their intention to overcome the sluggish market conditions through diversification of applications and promotion of high value-added businesses.

Kim Kwangjin, a researcher at Hanwha Investment & Securities, said, "From Q2 next year, it is expected that server companies will complete inventory depletion and resume restocking centered on DDR5, making a mid-teens percentage demand growth next year quite possible." However, he added, "We cannot completely rule out the possibility of prolonged demand contraction due to economic slowdown."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)