KPMG Survey of 1,300 Global CEOs on Business and Economic Growth Outlook

85% of Global CEOs Optimistic About Business Growth Over the Next 3 Years

[Asia Economy Reporter Ji Yeon-jin] More than 8 out of 10 global chief executive officers (CEOs) foresee an economic recession within the next year.

According to a survey conducted by global accounting and consulting firm KPMG (Chairman Bill Thomas) of 1,325 CEOs worldwide, 86% of respondents predicted an economic recession within the next year. Among them, 58% anticipated a mild and short recession, and 71% expected the recession to impact their company's revenue by up to 10%.

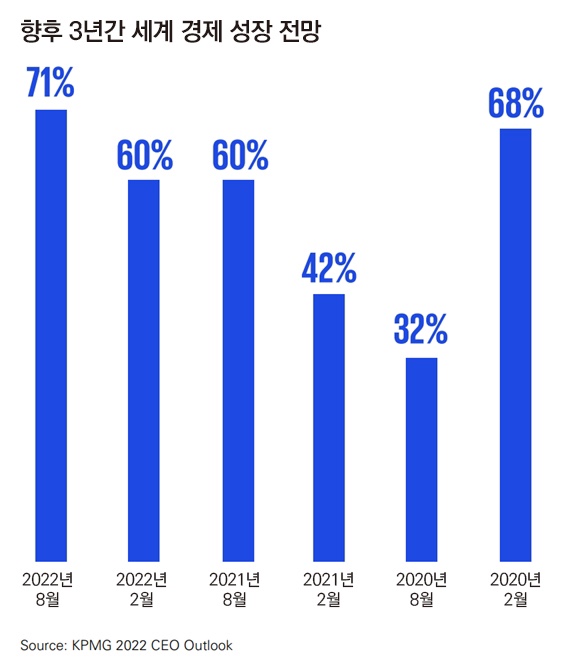

However, 71% of these global CEOs expressed optimism about the world economy over the next three years. This marks an 11 percentage point increase from 60% earlier this year, reaching the highest level since measurements taken before the pandemic. Additionally, 85% showed confidence in their company's growth over the next three years. Global CEOs demonstrated a strong willingness to actively invest in business expansion and innovation, with 47% showing high interest in mergers and acquisitions (M&A).

Furthermore, 76% of CEOs responded that they have established risk mitigation plans in preparation for a recession. They also predicted that geopolitical uncertainties will continue, with 81% stating they have developed strategies to address these challenges.

Bill Thomas, Chairman of KPMG, stated, “The global pandemic, geopolitical uncertainties, and inflation have caused disruptions within a short period, but global CEOs are confident in their companies' resilience as they overcome difficulties and are focusing on mitigating the uncertainties they face today.”

Global CEOs identified the most important factors for corporate operations over the next three years as ▲ workforce management ▲ ESG ▲ technology (Tech). Despite inflationary pressures, 71% of CEOs said retaining and attracting essential talent is a key operational strategy for future growth. In particular, the Employee Value Proposition (EVP), which involves considering what value a company offers to employees to attract and retain necessary talent, was ranked as the top organizational priority for growth over the next three years (25%). This is an increase from 19% last year.

65% "Return to office within 3 years" vs. only 7% "Remote work"

Regarding work styles, 65% of CEOs responded that employees will return to the office within three years, 28% anticipated a hybrid work model, and only 7% expected remote work.

Concerns about ESG management have also deepened. Forty-five percent of CEOs said ESG strategies have contributed to corporate performance, and 69% reported that stakeholders (customers, employees, investors, communities) have significantly increased demands for ESG disclosure and transparency. Thirty-eight percent admitted they have not established a convincing ESG message.

Seventeen percent of CEOs noted that stakeholder concerns about greenwashing have increased. This figure has more than doubled compared to 8% in 2021. Seventy-two percent predicted that stakeholder demands for disclosures related to gender equality and climate impact will become stricter.

Seventy-seven percent of CEOs identified information security as a key factor for gaining a competitive edge. While 72% said they have plans to respond to ransomware attacks, the percentage of those who felt their cyberattack preparedness was insufficient rose from 13% in 2021 to 24% in 2022.

Meanwhile, the ‘Global CEO Outlook’ report, now in its eighth edition, presents survey results on global executives’ outlook on corporate and economic growth over the next three years and the impact of the upcoming recession on the future of companies. One-third of the surveyed companies have annual revenues exceeding $10 billion, and companies with revenues under $500 million were excluded from the survey. CEOs from 11 key industries?including banking, automotive, manufacturing, energy, infrastructure, technology, telecommunications, and consumer goods & retail?in 11 regions such as the United States, United Kingdom, Germany, France, China, Japan, and India participated in the survey.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.