Cabbage and Radish Prices Double, Dining Out Inflation Surges to 30-Year High

Consumer Prices Continue to Slow Rise for Two Months

Vegetable and Meal Prices Soar

BOK Forecasts 5-6% Inflation for Considerable Period

Big Step Rate Hike Expected at This Month's Monetary Policy Meeting

Consecutive Big Steps Possible in November

[Asia Economy reporters Seo So-jeong and Son Seon-hee (Sejong)] Last month, consumer prices rose to the mid-5% range, showing a slowdown in the upward trend for the second consecutive month, but it is still too early to judge this as a ‘stabilization.’ The decline in international oil prices played a key role in the easing of inflation, but with vegetable prices soaring more than 20% ahead of the Kimjang season, the cost of food on the table continues to surge. In particular, the prices of cabbage and radish nearly doubled compared to a year ago, and dining-out prices rose the most in about 30 years, signaling an unusual trend. As inflation is expected to remain high at around 5-6% for a considerable period, the Bank of Korea is also expected to take a big step at this month’s Monetary Policy Committee meeting.

◆Dining-out prices see largest increase in 30 years= According to Statistics Korea on the 5th, dining-out prices in September rose 9.0% compared to the same month last year. This is the largest increase in about 30 years since July 1992 (9.0%). Eo Un-seon, Director of Economic Trend Statistics at Statistics Korea, explained the background of the dining-out price increase: "The cumulative rise in prices of agricultural, livestock, and fishery products seems to have affected ingredient costs," adding, "When the wholesale price of alcoholic beverages rises, restaurants reflect this in their prices, which further drives inflation."

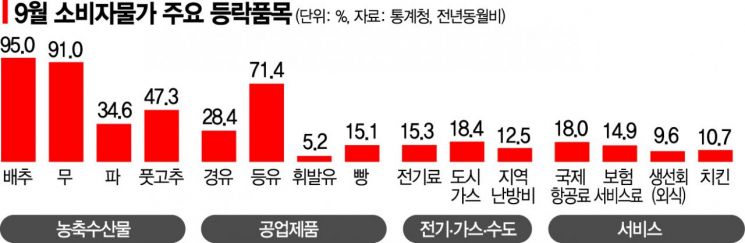

Looking at detailed items, last month’s cabbage price surged by a whopping 95% compared to a year ago, meaning the price nearly doubled. Radish showed a similar trend with a 91% increase. Other key items needed for Kimjang, such as green chili peppers (47.3%) and green onions (34.6%), also showed high inflation rates. The main cause was poor weather conditions such as heavy rain last month, which reduced sunlight hours and led to poor growth due to diseases. Additionally, increased demand ahead of the Chuseok holiday contributed to the rise. The overall vegetable price inflation rate was 22.1%.

Last month, the consumer price index rose by 5.6%, marking a slowdown for two consecutive months since July (6.3%). However, the government still maintains the ‘October peak theory.’ This is because there is still significant volatility in the international oil price trend, which has the greatest impact on inflation. Director Eo also said, "It is not impossible that the peak was reached in July," but added, "We need to watch closely as OPEC+ plans to cut production starting in October." If OPEC+ agrees to large-scale production cuts in anticipation of demand reduction amid growing concerns about economic slowdown next year, international oil prices could surge again, fueling inflation. Additionally, the scheduled increase in electricity and gas rates this month is another negative factor.

This is expected to raise inflation by 0.3 percentage points. In September, electricity, gas, and water prices rose 14.6% compared to a year ago, slightly slowing from the previous month’s 15.7%. If electricity and gas rates increase this month, the upward trend is expected to resume.

The Ministry of Economy and Finance stated, "To stabilize living costs, we will continuously monitor key inflation-related factors such as agricultural product supply and energy price volatility and respond promptly." In this regard, a plan to stabilize the supply of vegetables for the Kimjang season will be announced soon.

◆Consecutive big steps expected in November= Although the inflation rate has somewhat eased, it remains high at around 5%, strengthening expectations that the Bank of Korea will implement a second big step by raising the base interest rate by 0.50 percentage points this month. The Bank of Korea held a ‘Price Situation Review Meeting’ this morning to assess recent inflation trends and future outlook. Lee Hwan-seok, Deputy Governor, stated, "The September consumer price inflation rate slightly decreased from the previous month due to a smaller increase in petroleum prices, but core inflation continues to expand, mainly driven by dining-out and personal service items." He explained that amid great uncertainty due to the developments in the Russia-Ukraine war and the strengthening of global tightening policies, risks remain on the upside, including high exchange rates and expanded production cuts by major oil-producing countries.

In particular, concerns over the interest rate gap between Korea and the U.S. have grown due to the U.S. signaling strong tightening, prompting the Bank of Korea to consider a big step. The U.S. Federal Reserve (Fed) is likely to raise rates by 0.75 percentage points and 0.50 percentage points in the remaining two meetings (November and December), pushing the year-end rate ceiling to 4.5%. If the interest rate gap between Korea and the U.S. widens further, foreign capital outflows could accelerate. The recently soaring won-dollar exchange rate is also a burden on inflation. Bank of Korea Governor Lee Chang-yong said at the National Assembly’s Planning and Finance Committee meeting on the 26th of last month, "If the exchange rate remains at a high level, it could act as additional inflationary pressure."

The market expects the Bank of Korea to take a big step this month. Some even predict consecutive big steps in October and November. Joo Won, head of the Economic Research Office at Hyundai Research Institute, said, "Although the inflation rate has somewhat eased, the decline is not significant, and personal service inflation is expected to remain high at around 6% for a considerable period, so the Bank of Korea will raise interest rates by 0.50 percentage points this month to curb inflation."

On the other hand, Kim Young-ik, professor at Sogang University Graduate School of Economics, said, "With the Fed signaling additional giant steps, the Bank of Korea will also take a big step this month to prevent excessive interest rate gaps. However, since inflation has slowed and prices may fall to the 4% range in November, coupled with growing concerns about an economic recession at year-end, an additional big step in November will be difficult."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.