Proportion of Real Estate Loans Low Compared to Total Assets, Deterioration in Asset Management Returns Inevitable

As the real estate market contracts, concerns over the insolvency of real estate project financing (PF) loans are also growing. The photo shows apartments and residential areas in Seoul. (File photo) [Image source=Yonhap News]

As the real estate market contracts, concerns over the insolvency of real estate project financing (PF) loans are also growing. The photo shows apartments and residential areas in Seoul. (File photo) [Image source=Yonhap News]

[Asia Economy Reporter Changhwan Lee] As the real estate market worsens, the risk of default in real estate project financing (PF) is increasing, raising concerns even in the insurance industry, which has large loan volumes. However, insurers analyze that an immediate capital soundness crisis is unlikely because the proportion of real estate PF loans relative to assets is not large. Nonetheless, as the previously high-yielding real estate PF contracts shrink, a decline in asset management returns is expected to be inevitable.

According to the Financial Supervisory Service and others on the 20th, as of the end of June this year, the amount of real estate PF loans by insurers was 43.3 trillion won, the highest among all industries. This is 2.6 times the level of 16.5 trillion won in 2016 over five and a half years.

Insurers rapidly expanded the scale of domestic real estate PF loan receivables over the past few years as asset management returns declined in a low-interest-rate environment. This was partly due to some insurers actively providing loans while other financial companies such as banks, savings banks, and securities firms were reluctant to lend for real estate PF due to regulatory restrictions.

However, as the real estate market has frozen this year, concerns about loan defaults have emerged. The delinquency rate of insurers' real estate PF loan receivables rose to 0.33% in the second quarter from 0.05% in the previous quarter, an increase of 0.28 percentage points (p). Although this is still lower than the delinquency rates of securities firms at 4.7% and card and capital companies at 0.9%, the rate of increase is steep.

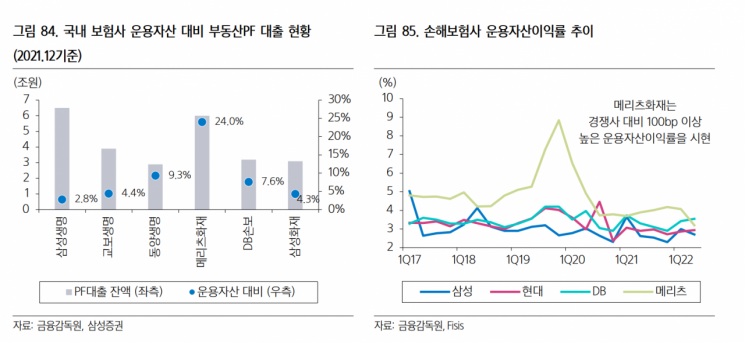

Financial authorities and the insurance industry believe that immediate concerns about capital soundness are unlikely because the proportion of real estate PF loans relative to insurers' asset size is not large and the delinquency rate is not high.

This is because the total loan amount of insurers accounts for only 4.7% of total managed assets and about 15.9% compared to the total loan receivables balance. Insurers generally maintain a conservative asset management atmosphere, investing most assets in relatively safe securities such as government bonds and special bonds.

A financial authority official said, "Since there are concerns related to real estate PF loans, we are continuously conducting inspections by business site," adding, "Among insurance companies, there have been no significant signs of default problems so far."

However, in some insurers, the proportion of real estate PF loans relative to assets is relatively high, so if delinquency rates rise, the companies' asset management returns may deteriorate.

Meritz Fire & Marine Insurance had the highest real estate PF loans at 24% relative to assets, followed by Tongyang Life Insurance at 9.3% and DB Insurance at 7.6%. Real estate PF loans offer higher interest rates compared to bonds, allowing for pursuit of high returns. These insurers have had higher asset management returns compared to others.

An official from a major insurer said, "The proportion of real estate PF loans in total assets is not large, and most of the loans are senior, so there is almost no risk of losing money," adding, "Recently, we have hardly been issuing new loans, so we are rather concerned about the deterioration of asset management returns."

Researcher Kyungja Lee from Samsung Securities explained, "For some insurers with a high proportion of real estate PF within managed assets, not only concerns about rising delinquency rates and reserve accumulation but also changes in asset management strategies due to market contraction and reduction in new investment opportunities are expected to be inevitable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.