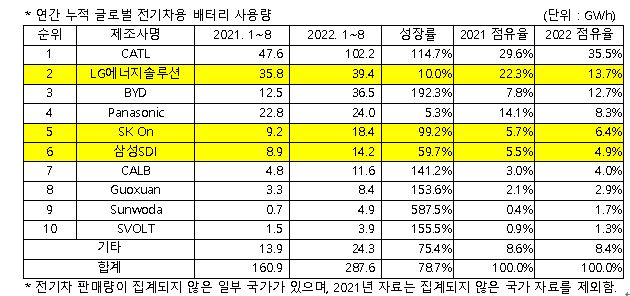

[Asia Economy Reporter Jeong Dong-hoon] From January to August this year, the market share of the three domestic companies in electric vehicle battery usage ranked 25%, showing a decline from 33.5% last year. Chinese companies led by CATL and BYD are occupying the global market with triple-digit growth.

According to SNE Research on the 6th, the market share of the three domestic companies fell by 8.5 percentage points compared to the same period last year. LG Energy Solution maintained its second place with 39.4 GWh, a 10.0% increase compared to the same period last year. SK On recorded 18.4 GWh, doubling its usage, and Samsung SDI recorded 14.2 GWh, a 59.7% increase.

The growth of the three companies is mainly due to the sales of models equipped with their batteries. SK On maintained steady sales of Hyundai Ioniq 5 and Kia EV6, while Samsung SDI showed a significant increase due to rising sales of electric vehicle models such as Audi's 'E-Tron', BMW's 'iX', and 'i4'. LG Energy Solution maintained double-digit growth thanks to strong sales of Volkswagen 'ID.4', Ford 'Mustang Mach-E', and increased sales of Tesla 'Model Y'.

Chinese companies led by CATL and BYD drove market growth. On the other hand, Japanese companies including Panasonic mostly showed growth rates below the market average and continued to decline.

The total battery usage of electric vehicles registered worldwide from January to August this year was 287.6 GWh, a 78.7% increase compared to the same period last year. The electric vehicle market has been growing continuously since the third quarter of 2020. In particular, global electric vehicle battery usage last month was 45.7 GWh, more than 1.9 times higher than the same period last year.

While major markets such as China and the United States all grew, battery usage in the Chinese market led the global electric vehicle market by growing more than 2.3 times compared to the same month last year. Despite the contraction of consumer sentiment amid the COVID-19 situation, the electric vehicle battery market has shown steady growth for 26 consecutive months, with market share continuing to rise centered on Chinese companies.

SNE Research stated, "Regarding regional battery supply and demand outlook, China is expected to have no supply shortage until 2030, but Europe and North America are expected to have no surplus supply despite new expansions." They added, "With the implementation of the Inflation Reduction Act (IRA), cell makers including those in Korea are expected to focus on investment in North America. It is necessary to pay attention to changes in battery supply and demand outlook after the IRA takes effect."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.