[Asia Economy Reporter Hwang Yoon-joo] Nine out of ten bond experts predicted that the Bank of Korea's Monetary Policy Committee, scheduled to be held on the 12th, will implement a 'big step' rate hike.

On the 7th, the Korea Financial Investment Association announced in its 'November 2022 Bond Market Index' report that 89% of survey respondents expected a 50bp increase. The remaining 6% anticipated a 75bp hike, and 5% forecasted a 25bp increase. All respondents agreed on a base rate hike.

Two reasons were cited for the rate hike: the widening interest rate differential between Korea and the U.S. due to the rapid U.S. base rate hikes, and concerns over inflation.

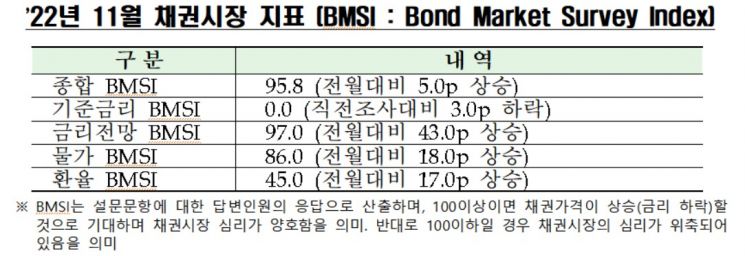

According to the comprehensive BMSI survey results, the bond market sentiment in November was 95.8, up 5 points from the previous month. This improvement was influenced by better bond market sentiment in areas such as interest rate outlook, inflation, and exchange rates.

BMSI is an indicator that reflects future interest rate directions and investment sentiment through surveys of bond market participants. A value above 100 indicates expectations of rising bond prices (falling interest rates) and a favorable bond market sentiment. Conversely, a value below 100 is interpreted as a contraction in bond market sentiment.

The interest rate outlook BMSI was 97.0, significantly improved from 54.0 in the previous month. The Korea Financial Investment Association explained, "Although major countries continue a steep interest rate hike trend, recent market stabilization measures by authorities and risk alleviation from the UK have led to a decrease in respondents expecting rate hikes in November."

40.0% of respondents (61.0% in the previous month) expected interest rates to rise, a 21.0 percentage point decrease from the previous month, while the proportion expecting rates to fall increased by 22.0 percentage points to 37.0% (15.0% in the previous month).

Bond market sentiment related to inflation also improved compared to last month. The inflation BMSI rose to 86.0 from 68.0 in the previous month. This was attributed to a slowdown in the rise of international oil prices and a reduction in the domestic consumer price increase for two consecutive months, leading to fewer respondents expecting inflation to rise in November.

23.0% of respondents (35.0% in the previous month) expected inflation to rise, a 12.0 percentage point decrease from the previous month. The proportion expecting stable inflation increased by 6.0 percentage points to 68.0% (62.0% in the previous month).

Bond market sentiment related to exchange rates also improved. The exchange rate BMSI increased to 45.0 from 28.0 in the previous month. This was interpreted as a decrease in respondents expecting exchange rate increases in November due to the withdrawal of the UK tax cut plan and expectations of a slowdown in the U.S. Federal Reserve's tightening pace.

58.0% of respondents (73.0% in the previous month) expected exchange rates to rise, a 15.0 percentage point decrease from the previous month. The proportion expecting stable exchange rates increased by 13.0 percentage points to 39.0% (26.0% in the previous month).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.