Korea Exchange Revises Delisting Requirements and Procedures to Protect Investors

[Asia Economy Reporter Myunghwan Lee] In the future, substantive reviews will be conducted for companies facing delisting due to financial reasons. Opportunities to file objections will also be granted for certain delisting causes that previously did not allow objections. The Korea Exchange (KRX) has decided to revise the delisting criteria and procedures to raise the bar for delisting in order to prevent investor damage.

On the 4th, the Korea Exchange announced, "We plan to revise the delisting criteria and procedures to ensure that delisting decisions are made after fully considering the possibility of corporate rehabilitation and to minimize investor damage." This decision is based on the discussions from the "3rd Financial Regulatory Innovation Meeting" held on the 30th of last month.

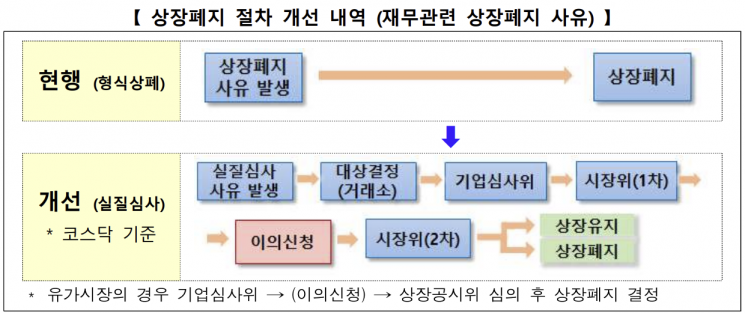

First, the Exchange decided to switch the financial-related delisting causes in the KOSPI and KOSDAQ markets to substantive reviews. This means that for companies facing delisting due to financial requirements, the decision will be made by considering the company's continuity and business viability rather than past performance.

Currently, if a financial-related delisting cause occurs, the delisting process proceeds immediately without any opportunity for objection or explanation. There have been criticisms that uniform standards are applied without considering the possibility of corporate rehabilitation or whether the temporary performance deterioration is unrelated to fundamentals.

According to this decision, the delisting review will consider various aspects such as future continuity and management stability, rather than past performance. However, the Exchange decided to exclude "full capital erosion" from this conversion because it indicates a higher level of insolvency compared to other causes.

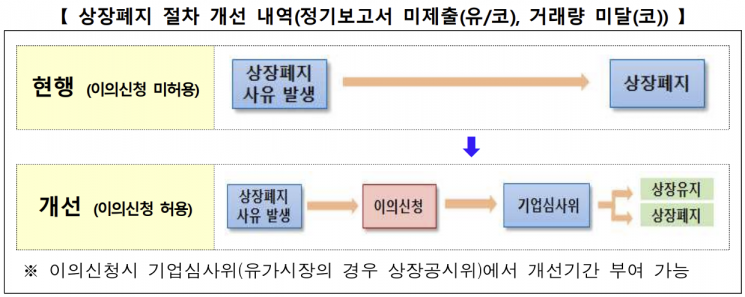

Objection and improvement opportunities will also be provided for causes such as failure to submit regular reports or insufficient trading volume, which previously did not allow objections.

Currently, if a company fails to submit regular reports or has insufficient trading volume, the delisting process proceeds immediately. There have been calls for a relief system for companies that miss the submission deadline due to unavoidable circumstances. There were also voices advocating for providing improvement opportunities, such as entering liquidity supply agreements, for stocks with insufficient trading volume.

The Exchange plans to allow objections and provide opportunities to resolve causes arising from failure to submit regular reports and insufficient trading volume. Failure to submit regular reports will apply to both KOSPI and KOSDAQ, while insufficient trading volume will be limited to the KOSDAQ market.

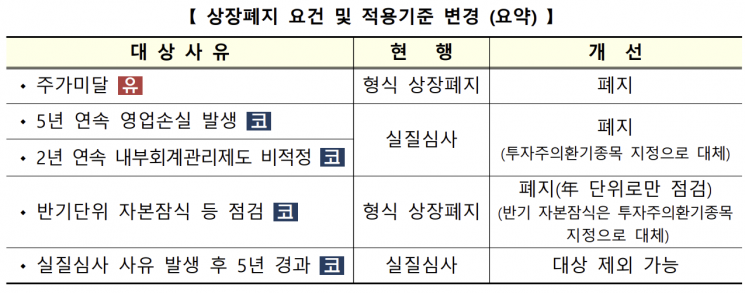

Additionally, the KOSPI's delisting criterion of "stock price below par value" (less than 20% of face value) will be removed. Instead, delisting decisions will be based on corporate value criteria under the "market capitalization below standard" requirement rather than stock price.

In the KOSDAQ market, substantive review causes such as "five consecutive years of operating losses" and "two consecutive years of internal accounting non-compliance" will be removed. The designation criteria for management stocks and delisting will also change from semi-annual to annual. Even if substantive review causes such as embezzlement are confirmed, if more than five years have passed since the occurrence and the impact on the company is minimal, the case may be excluded from review.

The Exchange plans to reflect these changes through amendments to listing regulations and enforcement rules between October and November. The KONEX market will also pursue simultaneous revisions for applicable matters.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.