The e-commerce industry, which was expected to reshape the U.S. retail market due to the pandemic, is now freezing. Although it had rapidly grown by emphasizing the convenience of online and logistics, recently, as consumers have started enjoying shopping again in offline stores, e-commerce companies are seen reverting to the past rather than continuing growth. Analysts say the industry failed to properly read market conditions such as consumer sentiment.

◆ Online Sales Share ↓ in the 'Endemic' Phase... Some Categories Like Apparel Draw Attention

On the 16th, Bloomberg cited data from the U.S. Census Bureau (USCB) and reported as follows. According to the report, the share of U.S. retail sales conducted online rose sharply from 11.1% in Q4 2019 before the pandemic to 16.4% in Q2 2020. However, it then gradually declined to 14.3% in Q1 2023 and 14.5% in Q2 2023.

Bloomberg noted that before COVID-19, the share of online sales in the U.S. had increased by about 1 percentage point annually since the mid-2010s, but in Q2 2020, this share expanded unusually rapidly within just three months.

Ed Yruma, a retail finance analyst at Wall Street investment bank Piper Sandler, said, "Everyone's logic was that this situation would continue for the next five years," adding, "What’s really interesting is that this turned out to be wrong." He evaluated, "We know the pandemic fundamentally changed us, but how it changed us is still unclear. Currently, consumers seem to be thinking, 'I want to go out.'"

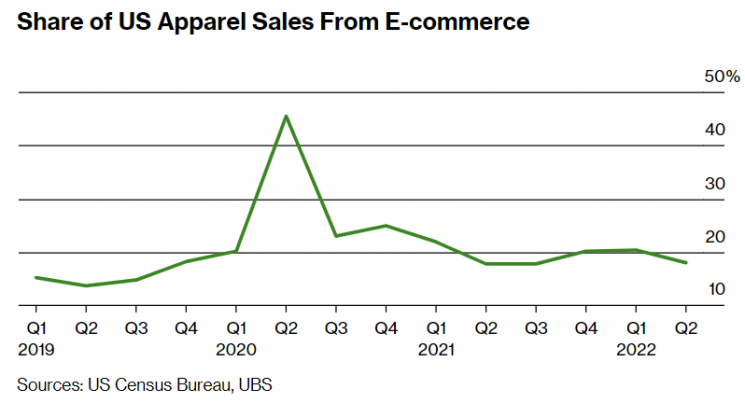

Looking more specifically, global investment bank UBS analyzed that some categories, including apparel, have seen their online sales share return to pre-pandemic levels. For groceries, online sales in the U.S. were 2.8% in Q2 2023, three times higher than in Q2 2019. However, for apparel, the share of online sales via e-commerce was 18.3% in Q4 2019, rose to 45.4% in Q2 2020, then dropped sharply to 22.9% in Q3 2020, and further declined to 18.0% in Q2 2023.

This has led to analysis that rising inflation and the U.S. Federal Reserve's interest rate hikes this year have hit consumer spending. However, according to the U.S. Department of Commerce's August retail sales report released last month, sales increased by 0.3% compared to the previous month, indicating consumers spent more. By sector, grocery store sales rose 0.5%, restaurant sales increased 1.1%, but online sales decreased by 0.7%. This suggests that while overall consumer spending increased in the U.S., the proportion of purchases made online declined.

◆ Industry's Overly Optimistic 'Misjudgment'... Cannot Ignore Shopping Mall Visit Habits

This has been interpreted as e-commerce companies making incorrect forecasts fueled by expectations of growth. William Brown, e-commerce manager at multinational retail and consumer finance group Unicomer, told Bloomberg that the industry misunderstood the online shopping boom as a choice rather than a forced event. He also said that federal government stimulus payments during the pandemic contributed to this misinterpretation. He said, "Many companies thought this would become the new normal. But that was simply unrealistic."

In fact, Shopify CEO Tobi L?tke admitted in July when announcing 1,000 layoffs, "We expected e-commerce growth to continue for 5 to 10 years after the pandemic, but we misjudged." Along with Shopify, Amazon announced on the 4th that it would temporarily halt retail hiring this year. Amazon had already cut 99,000 employees in Q2, suspended or delayed plans to build logistics warehouses, and shifted all call center staff to remote work, ceasing office operations to reduce costs.

As the situation unfolded, e-commerce companies' stock prices have plummeted this year. According to Bloomberg, while the U.S. S&P 500 index fell 25% from January to September, Amazon's stock price dropped 32%, and Shopify's plunged 80% during the same period. Consequently, their market capitalizations evaporated by approximately $500 billion and $143 billion, respectively. European online retailers ASOS and Boohoo Group also saw their stock prices fall by more than 70%.

Wendy Wood, a professor at the University of Southern California, said, "People underestimated the power of long-standing habits," and as social distancing eased and the public returned to daily life, previous habits resurfaced, leading to increased visits to shopping malls in the U.S. She explained that consumers remember the experience of purchasing products directly at malls and that some continue to follow these past habits.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)