Kakao Games Subsidiary Lionheart Announces IPO Bid Amid "Corporate Value Damage Controversy"

"Different Entity from Inception, Not a Split Listing" Despite Efforts to Appease Shareholders, Cold Reception Remains

[Asia Economy Reporter Lee Seon-ae] -55.10%, -65.73%, -73.45%. These are the stock return rates for Kakao Games, Kakao Bank, and Kakao Pay this year (based on closing prices on the 6th). Kakao, which has listed its subsidiaries one after another like an octopus's arms, has also seen a decline rate of 52.13%. Compared to the peak of 173,000 KRW recorded on June 24 last year, it has plummeted by 68.32%. This gives a rough estimate of the losses suffered by individual investors who invested in both the parent company and its subsidiaries. However, criticism is mounting again over the octopus-like listing strategy. The protagonist is Lionheart Studio, a game company under Kakao Games. Lionheart is the developer of Kakao Games' flagship game "Odin," and since Odin is a core game for Kakao Games, there is controversy over the inevitable damage to corporate value. Although Lionheart appeals to shareholders that this is not a "split listing" since it was established as a separate corporation and later acquired by Kakao Games, public opinion remains cold.

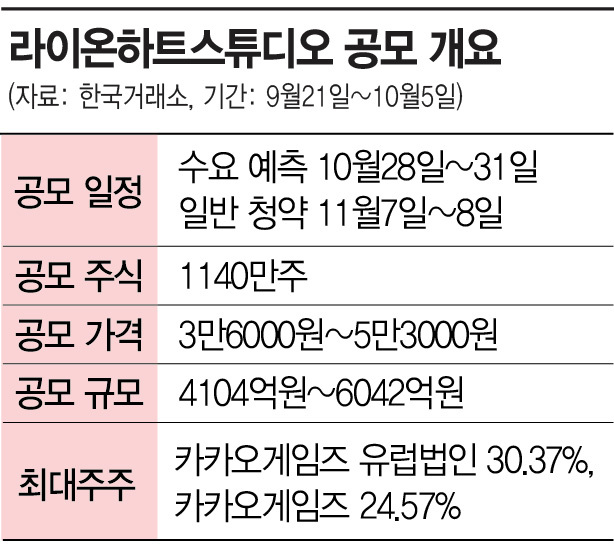

According to the investment banking (IB) industry on the 7th, Lionheart will conduct a demand forecast for institutional investors from the 28th to the 31st of this month and will proceed with a general investor subscription on the 7th and 8th of next month. Earlier, on the 30th of last month, it submitted a securities registration statement to the Financial Services Commission, signaling its intention for an initial public offering (IPO). The lead underwriters are Korea Investment & Securities and JP Morgan, with NH Investment & Securities and Goldman Sachs serving as joint underwriters.

According to the securities registration statement, 11.4 million shares will be offered, with the desired public offering price per share ranging from 36,000 to 53,000 KRW. The expected market capitalization is between 3.1 trillion and 4.56 trillion KRW. If the desired public offering price is set at the upper limit, the valuation will exceed 4.5 trillion KRW, making it the largest IPO on the KOSDAQ this year.

The problem lies in the damage to Kakao Games' corporate value. Over the past two years, Kakao has successively listed its subsidiaries: Kakao Games in September 2020, Kakao Bank in August 2021, and Kakao Pay in November 2021. Since then, the stock prices of both the parent company Kakao and its affiliates have plummeted, increasing the losses for individual investors. As a result, Kakao is not free from the perception that it benefits only major shareholders by spinning off successful businesses. If Lionheart also enters the stock market, the controversy over double counting (overlapping valuation of corporate value) will inevitably intensify.

On September 1st, a national petition was posted opposing the split listing of Lionheart Studio, a subsidiary of Kakao Games. The petitioner stated, "Kakao has caused social conflicts through its octopus-like expansion and listing of subsidiaries," and requested, "Please prohibit the IPO of Lionheart, a subsidiary of Kakao Games, to put an end to the reckless listing of subsidiaries by listed companies." Although the petition ended on the 3rd due to insufficient support and expiration of the consent period, it garnered 13,777 supporters by the end.

However, Lionheart claims to feel somewhat unfair. It has been proven legally that there is no problem, and the Korea Exchange has approved the review. Lionheart was established by CEO Kim Jae-young, who hit a mobile game "Blade" in 2018. In other words, its origin is different. However, in the year it was established, Kakao Games invested 5 billion KRW to acquire shares. Subsequently, additional investments were made in 2020 to increase its stake, and in November last year, Kakao Games' European branch acquired shares, incorporating Lionheart into the Kakao group.

Therefore, Lionheart informs shareholders that this is not a split listing since it is a company acquired by Kakao Games, but public opinion remains unfavorable. The reason is that although the proportion of Lionheart's contribution to Kakao Games' operating profit has not been disclosed, it is judged to be significant. As of the 6th, Kakao Games' market capitalization on the KOSDAQ market is approximately 3.4333 trillion KRW. An individual investor in a shareholder community lamented, "If the subsidiary Lionheart is listed, its market capitalization could rival that of the parent company Kakao Games, so individual investors' anxiety about the 'parent company discount' is inevitably high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.