[Asia Economy Reporter Lee Seon-ae] It is truly a difficult time for Kakao Games. As Lionheart Studio, a game company under Kakao Games, proceeds with its initial public offering (IPO), individual investors fearing double counting (overlapping valuation) are strongly opposing it, and the securities industry has even issued reports lowering the target stock price.

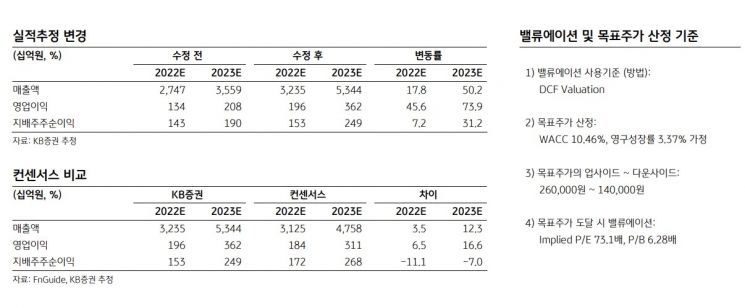

On the 7th, Ebest Investment & Securities maintained a buy rating on Kakao Games but lowered the target stock price by 15.7%, from 70,000 KRW to 59,000 KRW, citing expectations of poor performance. Given the weak earnings momentum and valuation momentum, the stock price needs to be monitored for the impact of Lionheart Studio's IPO, and it is necessary to establish an investment response strategy going forward. Additionally, the current stock price is trading at a price-to-earnings ratio (PER) of 21.4 times based on the 2023 earnings per share (EPS) attributable to controlling shareholders, which is significantly higher than the average for major domestic game stocks, making the valuation burdensome. The market consensus earnings forecasts are also too high, adding to the pressure on earnings momentum.

Researcher Sung Jong-hwa of Ebest Investment & Securities said, "Kakao Games' third-quarter revenue is expected to decrease by 2.2% quarter-on-quarter to 331.4 billion KRW, and operating profit is expected to drop sharply by 30.7% to 56.1 billion KRW, significantly missing consensus (market average forecast). This is due to underperformance compared to expectations for key games such as 'Uma Musume Korea' and 'Odin Korea, Taiwan,' and the increase in major operating expenses is due to structural factors rather than one-off events, leading to a substantial downward revision of forecasts not only for the third quarter but also for the fourth quarter and beyond."

Researcher Sung analyzed, "'Uma Musume: Pretty Derby' will see a downward stabilization in daily average revenue, but due to a significant increase in operating days, quarterly revenue will increase sharply compared to the previous quarter," while "'Odin: Valhalla Rising' sales in Korea and Taiwan are expected to plummet during the same period."

He added, "Payment fees and marketing expenses will increase compared to the previous quarter, and labor costs will also rise slightly. Since Uma Musume is a publishing game, royalties to the developer will incur, causing payment fees to surge further, which will be a key factor in the deterioration of profitability in the third quarter."

He advised, "Considering the recent market situation, it is difficult for new game momentum to work in terms of pre-launch expectations before new game launches, so it is realistic to continuously update the launch schedules of major new titles and verify the hit level after each launch to establish an investment response strategy."

Meanwhile, individual investors of Kakao Games are viewing Lionheart's listing with discomfort. Lionheart is the developer of Kakao Games' flagship game 'Odin,' which is a core game for Kakao Games, leading to controversy over inevitable corporate value dilution. Over the past two years, Kakao has successively listed its subsidiaries: Kakao Games in September 2020, Kakao Bank in August 2021, and Kakao Pay in November 2021. Since then, the stock prices of both the parent company Kakao and its affiliates have plummeted, increasing losses for individual investors. As a result, Kakao is not free from criticism that it is splitting off successful businesses to benefit only major shareholders. If Lionheart also enters the stock market, the double counting controversy will inevitably intensify.

However, Lionheart claims to be somewhat unfairly treated. Lionheart was established by CEO Kim Jae-young, who hit a mobile game 'Blade' in 2018. In other words, its origin is different. In the year it was founded, Kakao Games invested 5 billion KRW to acquire shares. Subsequently, additional investments were made in 2020 to increase its stake, and in November last year, Kakao Games' European branch acquired shares, incorporating Lionheart into the Kakao group.

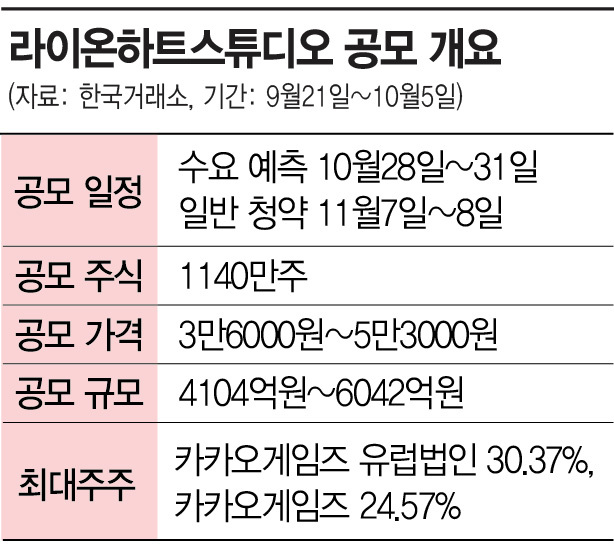

Therefore, Lionheart is informing shareholders that it is a company acquired by Kakao Games and not a split IPO, but the perception is not favorable. The reason is that although the proportion of Lionheart's contribution to Kakao Games' operating profit is not disclosed, it is believed to be significant. Individual investors express anxiety about a 'parent company discount' because if Lionheart goes public, its market capitalization could rival that of the parent company Kakao Games. According to the securities registration statement, 11.4 million shares will be offered with a desired public offering price per share of 36,000 to 53,000 KRW. The expected market capitalization is 3.1 trillion to 4.56 trillion KRW. If the desired public offering price is set at the upper limit, the valuation would exceed 4.5 trillion KRW, making it the largest IPO on the KOSDAQ this year.

However, Researcher Sung viewed the market capitalization based on the desired public offering price in the securities registration statement, ranging from 3 trillion to 4.5 trillion KRW, as unrealistic. Although the listing is scheduled for November this year, he also sees a low possibility of listing within this year. He said, "It is not only a matter of market sentiment about the subsidiary IPO and preventing double valuation but also necessary to consider valuation advantages and disadvantages. Compared to the current valuation based on actual performance including Odin, if Lionheart's value is separately calculated and the sum-of-the-parts (SOTP) method is applied (excluding Odin's performance for other businesses), it would not be disadvantageous if Lionheart's market capitalization after the IPO is 30-40% or more of the current Kakao Games market capitalization." He added that although the desired public offering price in the securities registration statement is unrealistic, a public offering price corresponding to a market capitalization of 1 trillion to 1.4 trillion KRW, which is 30-40% of Kakao Games' market capitalization of about 3.4 trillion KRW, is sufficiently realistic.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)