Mortgage Loan 450 Million KRW, Interest Rate Rises from 3.77% to 6.01% in One Year

Monthly Repayment Increases by 600,000 KRW

September COFIX Hits Highest Level in 10 Years

Commercial Banks Immediately Reflect Increase

Mortgage Loan Interest Rate Rises Up to 6.49%

Further Increase in Mortgage Loan Interest Rates Expected in November

Jung Minseong (46), who lives in Mokdong, Yangcheon-gu, Seoul, could hardly believe his eyes when he received a loan interest rate notification text from his main bank on the 18th. The rate displayed on his phone was 6.01%. When he moved last October, a year ago, and took out a mortgage loan of 450 million KRW, the rate was 3.77%. At that time, the principal and interest payment was about 2.1 million KRW. Having chosen a variable interest rate, Jung receives a new rate notification every six months. He said, "When the rate rose to 4.33% in April this year, I thought it was inevitable due to the rising interest rate period, but I can't believe it suddenly jumped to the 6% range today," adding, "The monthly principal and interest repayment has increased to 2.7 million KRW."

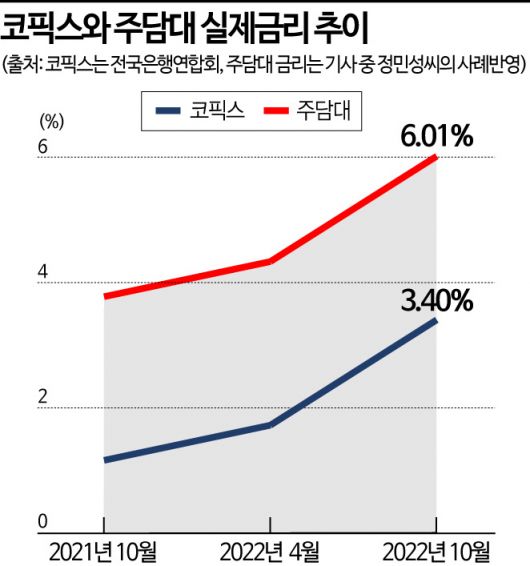

The sharp rise in Jung's mortgage loan interest rate is due to the increase in COFIX (Cost of Funds Index). COFIX is the benchmark for variable mortgage loan rates, and the COFIX based on new transactions (September) announced by the Korea Federation of Banks on the 17th was 3.40%, marking the highest level in 10 years and 2 months. It rose 0.44% compared to the previous month.

COFIX is the weighted average interest rate of funds raised by eight domestic banks. It reflects changes in interest rates of deposit products such as actual deposits, savings, and bank bonds handled by banks. When COFIX falls, banks can secure funds by paying less interest, leading to lower loan interest rates; when COFIX rises, the opposite occurs.

The variable mortgage loan interest rates of commercial banks accurately reflect the increase in COFIX. The COFIX announced in October last year was 1.16%, but it rose by 2.24 percentage points in one year, and Jung's loan interest rate followed the same trend and increased accordingly.

The Bank of Korea raised the base interest rate by 0.5 percentage points, and the real estate transaction market is expected to experience a prolonged winter. On the 13th, a red light was on at a traffic signal near an apartment in downtown Seoul.

The Bank of Korea raised the base interest rate by 0.5 percentage points, and the real estate transaction market is expected to experience a prolonged winter. On the 13th, a red light was on at a traffic signal near an apartment in downtown Seoul.

Not only existing borrowers but also those who need to take out new loans were hit hard. Mortgage loan interest rates jumped overnight. From the 18th, the mortgage loan interest rates of commercial banks rose by 0.44 percentage points compared to the previous day, directly reflecting the increase in COFIX from the previous month.

In just one day, Kookmin Bank's rates rose from 4.65~6.05% to 5.09~6.49%, Woori Bank's from 5.24~6.04% to 5.68~6.48%, and NH Nonghyup Bank's from 4.50~5.60% to 4.94~6.04%. Jeonse loan interest rates also jumped similarly, with most banks' upper limits exceeding 6%.

The problem is that mortgage loan interest rates are likely to rise even more sharply next month. The Bank of Korea took a big step last week by raising the base rate by 0.5 percentage points, causing commercial banks to increase deposit and savings interest rates by up to 1 percentage point, and this increase will be reflected in the COFIX for October, which will be announced in November.

In the financial sector, if the statement by Bank of Korea Governor Lee Chang-yong, "We will continue to raise rates for the time being, expecting the final base rate to be around 3.5%," materializes, variable mortgage loan interest rates are expected to approach 7%, and fixed rates could exceed 8%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.