The Korea Insurance Research Institute held a seminar on "2023 Insurance Industry Outlook and Challenges" on the morning of the 6th at the Conrad Hotel in Yeouido, Seoul. Ahn Cheol-kyung, President of the Korea Insurance Research Institute, is delivering the welcoming address.

The Korea Insurance Research Institute held a seminar on "2023 Insurance Industry Outlook and Challenges" on the morning of the 6th at the Conrad Hotel in Yeouido, Seoul. Ahn Cheol-kyung, President of the Korea Insurance Research Institute, is delivering the welcoming address.

[Asia Economy Reporter Changhwan Lee] With inflation expected to continue next year and an economic slowdown set to intensify, the insurance industry is also forecasted to suffer from low growth. As overall economic uncertainty increases, there are calls for insurance companies to strengthen risk management.

On the morning of the 6th, the Korea Insurance Research Institute held a seminar titled "2023 Insurance Industry Outlook and Challenges" at the Conrad Hotel in Yeouido, Seoul.

Kim Sejung, Head of Trend Analysis at the Korea Insurance Research Institute, who presented on the topic of "Insurance Industry Outlook," stated, "Next year, financial market volatility caused by expanding inflation (price increases) will continue following this year," and added, "The economic slowdown trend that began in the second half of this year is expected to intensify next year."

Inflation is analyzed to negatively impact the insurance industry through channels such as a decrease in the real value of insurance contracts, an increase in insurance claim amounts, and rising administrative expenses.

Kim said, "If a domestic economic recession occurs, it will weaken not only the growth and profitability of the insurance industry but also its long-term growth foundation," adding, "Insurance demand may shrink, and cancellations may increase, leading to slower growth. Additionally, moral hazard may rise, causing loss ratios to increase and profitability to decline."

He also predicted, "The willingness of insurance companies to innovate may decrease, and delays in social consensus on pension reform and non-reimbursable expense management could further weaken the long-term growth foundation."

"Due to financial uncertainty, next year's earned premiums expected to grow only slightly"

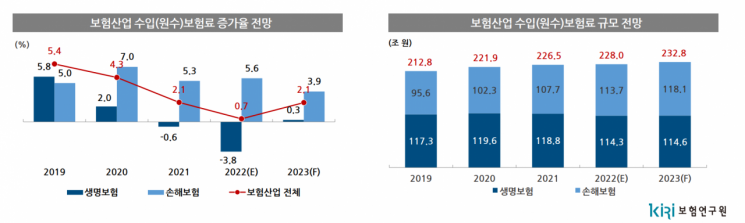

Next year's earned premiums in the insurance industry are projected to increase by only 2.1% compared to the previous year, due to the expansion of financial environment uncertainty causing a slowdown in performance of savings and investment-type products.

Life insurance earned premiums are expected to grow by just 0.3% next year, despite a significant base effect from this year's sharp decline (-3.8%), due to sluggish performance in general savings insurance and variable savings insurance.

Non-life insurance gross written premiums are predicted to increase by 3.9% year-on-year, driven by growth in long-term and general non-life insurance.

Following this, Kim Haesik, Head of Research Coordination at the Korea Insurance Research Institute, who presented on "Challenges in the Insurance Industry," stated that the insurance industry is exposed to economic uncertainty in the short term and institutional and demand uncertainties in the long term, necessitating strengthened risk management.

Kim said, "In response to economic uncertainties such as high inflation, high interest rates, and high exchange rates, it is necessary to enhance the stability of insurance supply and strengthen the role of long-term investors who contribute to economic and financial market stabilization," adding, "It is essential to strengthen asset soundness and liquidity management and establish capital management infrastructure such as contract buybacks to secure the stability of insurance supply."

He continued, "Insurance claim management in response to high inflation is necessary, and related regulations should focus on minimizing market distortion while ensuring insurance accessibility for vulnerable groups," adding, "On the other hand, close public-private cooperation is needed so that the insurance industry can play a shock-absorbing role during crises through socially responsible long-term investments and participation in market stabilization funds."

He also emphasized the need for the insurance industry to transition to a sustainable and scalable business model in response to demand uncertainties such as the introduction of the new accounting standard IFRS17 next year and changes in consumer composition, including the increasing proportion of single-person and two-person households.

Kim argued, "In response to the industrial convergence of the digital economy, it is necessary to expand market boundaries, such as linking asset management markets and electronic financial services with insurance," and "It is important to respond to diverse consumer demands, such as risk management for households, generations, or small and medium-sized enterprises, through market segmentation and flexible organization."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.