This Year's Import Amount $2.12055 Billion

460.7% Surge Compared to Same Period Last Year

Cause: Inelastic Supply-Demand Mismatch Characteristics

Battery Unit Cost Cathode Material Cost 21.7%

Concerns Over Worsening Supply Shortage by 2030

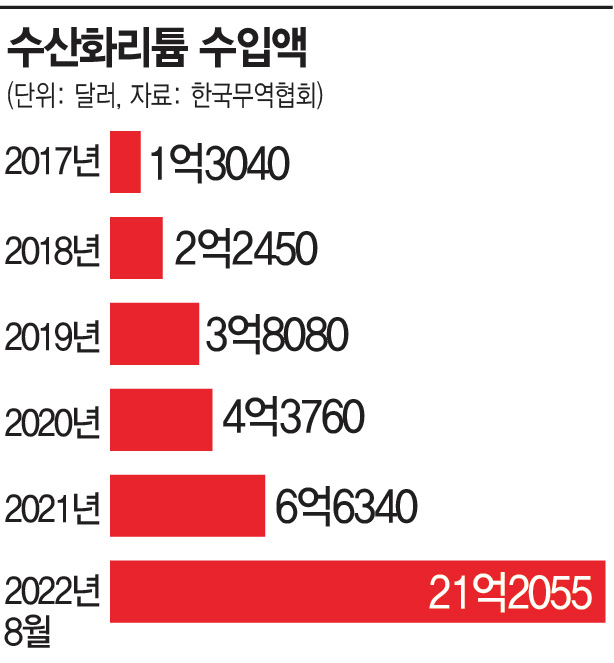

[Asia Economy Sejong=Reporter Dongwoo Lee] The domestic import value of lithium hydroxide, a key raw material for electric vehicle battery materials, has surpassed $2 billion for the first time ever. This is due to the surge in lithium demand worldwide combined with supply instability, causing import prices to skyrocket more than 13 times over the past year. The continuous increase in the cost of key raw materials could eventually lead to a deterioration in product margins, raising tension within the domestic battery industry.

According to KOTRA on the 6th, the cumulative import value of lithium hydroxide in Korea from January to August reached $2.12055 billion, a 460.7% increase compared to the same period last year ($378.21 million). This amount is three times the total lithium hydroxide import value last year ($663.4 million) and marks the highest level since related statistics began in 1977.

Lithium hydroxide is mainly used in cathode materials for electric vehicle batteries, which require higher energy density and capacity than lithium carbonate, making it suitable for long-distance driving. It accounts for 69% of Korea’s total lithium imports and is used in over 90% of high-performance ternary batteries (NCM, NCA) produced by domestic companies.

The sharp increase in lithium hydroxide import value was decisively caused by soaring import prices as supply failed to keep up with growing demand. The Korea International Trade Association also analyzed the factors behind the increase in lithium imports for batteries up to July this year, concluding that 74.0% of the increase was due to price factors and 26.0% due to volume factors, indicating that supply shortages and resulting price hikes drove the overall import value more than production volume increases.

This is attributed to the traditionally inelastic supply of lithium relative to demand and price fluctuations, which frequently causes supply-demand mismatches. Jihoon Lim, a researcher at the Korea International Trade Association’s Institute for International Trade and Commerce, explained, "Lithium production is planned on a 1-2 year basis and mine development takes 4-7 years, whereas demand can change significantly in the short term, resulting in much larger price fluctuations compared to other raw materials."

For example, lithium production grew by 80% in 2017 compared to the previous year, but from 2018 to 2020, price drops caused by oversupply led to many latecomer companies going bankrupt as they could not sustain production costs. The bankruptcy of ‘Altura Mining,’ which owns mines in Australia, is a representative case. When global lithium supply shrank and demand from electric vehicle production rapidly recovered from early last year, a supply crisis occurred.

As a result, global lithium supply had a surplus of 69,000 tons in 2020 but faced a shortage of 7,000 tons last year. The closure of factories in Sichuan Province, responsible for over 20% of lithium supply, due to drought and power outages in China also pushed import prices higher. According to the Trade Association, the price of lithium hydroxide was $76,577 per ton as of the end of March this year, a 1014% increase from the low of $6,874 per ton in October 2020. Although it slightly dropped to $69,235 per ton in early last month, prices remain high.

The problem is that the increase in raw material import costs is raising production burdens in battery pricing. According to the International Energy Agency (IEA), the share of cathode material costs in battery prices was 21.7% last year, up 6.7 percentage points from 15.0% the previous year. Moreover, in the long term, by 2030, the rapidly increasing lithium demand is unlikely to be met by supply, potentially worsening raw material shortages.

High dependence on China is also an issue. Currently, 64% of domestic lithium is imported from China, and for lithium hydroxide, the import dependence on China approaches 84%. A battery industry official said, "Lithium demand is predicted to be 42 times higher in 2040 compared to 2020, representing the steepest increase among minerals, which could increase production burdens."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)