Operating Profit Falls Below 11 Trillion Won in Q3...32% Reduction

[Asia Economy Reporters Sunmi Park and Yeju Han] Samsung Electronics announced shock-level third-quarter earnings. Although sales exceeded 70 trillion won for five consecutive quarters, operating profit shrank by 32% compared to a year ago.

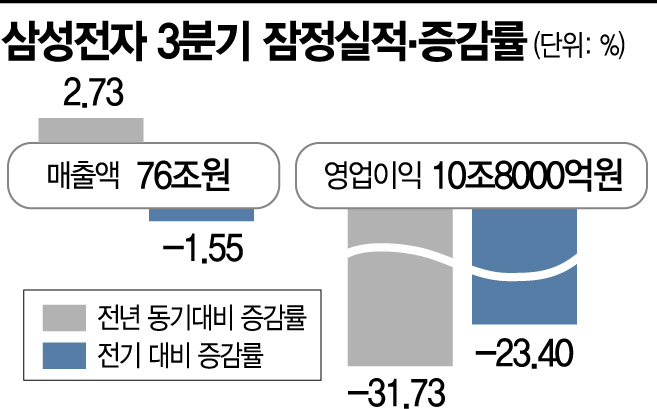

On the 7th, Samsung Electronics announced its preliminary third-quarter results, reporting consolidated sales of 76 trillion won and operating profit of 10.8 trillion won. Sales increased by 2.73% year-on-year, but operating profit decreased by 31.73%. Compared to the second quarter, both sales and operating profit declined by 1.55% and 23.4%, respectively.

This third-quarter performance fell short of market expectations. According to financial information firm FnGuide, the market consensus (average estimate by securities firms) was sales of 78.6 trillion won and operating profit of 11.75 trillion won.

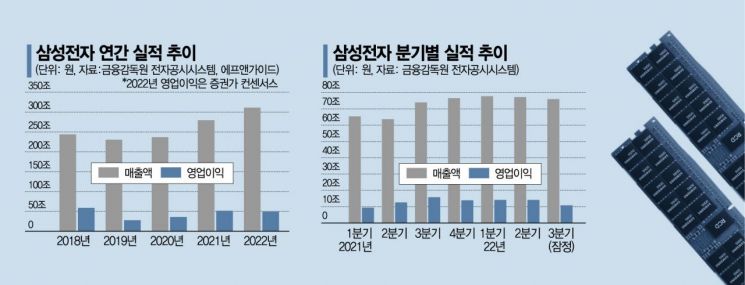

Although sales have surpassed 70 trillion won for five consecutive quarters, the streak of record quarterly sales halted after the second quarter and has been declining since. Samsung Electronics achieved its highest-ever sales record of 73.98 trillion won in the third quarter of last year, followed by 76.57 trillion won in the fourth quarter, and 77.78 trillion won in the first quarter of this year, setting new records for three consecutive quarters. However, sales dropped to 77.2 trillion won in the second quarter and further declined to 76 trillion won in the third quarter.

Profitability has worsened significantly. Operating profit, which barely exceeded 14 trillion won in the second quarter of last year, plunged to the 10 trillion won range in the third quarter of this year. The deterioration is attributed to uncertain global business conditions including ▲ the Russia-Ukraine war ▲ rising raw material and logistics costs due to inflation ▲ weakened consumer sentiment ▲ volatile exchange rates ▲ intensified competition and sharp demand decline in the semiconductor market.

However, these adverse factors are unlikely to ease in the fourth quarter, and if the current pace continues, Samsung Electronics' annual sales for this year are estimated to barely reach 300 trillion won.

Samsung Electronics' annual sales showed a steep increase from 230.4 trillion won in 2019 and 236.81 trillion won in 2020 to 279.6 trillion won last year. Including the announced preliminary third-quarter results, cumulative sales from the first to third quarter amount to 230.99 trillion won, with operating profit at 39.02 trillion won. Operating profit has also significantly retreated from 51.6 trillion won last year, and there is a possibility it may fall short of 50 trillion won this year.

Shrunken Profitability... More Pessimistic Outlook for Q4

Samsung Electronics' third-quarter earnings, with profitability shrinking by over 30%, reflect the accelerated decline in demand for sets such as smartphones, PCs, and TVs amid growing concerns about a global economic downturn, as well as the impact on semiconductors, which had previously boosted profitability. The problem is that improvement in the fourth quarter is unlikely. There are forecasts that maintaining an annual operating profit of 50 trillion won could become difficult.

◆ Operating Profit Shrinks by 31.73%... Profitability Falls Short of Expectations = The third quarter, burdened by rising raw material prices and logistics costs combined with weak demand, put the brakes on Samsung Electronics' growth. While sales exceeded 70 trillion won for five consecutive quarters and the third-quarter sales alone set a record high, operating profit fell drastically by 31.73% and 23.4% compared to the third quarter of last year and the second quarter of this year, respectively. This marks a negative growth year-on-year for the first time in about three years. It means that despite selling more, the company failed to generate higher profits.

Although detailed results by business division were not disclosed this time, the industry estimates that all areas except MX (Mobile eXperience) and Display suffered profitability deterioration. MX saw weak smartphone sales but managed to defend against profitability decline due to an increased proportion of foldable phones, which raised the average selling price (ASP). The Display division likely saw significant operating profit growth due to reduced losses from halting LCD line operations and strong demand from Apple.

On the other hand, the semiconductor division, which had driven Samsung Electronics' profits, reportedly posted operating profit around 6 trillion won, down about 30% from the previous quarter. The home appliances division is also expected to have operating profit in the 300 to 400 billion won range, considering weak TV sales and increased costs due to inflation, including Harman's performance.

Choi Doyeon, a researcher at Shinhan Financial Investment who closely estimated Samsung Electronics' third-quarter operating profit, projected semiconductor operating profit at 6 trillion won, down 39.8% year-on-year; CE (Consumer Electronics) at around 300 billion won, down 13.8%; and Display and Mobile divisions at 1.9 trillion won and 3 trillion won, up 78.8% and 13.6%, respectively. He said, "The decline in demand for sets such as smartphones, PCs, and TVs is very rapid, and the reduction in semiconductor orders is even faster," adding, "The earnings outlook for this year may be further downgraded."

Notably, this profitability deterioration occurred despite the positive effect of the won-dollar exchange rate increase, suggesting that excluding the exchange rate effect, the actual earnings shock Samsung Electronics experienced was even greater.

◆ Lowering Earnings Forecasts... "Q4 Will Be Worse" = Due to seasonal demand slowdown for sets, the MX and Display divisions, which defended profitability in the third quarter, may also see a slowdown in the fourth quarter. There are even predictions that Samsung Electronics' fourth-quarter operating profit will shrink further to the 8 trillion won range, making it difficult to maintain an annual operating profit of 50 trillion won.

Samsung Electronics' third-quarter earnings consensus has steadily declined. In the past two months alone, the third-quarter operating profit forecast dropped by 11%. The main reason for the rapid downward revision is the swift deterioration in the memory semiconductor market, Samsung's core business. Expected declines in the DX (Device eXperience) division's performance due to reduced sales of home appliances, smartphones, and TVs have also accelerated the downward revision.

The MX division, which sells smartphones and other devices, may expect some boost from the Galaxy Z Flip4 and Fold4 launches in the fourth quarter. However, with the triple high (high inflation, high exchange rates, and high interest rates) expected to continue at least until the end of the year, consumer spending power on IT products is predicted to sharply weaken. The semiconductor and electronics industries anticipate that set manufacturers will maintain conservative inventory management policies for the time being, leading to simultaneous declines in semiconductor prices and shipments.

Seoseungyeon, a researcher at Shinyoung Securities, said, "With the prolonged Russia-Ukraine war and rising prices suppressing the year-end shopping season, IT set demand is expected to remain weak through the first half of next year." Following the disappointing third-quarter results, the securities industry is expected to soon revise down Samsung Electronics' operating profit estimates for this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.