5G Subscriber Growth Slows... Driving New Business Expansion

[Asia Economy Reporter Oh Soo-yeon] Despite stagnation in the telecommunications sector's performance, the three major mobile carriers are expected to achieve a combined operating profit of 1 trillion KRW in the third quarter, driven by growth in non-telecom sectors.

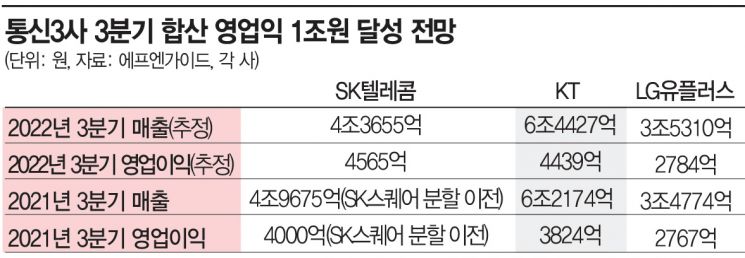

According to FnGuide consensus on the 12th, the combined operating profit of the three mobile carriers for the third quarter was estimated at 1.1788 trillion KRW. SK Telecom is expected to record sales of 4.3655 trillion KRW and an operating profit of 456.5 billion KRW in the third quarter. Compared to the same period last year before the SK Square spin-off, sales decreased by 12.1%, but operating profit increased by 14.1%. KT is expected to post sales of 6.4427 trillion KRW and an operating profit of 443.9 billion KRW, representing growth of 3.6% and 16.1% respectively compared to the same period last year. During the same period, LG Uplus is projected to record sales of 3.531 trillion KRW and an operating profit of 278.4 billion KRW, marking a 1.5% increase in sales and a 0.6% rise in operating profit compared to the previous year, with operating profit expected to turn positive in the third quarter.

In the core telecommunications sector, the growth rate of 5G subscribers has slowed. According to the Ministry of Science and ICT's wireless communication service subscription status, the number of 5G subscribers increased by only about 580,000 in August. The total number of 5G subscribers reached approximately 25.71 million by August, casting doubt on the original target of 30 million subscribers by the end of the year.

However, there appears to be no performance deterioration due to the introduction of the mid-tier 5G plan. Prior to the launch of the mid-tier plan in August, many predicted a negative impact on the average revenue per user (ARPU), but industry insiders report that the actual effect was minimal. Additionally, with overseas travel demand rising again, roaming revenue, which had sharply declined over the past two years due to the COVID-19 pandemic, is returning to an upward trend.

The non-telecom sector, which is expected to become a new growth engine for the three carriers, is growing steadily. It is assessed that the non-telecom sector drove the third-quarter results. SK Telecom's subscription service 'T Universe' surpassed 1.3 million monthly active users as of the end of August, marking its first anniversary. The transaction volume of products is also increasing. In the second-quarter earnings announcement, SK Telecom revealed that the total gross merchandise volume (GMV) of T Universe in the first half of the year was 260 billion KRW.

KT is growing mainly through its DigiCo (digital platform company) business, with the media sector standing out. The drama "Extraordinary Attorney Woo" was a phenomenal hit, and in the online video service (OTT) sector, KT merged Season with TVING and combined Skylife TV with Media Genie to enhance competitiveness. The IPTV brand was rebranded as Genie TV to proactively respond to the OTT-centered media consumption trend. Additionally, the retroactive wage increases typically reflected in the third quarter were not applied this quarter, temporarily having a positive impact on performance.

LG Uplus recently declared its transition to a platform company and announced plans to expand the non-telecom revenue ratio to 40% by 2027, focusing on new businesses. In July, it launched the subscription service 'Yudok' and is accelerating the discovery of killer content such as 'Idol Nara' and 'Idol Plus.'

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.